Radian Group sold Clayton Services, a due diligence company it acquired in the 2014 purchase of Clayton Holdings, to Covius Holdings. Terms of the deal were not disclosed.

Back in May 2014, Radian — a holding company whose main business is private mortgage insurance —

While

Just over three years later in October 2017, Radian announced a restructuring of the Clayton business. However, both before and after the restructuring announcement, Clayton added other parts to its services offerings, all of which Radian is keeping. These include Green River Capital (part of the original Clayton Holdings purchase),

For the fourth quarter of 2019, Radian will record a pretax, noncash impairment of goodwill and other acquired intangible assets of approximately $18.5 million related to the Clayton Services sale to Covius.

That is in addition to previous charges to earnings that Radian took as a result of the Clayton restructuring, including $131 million

"The driving force behind all that we do at Radian is our focus on our core mortgage and real estate capabilities and our commitment to serving the strategic needs of our clients," its CEO Rick Thornberry said in a press release. "We continually evaluate and refine the strategic solutions that we offer across the mortgage and real estate value chain, and part of that evaluation means making adjustments when necessary. We will continue to focus on building our core mortgage and real estate products and services through a data-driven, digital transformation that has come to define our One Radian strategy."

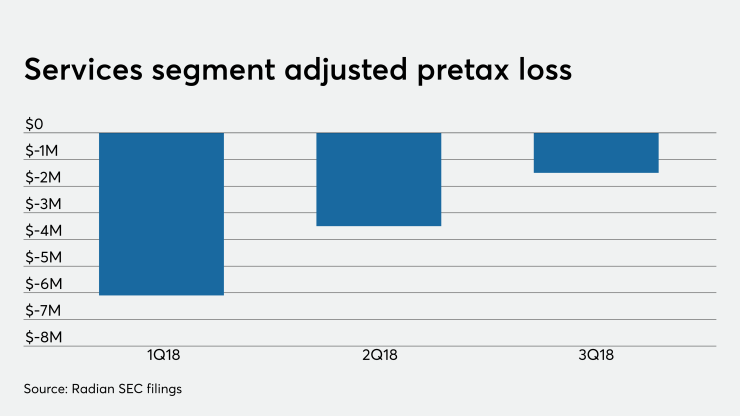

In the third quarter, Radian's services business lost an adjusted pretax $1.5 million, an improvement over the $7.9 million loss for the same period in 2018. Revenue improved to $43.6 million from $37.3 million the prior year period.

Approximately 550 Clayton employees will be joining Covius, along with the senior due diligence and surveillance management teams.

"Clayton is one of the most recognized brands in capital markets and mortgage securitization," Rob Clements, Covius' chairman and CEO, said in a separate release from that company. "This transaction will significantly expand the offerings and presence of Covius in those sectors. Clayton will be a core business for Covius. We intend to invest the capital and resources to grow Clayton's market share and build the technology required by the increasingly digital processes of the origination and secondary markets."