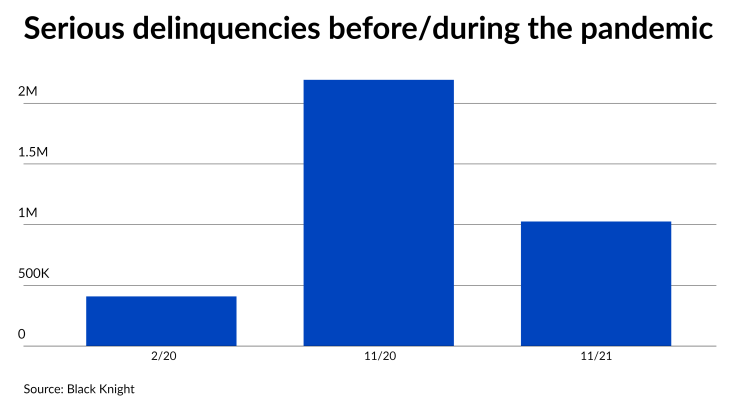

Mortgages 90-plus days past-due fell further last month, but the number of loans in this category was still more than twice as high than just prior to the pandemic.

Serious delinquencies in November declined by 80,000 from October, but more than 1 million remain, according to Black Knight’s latest First Look report. Just 409,000 loans were seriously delinquent but not in foreclosure at the end of February 2020.

The relative numbers for mortgages that traditionally would be on the verge of foreclosure absent pandemic-related mandates, and the pace at which they’ve been falling, suggests a full recovery could take months but potentially less than a year. Serious delinquencies were down by nearly 1.17 million from 12 months ago.

Improvement in delinquencies overall appears to be continuing apace, according to Black Knight. The national delinquency rate, inclusive of payments late by 30 days or more, fell by 4.1% in November, matching the average rate of decline for the past 18 months.

But what happens next depends largely on how or whether the rise of

Plans that provided federally-authorized forbearance on loan payments for borrowers with pandemic-related hardships continued to expire in droves through November, with more than 800,000 exiting in the past two months combined, according to Black Knight.

“Given the size of this population, both serious delinquency and foreclosure metrics demand close attention as we enter 2022,” the data and technology vendor said in its report.