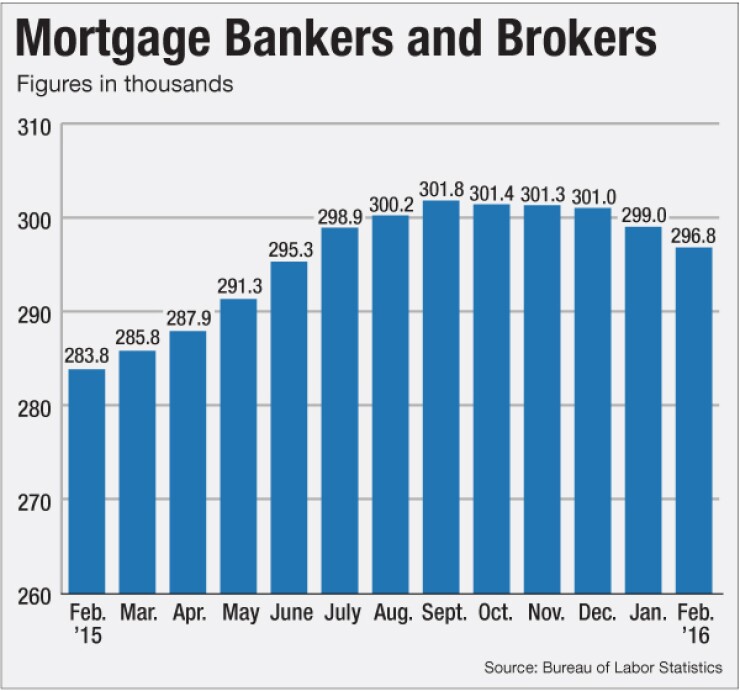

Nonbank mortgage lenders and brokers cut 2,200 full-time employees from their payrolls in February, following a layoff of 2,000 workers in the prior month.

The Bureau of Labor Statistics reported Friday that employment in the nonbank mortgage sector fell to 296,800 in February from

The recent slide in sector employment could reflect layoffs as the industry has largely adjusted to the new Truth-in-Lending-Real Estate Settlement Procedures Act integrated disclosures regime. It also could reflect the recent downturn in the stock market and seasonal factors.

However, spring home sales are getting off to a good start for the year. "Pending home sales rose solidly in February to their highest level in seven months and remain higher than a year ago," according to the National Association of Realtors.

Solid job growth and relatively low mortgage rates has bolstered demand for single-family homes, according to Robert Mellman, managing director at JPMorgan Economic Research.

For the three months through February, new home sales were 5.2% above their second-quarter 2015 and third-quarter 2015 average. "Mortgage purchase applications were 9.4% higher," according to a March 31 JPMorgan Economic Research report.

The report notes that the number of potential first-time buyers (in the 25-39 age bracket) will increase by 1.22 million this year, the largest increase of this economic expansion.

"While demographic factors are usually not the dominant influence on home sales, they should be a force for stronger sales and construction this year absent substantial change in the economic or interest rate environment."

The BLS reported Friday that the U.S. economy created 215,000 jobs in March and the bureau revised its February jobs number up slightly to 245,000. The unemployment rate ticked up to 5% from 4.9% in February.

"The March jobs report was very solid," said Douglas Holtz-Eakin, president of the American Action Forum and former director of the Congressional Budget Office, in a note Friday. He noted that the uptick in the unemployment rate was due to an increase in labor force participation. "The labor force grew by 396,000 — the fourth straight month with strong growth in the labor force."