Officials at New York Community Bancorp continued Wednesday to tout the benefits of the still-pending purchase of Flagstar Bancorp, but they stayed tight-lipped about the deal's status.

With just five days remaining until the companies run up against their latest transaction deadline of Oct. 31, analysts tried to pry loose any details about where the $2.6 billion acquisition stands.

What they heard instead was much of what they've been hearing since the deal was announced in April 2021: bringing Flagstar into the fold will diversify New York Community's funding profile, reduce its interest rate sensitivity and help it transform into a commercial bank.

"Let me be clear. … We're not going to speak specifically about the pending merger," CEO Thomas Cangemi said in response to an analyst's question about the deal.

"However … we're very comfortable that this business combination is a powerful opportunity for these two companies to come together and build a new [company] that has good diversity, a tremendous [and] unique opportunity on the deposit side on funding and gives us an opportunity to transition from a thrift into a commercial banking enterprise," he added.

When it was

As the original April 24, 2022, deadline to complete the acquisition passed without the blessing of federal regulators, New York Community and Flagstar decided to

If the deal closes, it will be the Hicksville, New York-based New York Community's first whole-bank acquisition since 2007. A onetime active acquirer of New York-area thrifts, the company's last attempt at M&A fell apart in 2016 when its bid for rival Astoria Financial was

It remains unclear what exactly is holding up the approval process. But several larger bank mergers and acquisitions have taken longer than expected to close following President Biden's July 2021 executive order

In a post-earnings call research note, analyst David Chiaverini of Wedbush Securities said he chalked up the delay "to regulatory slowness" and as such is tweaking his models to reflect a Jan. 1, 2023, completion date.

There could be other reasons for the holdup. This month, Capitol Forum reported that the Department of Justice is thinking about bringing a racial discrimination case against Flagstar for allegedly charging Black borrowers more for home loans than other borrowers.

Bank regulators are pushing large regional banks to have more definitive resolvability plans as part of their merger review, but some observers say those requirements are effectively new capital requirements by other means.

The report cited anonymous sources who pegged the issue on correspondent lenders, which originate, underwrite and fund home loans before selling them to other larger primary lenders such as Flagstar.

Neither New York Community nor Flagstar addressed the report during Wednesday's call. A spokesperson for New York Community said the company had no comment on the report.

With the acquisition up in the air, New York Community spent a lot of time talking up some of the improvements it is making on its own to transform its business model.

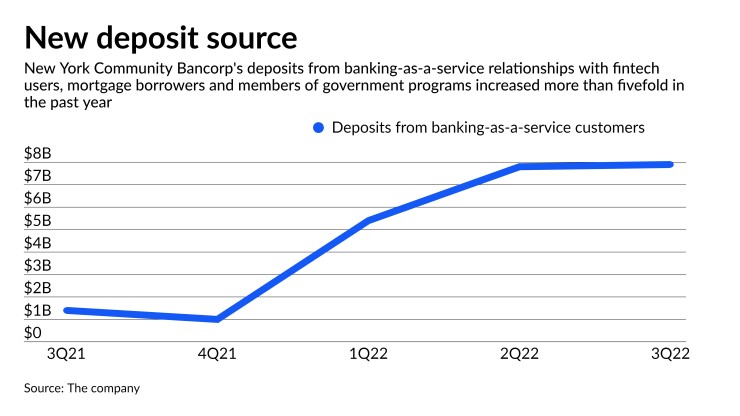

For starters, the funding mix is improving as the $63 billion-asset company keeps shedding higher-cost deposits such as certificates of deposit and wholesale funding in favor of adding more interest-checking accounts. The increase in interest-bearing accounts — which now make up 34% of total deposits, up from 18% during the third quarter last year — is tied to reeling in more deposits from loan customers and growing banking-as-a-service relationships with fintechs users, mortgage borrowers and members of government programs, including users of the U.S. Treasury's prepaid debit card program, the company said.

Both strategies were launched last year. Loan-related deposits have increased 26% since the start of the year to $4.8 billion, the company reported. Deposits from banking-as-a-service relationships have risen more than fivefold in the past year, company data shows.

The recent win of two new banking-as-a-service contracts "should result in fee income and deposit growth opportunities for the company," Cangemi said.

"We are pleased with the success we have gotten with those two programs and expect they will continue to be the primary drivers of our deposit growth going forward," he added.

Diversifying the loan portfolio, which is one of the goals of the Flagstar acquisition, is taking longer. Multifamily loans continue to make up the vast majority of New York Community's loan book — 76% during the third quarter, up from 75% in the year-ago period — while commercial real estate loans accounted for 14% of the total loan portfolio, down from 15% as of Sept. 30, 2021.

For the quarter, New York Community reported $152 million in net income, up 2% year over year. Earnings per share of 30 cents were unchanged.

Given its liability-sensitive balance sheet, the company experienced margin compression during the quarter. It reported a net interest margin of 2.22%, which was down 30 basis points from the second quarter of this year and down 22 basis points compared with the year-ago quarter.

The company is preparing for the impact of more interest rate hikes by the Federal Reserve, on both a standalone basis and as part of a combined entity with Flagstar, Cangemi said.

"On a combined basis, we have an opportunity to really think about where we want to put our balance sheet, look at a transformational opportunity here and set the balance sheet for what's prepared for the future," he said. "I think that's the real excitement of the upside."