After weekly mortgage application volumes increased for the

The Mortgage Bankers Association's Market Composite Index, a measure of loan activity based on surveys of MBA members, registered a small seasonally adjusted uptick of 0.2% for the weekly period ending August 5. But weekly volume was still 63% lower on a year-over-year basis.

"Mortgage applications were relatively flat, with a decline in purchase activity offset by an increase in refinance applications," said Joel Kan, MBA's associate vice president of economic and industry forecasting, in a press release.

With

"The purchase market continues to experience a slowdown, despite the

The Refinance Index rose for the second straight week, climbing 4%, but volumes were 82% lower than they were one year ago during a much lower-rate environment. The MBA's data also aligned closely with information coming from Fannie Mae, which reported that the dollar amount of refinance transactions increased by 2.7% during the week, based on information its researchers obtained from its automated underwriting system.

The MBA's weekly survey showed refinances increasing not only by volume over the seven-day period, they also accounted for a larger share of overall activity, making up 32% of all applications compared to 30.8% a week earlier. But

Loan sizes averaged higher, both overall and by transaction type, for the second week in a row, the MBA reported. The mean refinance amount was $286,000, up 3.6% from $275,800, while average purchase-loan sizes inched up 0.8% to $416,300 from $413,000. Even as purchase activity has slipped over the past month, their average amounts are now 2.7% higher after dropping to a year-to-date low of $405,200 in early July.

The average amount recorded for new applications overall last week jumped 1% to $374,700 from $370,800 seven days earlier.

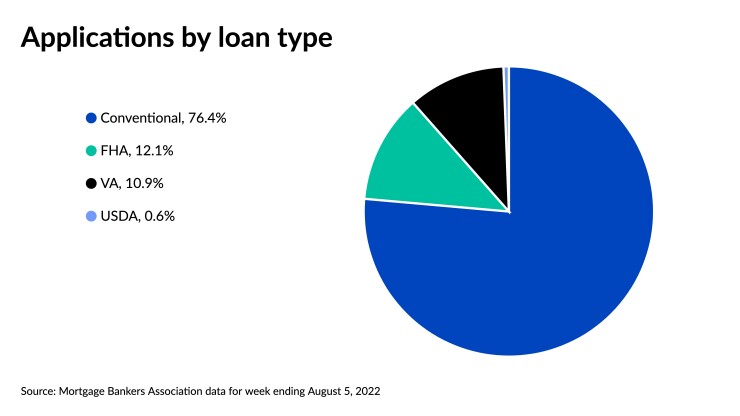

The share of government-insured mortgages relative to overall volume picked up, with Federal Housing Administration-guaranteed applications making up 12.1%, up from 11.9% a week earlier. Loans coming through the Department of Veterans Affairs took a 10.9% share compared to 10.8%, while the portion consisting of U.S. Department of Agriculture applications was unchanged at 0.6%. By volume, seasonally adjusted government-backed activity registered a 1.3% increase from the prior week.

Maintaining the up-and-down movement of the past few months, the average contract rate for the 30-year fixed mortgage with conforming balances of $647,200 or less increased among MBA lenders, rising 4 basis points to 5.47% from 5.43% week over week.

The average contract interest rate for 30-year fixed jumbo mortgages above the conforming amount also came in higher at 5.09% compared to 5.06% seven days earlier.

But interest rates for 30-year FHA-backed loans headed in the other direction, falling 4 basis points to 5.35% from 5.39% the prior week.

Following an earlier 21-basis point drop, the average 15-year fixed-contract rate remained at 4.74% week over week.

Meanwhile, the 5/1 adjustable-rate contract average headed upward again, climbing 5 basis points to 4.6% from 4.55% the previous week.