WASHINGTON — Federal regulators are concerned about credit and interest rate risk on apartment and other multifamily loans — and warning lenders that they need to be cautious.

In a joint statement issued Friday, the federal banking regulators said high concentrations of commercial real estate loans on the balance sheets, including multifamily, can lead to "greater risk of loss and failure."

The regulators also expressed concerns that lenders are resorting to less-restrictive loan covenants, extended maturities, longer interest-only payment periods, and limited guarantor requirements to remain competitive.

"Financial institutions should maintain underwriting discipline and exercise prudent risk-management practices to identify, measure, monitor, and manage the risks arising from CRE lending," the regulators said. "Financial institutions should have risk-management practices and maintain capital commensurate with the level and nature of their CRE concentration risk."

The statement came just days after the Office of the Comptroller of the Currency cited multifamily loans as a potential interest rate risk in its own report.

"Rising rates generally puts upward pressure on capitalization rates. This risk applies to all forms of the CRE lending, but multifamily loans are a particular concern, given that cap rates are at or near historic lows," said the report, which was issued Wednesday.

Federal Deposit Insurance Corp. Chairman Martin Gruenberg and Comptroller Thomas Curry have also both raised worries that banks and thrifts are easing credit underwriting standards on multifamily loans.

Bank examiners are likely going to be taking a closer CRE and multifamily loans, industry observers said.

"I think they are going to be stricter," said Ronald Glancz, a partner at Venable law firm in Washington. "Whereas something before was close call, now a loan might be written up and criticized."

A former FDIC and OCC attorney, Glancz also noted that the statement is designed to allow banks and regulators to get ahead of the problem. "It is being issued maybe earlier than it might have been before the last crisis," he said. "The regulators don't want to be criticized because they didn't act soon enough."

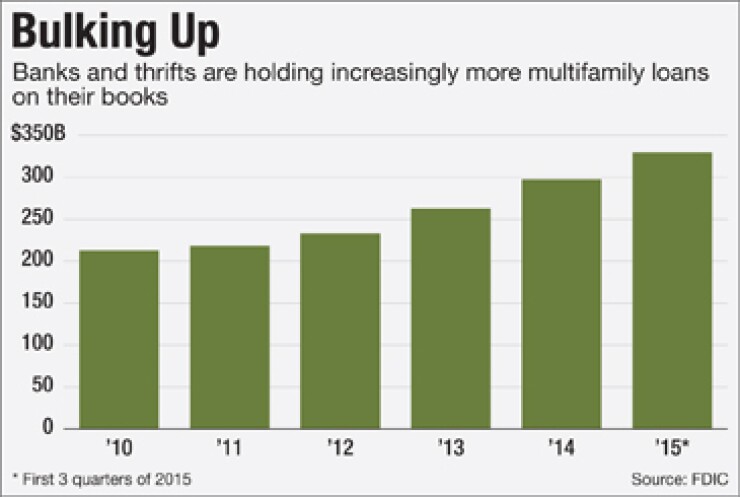

The added scrutiny by regulators on multifamily lending could slow what has been a steadily recovering market following the financial crisis. Multifamily demand and construction recovered at a faster clip than other commercial real estate properties. Yet that could haunt banks and thrifts that are now holding a record amount of multifamily loans on their balance sheets.

Banks and thrifts held $329.1 billion in multifamily loans as of Sept. 30, up from $288.9 billion a year earlier.

"The challenge on the lenders is that prices of multifamily properties have been bid up so much," said Lawrence Yun, chief economist for the National Association of Realtors.

That creates risk in terms of collateral value, he said.

"Even though the rental income looks good, prices of the properties may have already peaked," Yun said.

At the same time, construction of new multifamily units has surpassed historical highs.

"The biggest question of the year is whether apartment deliveries are at an inflection point," according to a Nov. 25 report by economists at Wells Fargo Securities.

With young adults steadily securing full-time jobs and gradually leaving the comfort of their parent's home, the apartment sector has more room to grow, according to the report. But "the ramp up in supply will put upward pressure on the vacancy rate," the report said.

The apartment market in some cities is not as tight as it was a year or two ago, according to Frank Nothaft, chief economist CoreLogic.

In some markets, apartment managers are offering enticements to attract tenants to newly completed projects.

"That has slowed the pace of rent increases," Nothaft said in interview.

But he expects demand for rental apartments will be "pretty vibrant" over the next few years.

Economists at the National Association of Home Builders are forecasting a slight slowdown in multifamily housing starts next year. They expect construction of 382,000 multifamily units in 2016, down from just below 400,000 units this year.

"It appears the multifamily construction boom is topping out, but the inventory of single-family homes is still tight," said David Crowe, the chief economist for the NAHB.

But analysts at Wells Fargo Securities are forecasting 430,000 multifamily starts in 2016, up from 400,000 in 2015.

Meanwhile, Fannie Mae and Freddie Mac are still the largest buyers and securitizers of multifamily loans.

According to analysts at Trepp, the two government-sponsored enterprises have purchased $90 billion in new multifamily business for the year as of Oct. 30. The Federal Housing Finance Agency had capped the GSEs' multifamily purchases at $30 billion each, but relaxed the cap in May.

The GSEs still have the largest share of overall multifamily lending, at close to 42% for the first three quarters of 2015, with banks coming in second at 33%.

"Both groups increased their overall share of the market from 2014,'' said Sean Barrie, a Trepp analyst, in an interview.