The hottest channel in mortgage originations is the so-called mini-correspondent business. Loan aggregators seem to be tripping over themselves to work with these small mortgage bankers. There's just one problem.

Critics say many of these outfits are really mortgage brokers in all but name, lacking the staffing needed to prevent fraud and the capital to repurchase loans that go bad.

And while some view mini-correspondent as a legitimate niche that just requires special attention from lenders, other observers worry that the channel's primary reason for existence is to allow

"There is still a question mark about whether it is an effort to circumvent the Consumer Financial Protection Bureau. That is the big concern right now," says Tom LaMalfa, an industry consultant.

Mini-correspondents are mortgage bankers that have limited net worth. They can close loan in their own names, but typically the warehouse lines are either provided by entity buying the loans or require lender approval of the takeout investor.

One industry veteran who is highly skeptical of the mini-correspondent channel says these outfits lack the infrastructure to control fraud risk.

"I've been in shops that have no underwriters, no docs people and no funders. There are people out there buying loans from them," says Rick Soukoulis, the CEO of mortgage banker Western Bancorp in San Jose, Calif.

The channel exists because of displacement of originators in the market, says David Lykken, managing partner of Mortgage Banking Solutions, a consulting firm in Austin, Texas. The bar

BLURRED LINES

Mini-correspondent is not a new term; the channel existed prior to the housing crisis, says Rick Seehausen, the CEO of LenderLive Network, an outsourced fulfillment services provider in Glendale, Colo.

"In our sales presentations, 'mini-correspondent' is a term that we used back in the early to mid-2000s," he says. Besides mini-correspondent, other terms for whole loan sellers used in the market include broker-to-banker conversions, delegated correspondent and non-delegated correspondent.

"Is the non-delegated correspondent and the mini-correspondent one thing or two things? I think these are different terms being used to fundamentally describe the same thing," Seehausen says.

The lines defining these channels are "nebulous," LaMalfa says.

A dubious distinction was drawn between the

This divide drove many of the early broker-to-banker conversions. The fees paid by the purchaser of a closed loan do not have to be disclosed to the borrower but fees paid on a brokered loan do.

A similar rule applies to the 3% fee cap established in the QM rule under the Dodd-Frank Act. Fees paid to the broker by the lender count towards the cap, but whole loan sale fees don't. The CFPB did not return a request for comment on whether it is looking at the issue.

The typical minimum net worth for a mini-correspondent is $75,000. With such thin capital, Soukoulis says, if there is a problem with the loan, "what are you going to buy back?"

The same worry about buybacks concerns John Councilman of AMC Mortgage, a brokerage based in Fort Myers, Fla. Becoming a mini-correspondent is "too dangerous" for a firm like his, he says.

There is no market for loans that fall outside mainstream investor guidelines, so having to repurchase one, or take it off the warehouse line, "would be devastating because of the losses we would suffer," he says. Traditional correspondent sellers are "are getting clobbered" when they have to buy back a loan.

Councilman, the president-elect of NAMB, a broker trade group, says he looked at becoming a mini-correspondent, but instead AMC Mortgage has gone the opposite direction. It dropped two of its three mortgage banker's licenses, in Pennsylvania and Florida, and kept the one it had in Maryland only because it used to originate some loans there for its portfolio.

In a lot of cases with the new crop of mini-correspondents, it is the takeout investor that is providing the green light to close, not the warehouse provider, says Soukoulis.

That situation is "like having a credit card in your wallet, but unless you showed up with me at Macy's you couldn't buy a pair of socks; 'I'm here with Brad, he's good for those socks.' It is a ridiculous proposition," he says.

RISK CONTINUUM

Stanley Middleman, the CEO of Freedom Mortgage in Mount Laurel, N.J., agrees that the staffing is thin at many of these mini-correspondent shops. But he says he looks at the channel from the perspective of the creation of the mortgage servicing right asset.

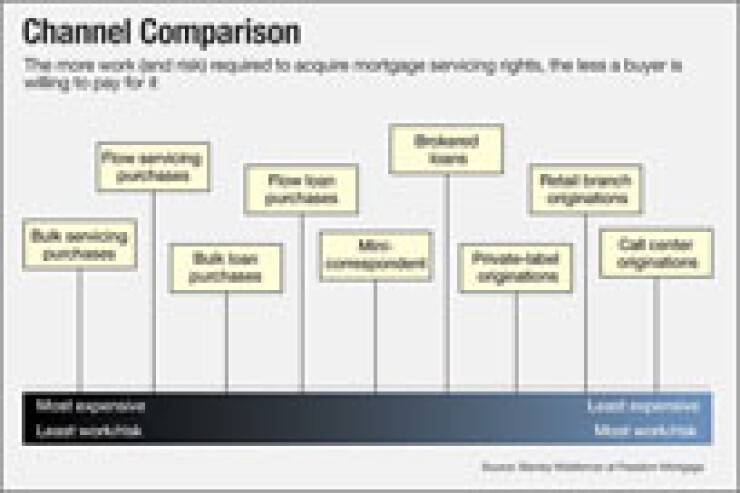

There is a legitimate difference between the various origination channels in terms of the work to be put in by the buyer regarding the acquisition of the related mortgage servicing right. As the amount of work a company like Freedom has to do to originate the MSR asset increases, the price paid for it decreases.

