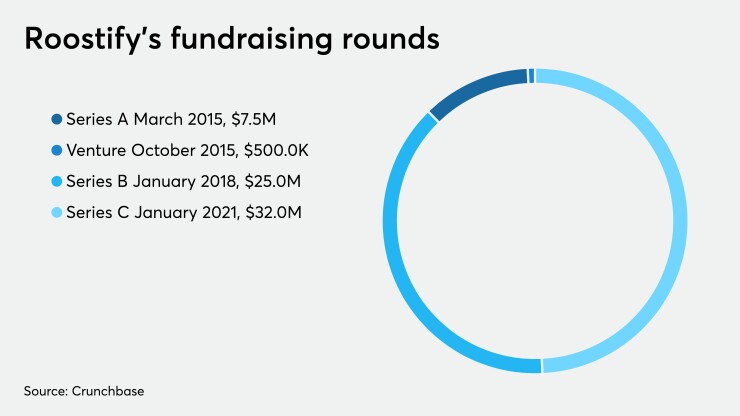

Mortgage fintech Roostify has completed a Series C funding raise that nearly doubled the amount of capital it has received from outside investors.

The round, led by Ten Coves Capital, added $32 million in funding, bringing the total capital raised since the company's

Roostify plans to use some of the funds to grow its staff by 50%, and will also make further investments in developing artificial intelligence tools.

A key participant in this round was Stone Point Capital, the primary investor in nonbank mortgage lender Home Point Capital, which is in the process of doing

Returning investors Cota Capital, Mouro Capital, Colchis Capital, Point72 Ventures, and JPMorgan Chase also participated in this round.

Previously, Roostify raised $7.5 million in its Series A round and $25 million in its

"The opportunity to re-design the future of home lending through technology cannot be overstated, as the mortgage lending industry has been relatively slow to embrace digital technologies," Dan Kittredge, managing partner at Ten Coves Capital, said in a press release.

Ten Coves currently has an investment in fintech company Lendio. Previously, it invested in

Other current Stone Point investments include

Last October, Roostify partnered with

"Having easy access to meaningful digital tools is key to helping lenders thrive in a digital-first world," said Roostify CEO Rajesh Bhat. "With this capital infusion, we will accelerate our vision of simplifying home lending without compromising on quality and time-to-market."