Americans still view homeownership as an important life event, but only 14% of them claim it's of primary importance, according to Reportlinker.

The goal of homeownership ranked fourth among American priorities in 2017, one step down from achieving career goals and just above having or adopting children.

Despite homeownership's ranking dropping 5 percentage points from last year, the goal of homeownership more than doubled any other priority as a long-term goal, with 54% saying it was their primary long-term financial objective.

About 81% of consumers say homeownership is the best long-term investment a person can make, with the investment advantage being one of the forces driving

In this year's first quarter, the volume of new-owner households doubled the number of new-renter households, signifying that the younger generation is making its way into the buyers' market.

But as millennials look to leave their rentals behind, starter homes are beginning to make a comeback, and in response, builders are once again shifting their focus to lower price points that

Townhouses and smaller homes on narrow plots of land are also becoming more popular to cater to millennial demand.

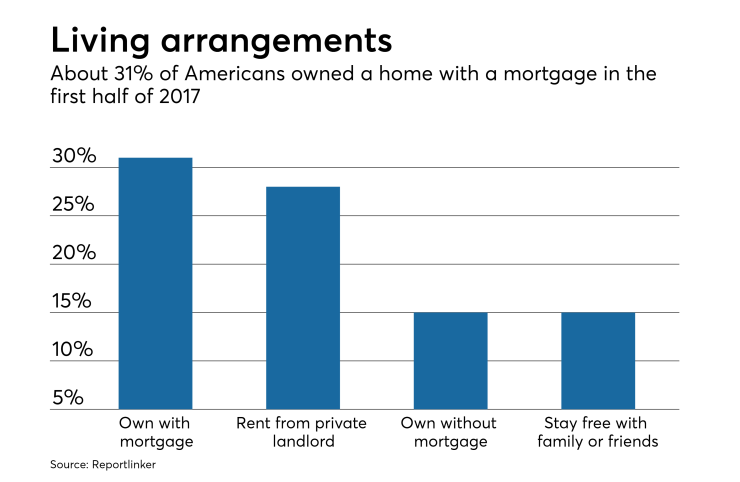

Among homeowners in general, 31% have a mortgage with 15% owning their home. Consumers aged 55 and over are most likely to be mortgage-free, and half of those aged 35-44 are more likely to still be making mortgage payments.