There were fewer new home purchase loan applications in April, as year-over-year activity declined for the first time in 2017.

The Mortgage Bankers Association Builder Application survey found new construction home application activity down 20% from its all-time high in March and down 4.3% from April 2016.

"A relatively strong March may have pulled forward some applications from April, exacerbating the normal seasonal falloff. On net, year-to-date applications for new homes are running about 3% above the same period from 2016," said Lynn Fisher, the MBA's vice president of economics and research, in a press release.

Going forward, new home purchases will likely be driven by supply issues rather than consumer interest.

"Despite steady demand for housing, homebuilders continue to face rising costs for labor and materials which will continue to moderate the pace of building," Fisher said.

New single-family home sales were running at a seasonally adjusted annual rate of 517,000 units in April, according to the MBA's estimate.

The seasonally adjusted estimate for April is a decrease of 22.8% from the March pace of 670,000 units. On an unadjusted basis, there were an estimated 50,000 new home sales in April, a decrease of 19.4% from 62,000 new home sales in March.

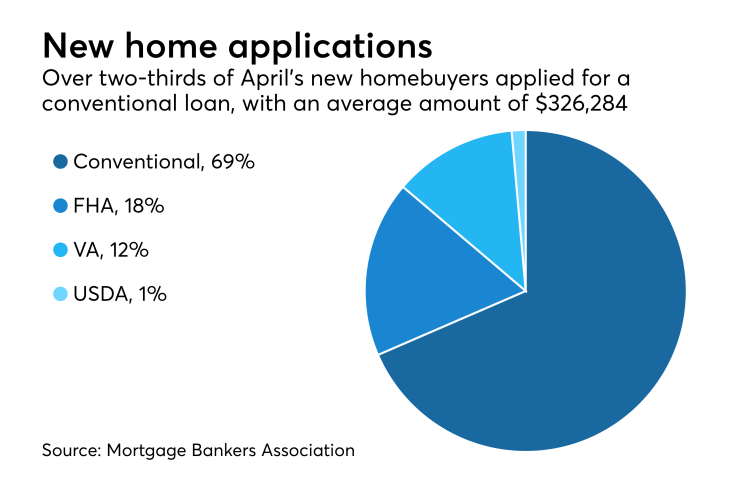

Conventional loans were 68.5% of application volume, followed by applications for Federal Housing Administration loans at 17.7%, Veteran's Affairs loans at 12.4% and U.S. Department of Agriculture loans at 1.4%. The average loan size decreased to $326,284 in April from $328,192 in March.