Ocwen is putting plans in place to realize $100 million in savings using resources from its acquisition of PHH Corp., which has just closed.

"We believe our increased size and scale will create both strategic and financial benefits,"

The company plans to realize the savings through "targeted cost synergies and improved economies of scale," according to Caldwell.

The combined company will service an estimated 1.7 million in loans with an unpaid principal balance of more than $296 billion.

With the closure of the transaction, former PHH Corp. CEO Glen Messina

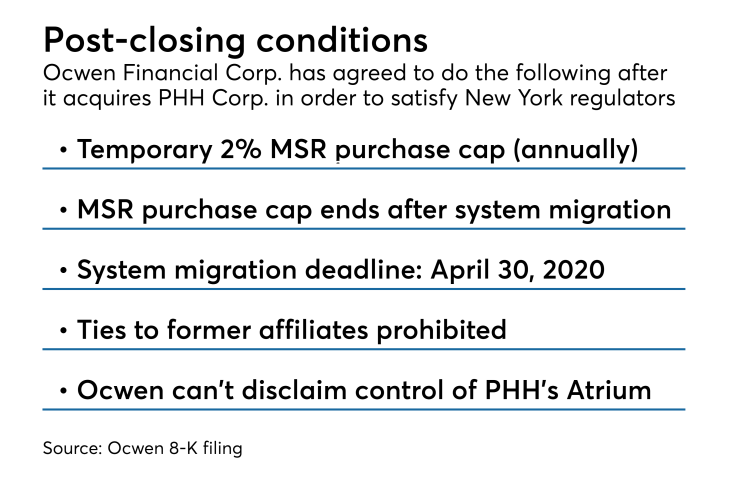

Ocwen will still have to satisfy

Many of the conditions revolve around ensuring the company follows through with the need to

Ocwen has had to address several legal and regulatory complaints over time, and one of its former executives was recently

A legal complaint against Ocwen related to robocalls has remained unresolved because, less than a week before the acquisition closed, a judge denied the terms of a settlement the plaintiffs had agreed to last year. The judge was concerned the $17.5 million payment

Ocwen is aware of the decision and reviewing the court order, according to a spokesman for the company.