Buyers are willing to pay the most for bulk portfolio purchases of MSRs, because they have to put the least amount of work into their creation, says Middleman.

Of the nine points along the continuum Middleman describes (see chart, above), mini-correspondent is in the middle. The buyer pays less than a closed loan purchased on a flow basis, but more than it would for a loan the buyer has to close in its own name that is originated by a broker.

Up and down the scale, companies must weigh the cost of acquiring loans against the savings from having someone else produce them, to determine what is best for their own business.

"With costs running away as fast as they are, today it may be more relevant to do less of the work and have less exposure to personnel costs by off-loading some of those responsibilities you took on to pick up additional margin when volume was high," Middleman says. "By understanding the different channels, you can better manage your business by altering your delivery process and using that to your advantage."

Freedom has put its mini-correspondent unit together with its wholesale unit. "We consider them similar because we underwrite the loans and draw the documents for those loans in both those instances," Middleman says. But because the mini-correspondent funds the loan in its own name, it gets a little bit of a better price than a broker, he says.

Other companies lump the mini-correspondent channel together with the full correspondents, and Middleman says he wouldn't second-guess their decision. "It's just chocolate and vanilla. It is who prefers to do what and for which reason. Often it is driven by the sales force and the company's ethos and the way they see the world," he says.

'SALESMAN IN CHARGE'

While Middleman says Freedom is comfortable with the size and structure of the mini-correspondents it buys from, Soukoulis at Western Bancorp fears the bar for new mini-correspondents is moving lower.

"The salesman is in charge of the boat. It is everything you don't want," he says. Particularly considering the role fly-by-night mortgage brokers played in the industry's last debacle.

"We've worked real hard since the collapse to get a little bit more control over the brokerage side of the business," so brokers can't falsify borrower names or appraisals. "It is virtually impossible, other than for occupancy, to commit fraud."

But the skeletal staffing and paltry capital at many mini-correspondent shops could push the needle back into the opposite direction.

If there is a problem with the loan, the aggregator is likely stuck with it, just as if the loan had been brokered. The mini-correspondent lacks the net worth and/or access to scratch and dent or other credit facilities to repurchase the loan, Soukoulis argues.

Seehausen at LenderLive begs to differ. Lenders, he says, have strict controls over the mini-correspondent, and little risk. The originator "has a loan the investor wants to buy. The investor's looked at it and said 'Yep, I like this loan.'

"And that's all good. There is nobody trying to circumvent the system here," Seehausen says.

Rather than lightweights, mini-correspondents were typically "larger brokers that could have been mortgage bankers anyway," he argues. They just didn't have much incentive to obtain warehouse lines before Dodd-Frank's fee cap and other rules tipped the scales in favor of doing so.

"You don't get a warehouse line if you don't have a healthy and strong balance sheet, profit and loss statement and things of that nature. The smaller brokers aren't going to able to do that," Seehausen says.

Even for captive warehouse line, the mortgage banker has to meet certain financial thresholds, Seehausen notes. These lines have requirements for the mortgage banker to maintain financial performance or the line can be revoked.

CONTROLLING THE TRANSACTION

Graduating to mini-correspondent status empowers brokers and allows them to create strategic partnerships with vendors, warehouse banks and investors, says Scott Compton, divisional production executive for Plaza Home Mortgage in San Diego.

Real estate agents like dealing with lenders, including mini-correspondents, he said, because "they think you are in control [of the transaction] and you truly are," Compton told attendees at the Regional Conference of Mortgage Bankers Associations in Atlantic City, N.J. in March.

A retired New Jersey regulator in the audience, Sue Toth (who is also a past president of the American Association of Residential Mortgage Regulators), brought up an alarming trend: There are websites which say originators can act as mini-correspondents while still licensed as brokers. In New Jersey, at least, this "is a no-no," she said. The Garden State has a strict definition of who qualifies to be a mortgage banker.

Compton replied that his company will do a one-on-one interview with the prospective mini-correspondent and the first topic is licensing. Many of those looking to make the move have been told by others that they could be a mini-correspondent with their current status, only to be told later by regulators that they could not, he said.

Soukoulis says he founded a mortgage brokerage and moved up to be a mortgage banker a number of times in his career.

"There is nothing wrong with the emerging mortgage banker market. But nobody ever let me do it for $75,000 in net worth," he says.

Even if the mini-correspondent channel lasts, the name may not.

"I think it's a bad term because nobody feels good about being a 'mini' anything," Seehausen says.