The share of seriously delinquent mortgage loans in June declined 57% on a year-over-year basis, the driver of a drop in the overall late payment rate, data from CoreLogic found.

For June, 2.9% of all mortgages were 30 or more days past due on their scheduled payment or in foreclosure. This was down from 4.4% during June 2021. However, the rate was slightly higher than May's 2.7%.

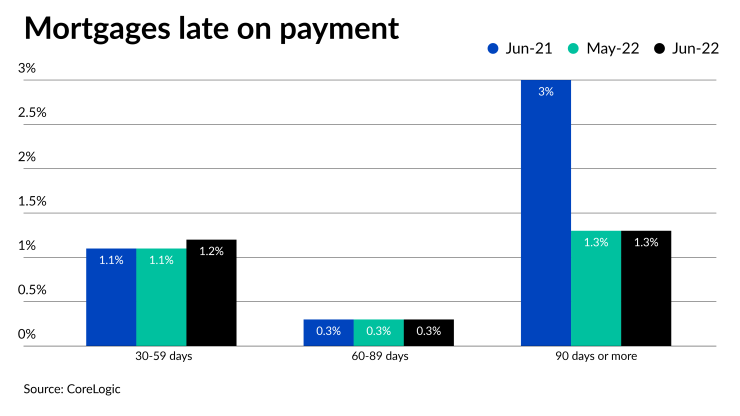

Mortgages with loan payments that are late by 90 days or more or are in foreclosure made up 1.3% of June's delinquencies,

However, the foreclosure inventory ended June at 0.3, unchanged from May, but up from 0.2% for June 2021.

But the percentage of loans between 30 and 59 days late grew slightly to 1.2% in June from 1.1% for both May and June 2021.

"While early stage delinquencies edged up in June, they remained near historic lows through the first half of 2022," said Molly Boesel, principal economist at CoreLogic, in a press release. "Later-stage delinquencies fell by 60% from June 2021, with only a small increase in foreclosures, indicating that delinquent borrowers are able to find

The share of mortgages where the borrower is between 60 and 89 days late ended June at 0.3%, unchanged from May and June 2021.

The transition rate, the share of loans that moved from current to 30 days past due, was 0.7%, slightly higher than June 2021's 0.6%.

All states posted annual declines in their overall delinquency rates, led by Hawaii and Nevada, both down 2.6 percentage points. New Jersey was next with a 2.4 percentage point declined, followed by New York, down 2.3 percentage points.