Mortgage applications for new homes rose on a monthly basis in August, as the

Loan applications in August rose 9% from

“While the new-home construction market is a much smaller segment of the overall housing market, prospective buyers are increasingly turning to new homes because of the very low levels of existing homes for sale,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting, in a press release.

The MBA estimated that 71,000 new homes were sold in August 2021 on an unadjusted basis, up 10.9% from 64,000 sales in July.

The monthly spike deviated from the pace of activity seen in previous years, a sign of greater-than-expected demand. Late summer is usually a slower period for new-home purchases, according to Kan.

Even though activity fell on a year-over-year basis, new-home sales still accelerated at its fastest rate since January. The heightened pace of activity led the MBA to boost its estimate of new single-family home sales to a seasonally adjusted annual rate of 874,000 units, up 12.2% from July’s 779,000.

“This is consistent with improving homebuilder sentiment, as

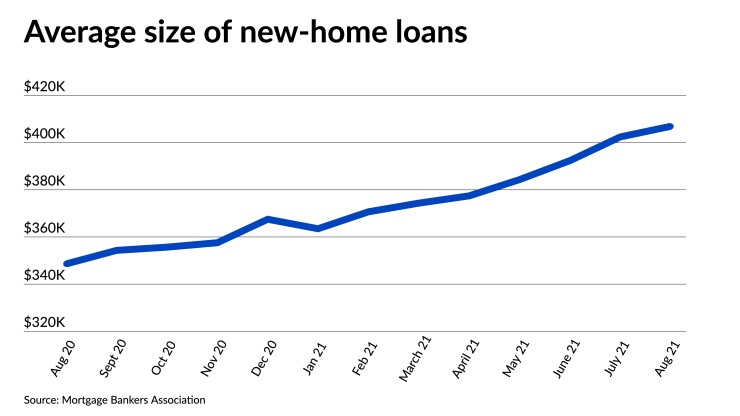

But higher costs for other materials, as well as labor shortages and ongoing supply disruptions, are pushing up new-home prices. The average loan size came in at $406,922 — a survey record — increasing 1.1% from $402,440 in July. The share of mortgage applications for amounts of $400,000 or higher accounted for more than 40% of volume, up from 28% a year ago. Compared to August 2020, new-home loans averaged $348,576, 16.7% lower than current levels.

Conventional loans comprised 75.1% of the applications for new constructions, while mortgages backed by the Federal Housing Administration accounted for 13.8%. Loans sponsored by the Rural Housing Service and U.S. Department of Agriculture made up 0.6%, and Veterans Affairs-backed loans equaled 10.5% of total volume.