Wholesale subprime giant Option One Mortgage Corp. plans to close 12 mortgage processing offices and trim 600 workers by early September, industry sources have told MortgageWire.The company will also exit the bulk acquisition/flow correspondent market. At deadline time an Option One spokeswoman confirmed that cuts were under way, but stressed that the lender -- slated for sale to hedge fund Cerberus Capital -- will not exit any geographic areas. Of the 600 jobs that will be lost, 14% are in sales. Most of the job losses (66%) are in the production functions, the spokeswoman said. The offices slated to close include: Tempe, Ariz.; Milwaukee; Philadelphia; Foxborough, Mass.; Charlotte, N.C.; Columbus, Ohio; Ft. Lauderdale, Fla.; Bellevue, Wash.; Saratoga, Calif.; Rancho Cucamonga, Calif.; Rolling Meadows, Ill.; and Sterling, Va. The company's Lake Forest, Calif., branch will relocate to Irvine, Calif., by July 13. The Irvine-based lender is making the changes "to better align our cost structure to current revenues." (For more details, see the May 21 issue of National Mortgage News.)

-

The Federal Housing Finance Agency said it is reviewing more than 9,000 pages of records tied to fraud tips submitted through a hotline launched last April.

1h ago -

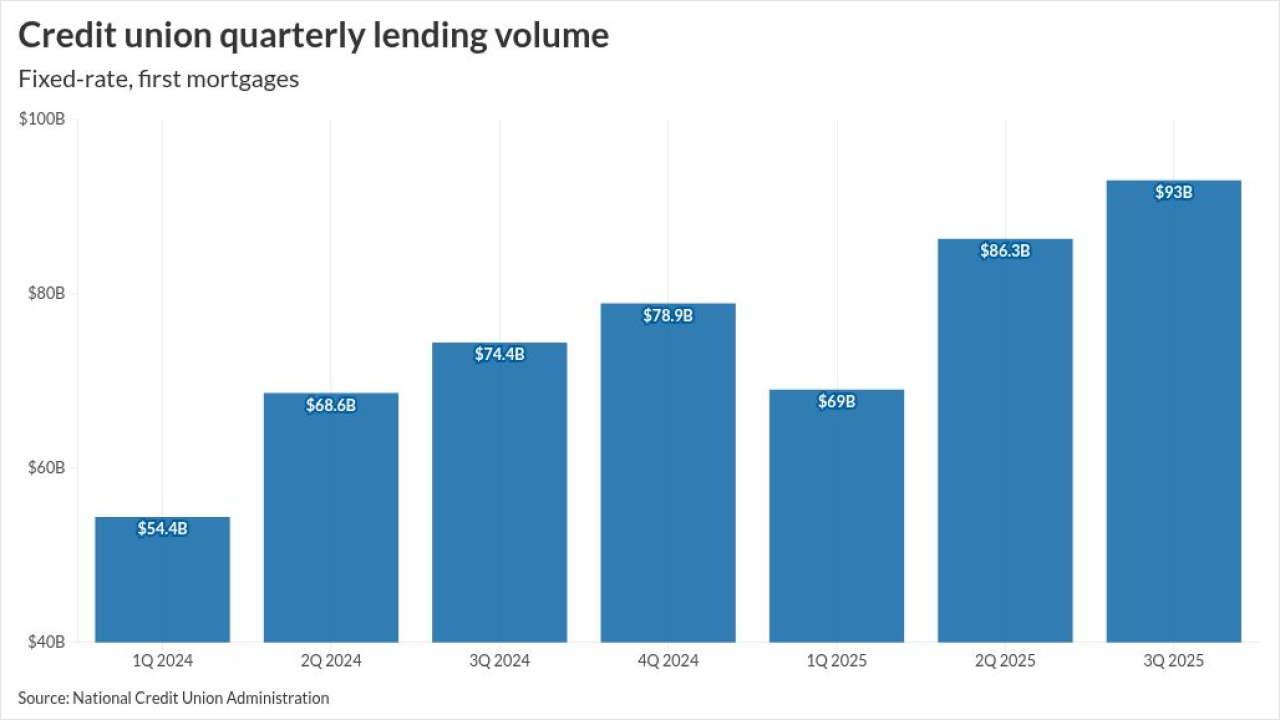

The agreement between servicing technology platform Vertyx and Great Lakes Credit Union arrives as the mortgage industry sets its focus on borrower retention.

