Mortgage delinquency cure rates for the first quarter were stronger than expected, giving confidence that the private mortgage insurers' loan inventory will continue to decline for the rest of 2021, a BTIG report said.

Still, the share of loans leaving the

"Relative to our current estimates, full quarter results were mixed — ending default inventory was better than expected for Essent and Radian and somewhat worse for MGIC and National MI," Gilbert said. "However, March quarterly cure rates are running ahead of our second quarter-to-fourth quarter estimates which, along with lower new default rates, give us confidence that default inventory will continue to decline in the coming quarters — driving loss ratios lower and return on equity higher."

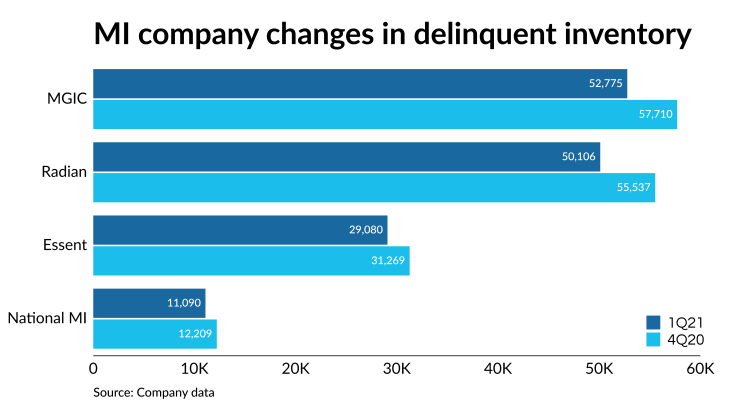

At the end of the first quarter, MGIC had 52,775 mortgages in the delinquent inventory, down from 55,103 on Feb. 28 and 57,710

That was slightly above Gilbert's estimate of 52,378 due to fewer cures than expected: 17,628 compared with a projected 18,756. But new defaults during the quarter of 13,011 beat BTIG's estimate of 13,795.

National MI ended March with 11,090 mortgages in the inventory, and that was 5% above Gilbert's expected 10,589.

Still, the inventory was down from 11,648 on Feb. 28 and 12,209 on Dec. 31, 2020.

The good news was that the default rate continued to decline during the quarter, to 2.54% in March, from 2.77% in February and 2.9% in January.

Gilbert was impressed by National MI's

"Insured loans increased 16% year-over-year, beating our plus-10% estimate," Gilbert said. "March NIW risk characteristics were consistent with February and National MI continues to increase its footprint in targeted risk segments, although layered risk of 0.1% remains consistent with prior quarter and is below pre-COVID levels."

At Radian, the delinquent inventory totaled 50,106 loans at the end of the first quarter, compared with 52,882 one month prior and 55,537 as of the end of the fourth quarter 2020.

The inventory's size "is better than our current 51,764 estimate on better than expected new defaults and cures," Gilbert said. "First quarter new defaults of 11,851 beat our 13,080 estimate and cures of 17,137 also beat our 16,661 estimate."

Finally, Essent ended March with 29,080 loans in the inventory; Gilbert had expected 29,359 loans.

This was down from 30,645 in February and 31,459 at the end of 2020.

The number of new defaults entering the inventory was lower than Gilbert had forecasted, at 7,422 instead of 8,156. However cures leaving the inventory were also lower than projected, at 9,737 compared with 10,227.