The median home loan payment remained

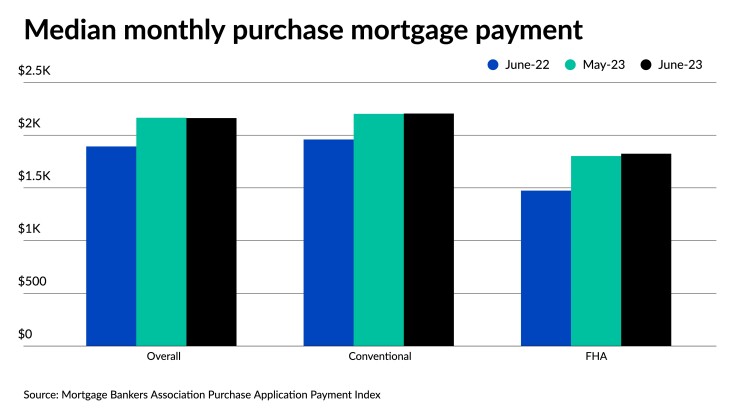

Median payments for June purchase applications came in at $2,162, edging down 0.1% from the previous month's $2,165, according to the Mortgage Bankers Association. The overall score of the trade group's Purchase Applications Payment Index, which factors in interest rates and median earnings income, in addition to payment amounts, decreased by the same percentage to a reading of 177.2 from 177.4 in May.

"Home buyer affordability is still strained this summer, with mortgage rates remaining high and volatile, and home prices high because of low inventory," said Edward Seiler, MBA's associate vice president, housing economics, and executive director, Research Institute for Housing America, in a press release.

On an annual basis, the PAPI, finished 8.1% higher, increasing from 163.9 in June 2022, as income growth helped offset a 14.2% rise in the median payment, which was $1,893 a year earlier. An increase in the MBA's index indicates declining borrower affordability, while downward movement signals improving conditions.

Monthly changes in median payments were muted across borrower and property types. The median for conventional loan applicants grew to $2,205 from 2,202 in May. On an annual basis, the figure was up 12.6% from $1,959.

Meanwhile, applicants taking out loans backed by the Federal Housing Administration last month had a median payment of $1,824 compared to $1,802 a month earlier. Last month's buyer faced an amount that was 23.7% higher than the median of $1,474 a year ago.

June's numbers offered a tiny hint of affordability returning, Seiler said. "The median purchase application amount fell from $330,000 to $326,000 in June, which is one positive sign that home prices are stabilizing. An ongoing combination of flattening home prices and lower rates would offer reprieve for households who are looking to buy a home."

However, June's PAPI would not have factored in a recent rise in mortgage rates, with the 30-year conforming average briefly

The July numbers, if maintained, might mean June's PAPI movements may turn out to be a blip rather than the beginning of a longer-term trend

Another mixed signal also came in housing numbers from Redfin this week. A report released by online real estate brokerage found the typical monthly mortgage payment this week

In MBA's look at June, the numbers showed affordability increasing for white, Black and Hispanic households alike with their component payment index scores all decreasing 0.1% from a month earlier.

States with the lowest levels of affordability were concentrated in the Western U.S. with Nevada, Idaho, Arizona, California landing in the "leading" four spots,

On the other end, affordability was highest in Alaska, Louisiana, Wyoming, Connecticut and North Dakota, all of which had index scores more than 40 points below the nationwide number.