1h ago -

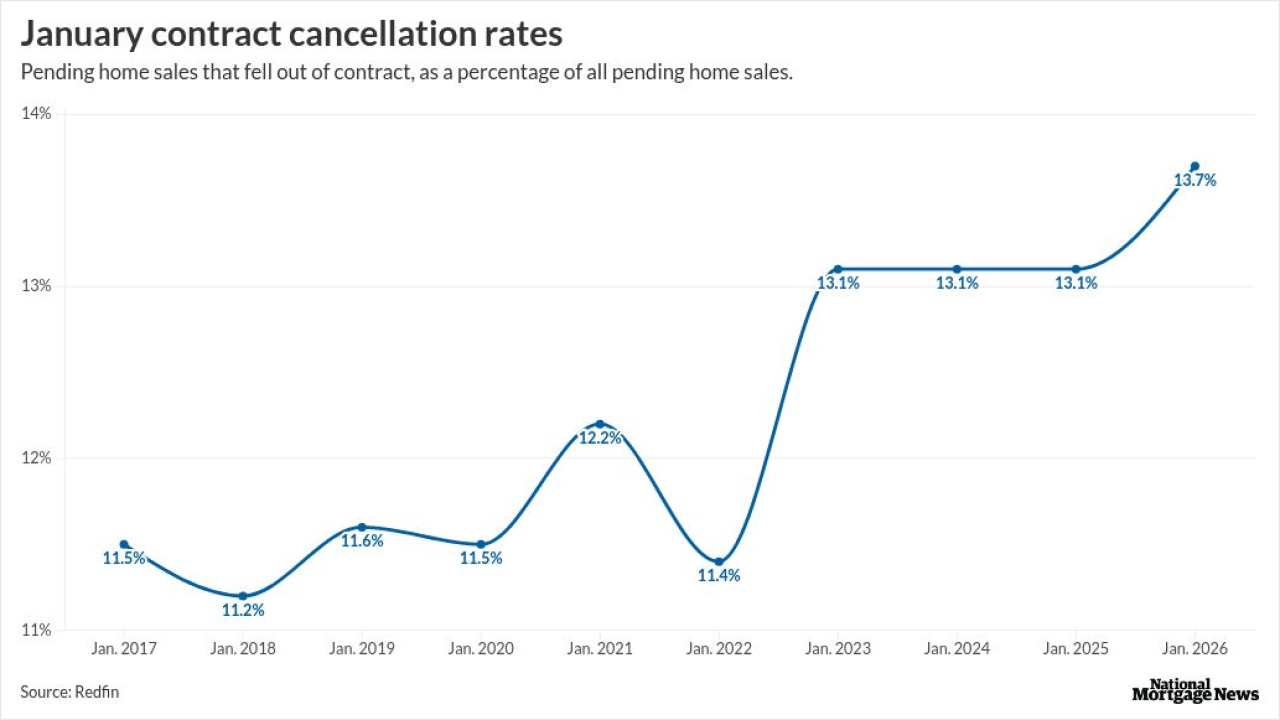

Nearly 14% of homes that went under contract last month were cancelled, up from 13.1% last year and the highest January share in records, according to Redfin.

2h ago -

Federal Reserve Gov. Lisa Cook said AI could boost productivity, but warned the transition may raise unemployment and force difficult tradeoffs between inflation and jobs.

4h ago -

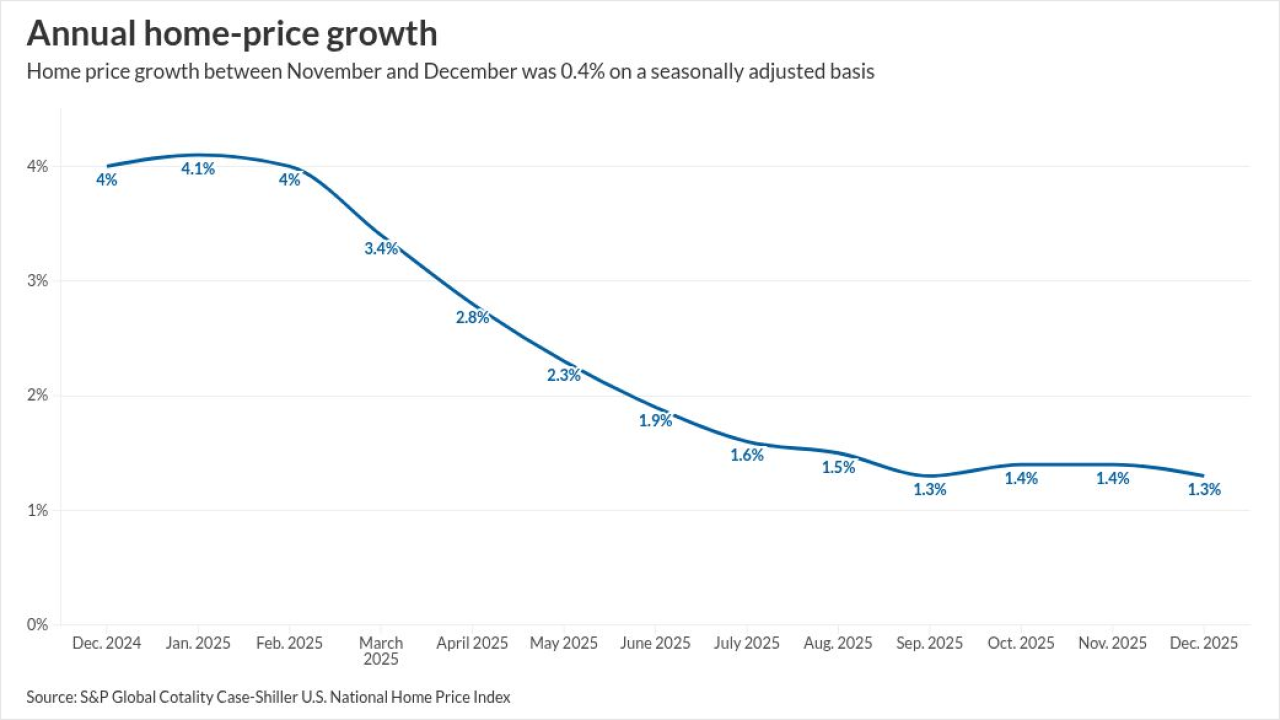

Home prices edged up nationwide, but gains were modest and uneven. Major indexes agree on direction, differ on size, as 2025 posted weak growth.

6h ago -

Federal Deposit Insurance Corp. report shows margins widened and profitability remained high even as credit quality saw some wobbles from consumer and commercial loan portfolios.

6h ago