Servicers of traditional single-family loans could face limits from Ginnie Mae on their ability to sell off a portion of the income they receive over time if they don’t comply with a new requirement.

The new rule is part of ongoing efforts by Ginnie Mae to better address the risks of a more diversified issuer base, which has raised some concerns that there could be

Under the new rule established by Ginnie Mae, servicers have until March 1, 2020 to retain a minimum of 25 basis points of the servicing on their portfolios or face a similar limit on the servicing they could sell off for cash in individual transactions.

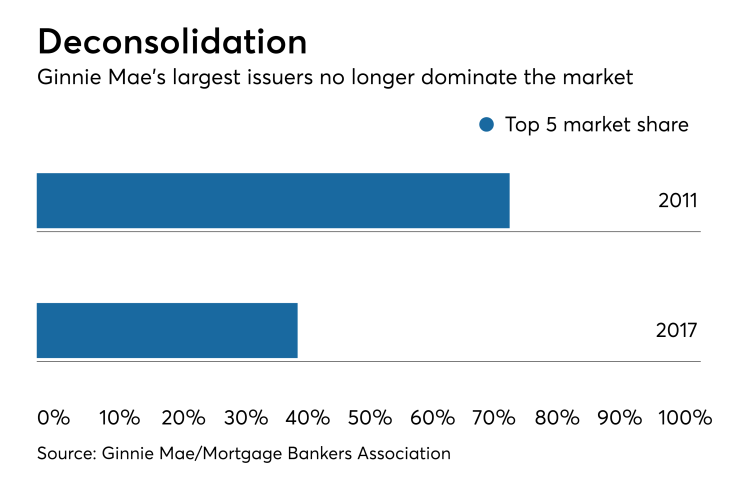

The new rule won't have quite the same impact on the industry as it would have in years past. That's because the large issuers Ginnie is involved with represent less than half of all the securitized mortgage volume the government agency guarantees, as opposed to more than 75% of them in 2011.

The rule could hit some firms hard. "Smaller players in this market can't meet that standard," Chris Whalen, chairman of investment banking and consulting firm Whalen Global Advisors, said in an interview about the new rule.

A "handful" of bank and nonbank issuers of various sizes would be at risk of being out of compliance if the rule were to be implemented today, some because their business models are built around a lower level of servicing spread, said

But Ginnie has already identified and notified them, and will work to help bring them in compliance before next March, she said.

"There will be no premature action prior to the effective date," Kasper said in an interview.

Ginnie is aware of the needs of the different subgroups within its issuer base and working to ensure its rules don't adversely affect them, she added.

Ginnie Mae added the new requirement for a minimum servicing portfolio spread because "the amount of net servicing income generated by each issuer portfolio is a key factor impacting that issuer's ability to remit scheduled payments to security holders," according to a

"We've had to take on portfolios that had very low servicing fees attached to them," Kasper said. "We need to make sure that there's value in that asset in the event of default."