New single-family home sales jumped 13% in October to a new monthly record, but there are signs that demand is softening along with prices of newly constructed homes.The U.S. Census Bureau reported that new-home sales rose to a seasonally adjusted annual rate of 1.42 million in October, up from 1.26 million in September. Despite the October sales report, National City Corp. chief economist Richard DeKaser said, "we are seeing a market that is at a turning point." He noted that the median price of new homes is up only 0.9% this year, compared with 18.0% in 2004. "We are seeing price softening, which is not something one typically observes during a period of extraordinarily robust demand," Mr. DeKaser said. He also observed that interest rates may have prompted some prospective homebuyers or "fence-sitters" to sign a sales contract. During October, the 30-year mortgage rate moved above 6% for the first time since March.

-

Federal Reserve Vice Chair for Supervision Michelle Bowman said in a speech Monday morning that the central bank will introduce two capital proposals that she said are aimed at boosting banks' role in the mortgage market.

7h ago -

The Public Interest Law Center filed an amicus curiae brief arguing against a joint motion to end a redlining agreement early against Lakeland Bank.

9h ago -

The mortgage broker trade group put out a white paper calling for lowering transaction costs, increasing housing supply and reducing regulatory barriers.

February 13 -

Fannie Mae and Freddie Mac will add loan-level buydown data to MBS this spring, giving investors clearer insight into prepayment risk tied to temporary rate incentives.

February 13 -

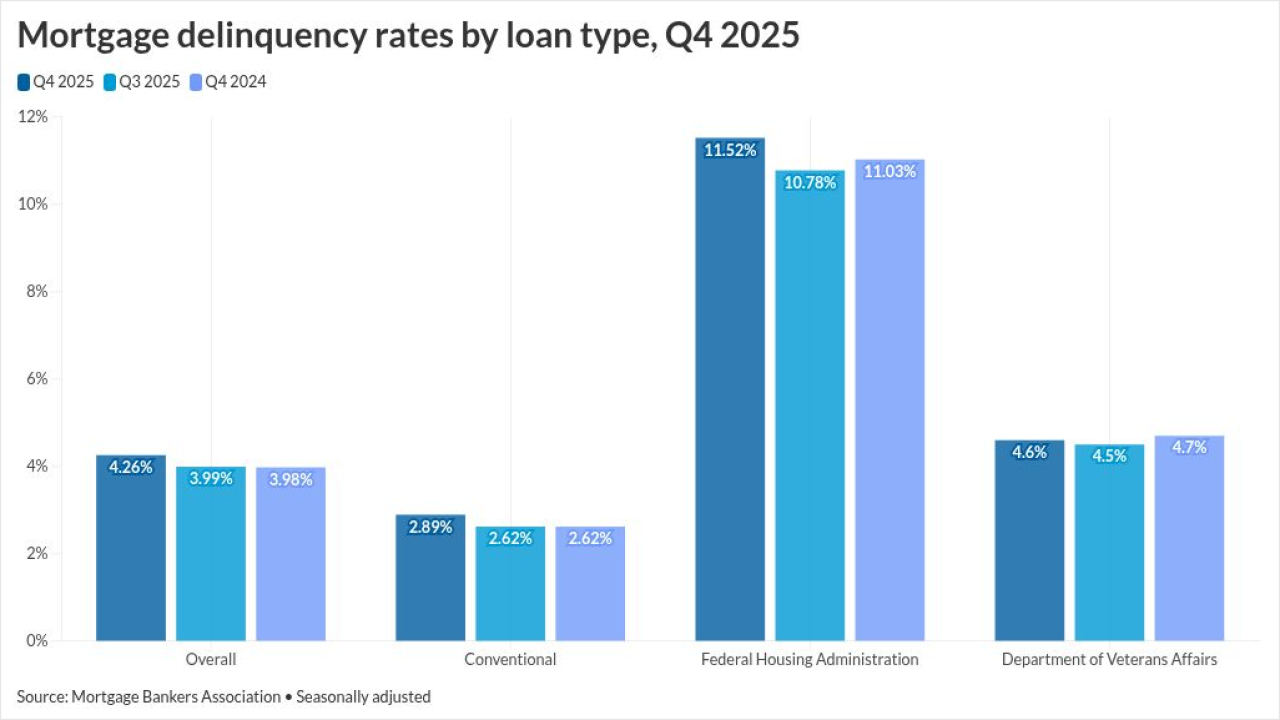

Mortgage delinquencies increased across loan types, and while 30-day late payments showed overall improvement, later-stage distress worsened.

February 13 -

The Bureau of Labor Statistics released its January Consumer Price Index Friday, showing that inflation rose 0.2%, while the annual rate eased to 2.4% after holding at 2.7% for several months. The data reduces the likelihood that the Federal Reserve will cut interest rates in the near future.

February 13