Distressed mortgages have generally been easier to manage during the pandemic than during the housing bust of 2008, except for one factor: the many investor rule changes around the forbearance extended under the CARES Act.

That’s among the key takeaways from a special topic analysis Fannie Mae recently conducted as part of its

Nearly one-third of servicers said keeping up with the policy changes from investors during the pandemic was more challenging than in 2008, and 38% called it just as challenging. Only 25% called it less challenging, and 4% said they didn’t really know how it compared.

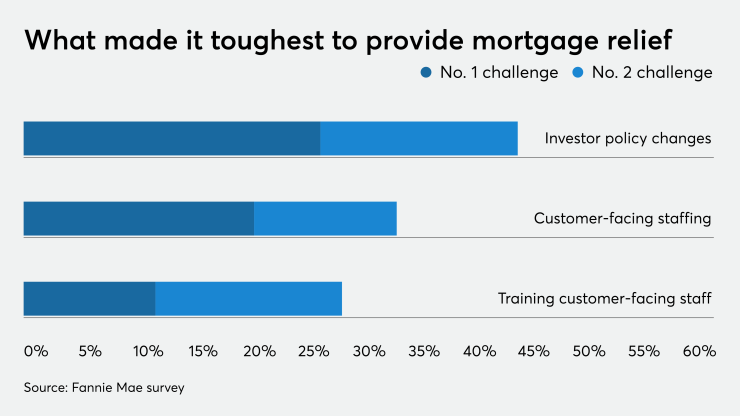

Nearly half or 45% of the more than 100 servicers surveyed identified shifts in those rules — such as

That finding related to other hurdles servicers identified related to communication.

Explaining post-forbearance plans to customers was among top challenges identified by 34% of servicers, with 15% putting it at No. 1 and 19% putting it at No. 2; followed by explaining implications of taking forbearance, which 31% of servicers listed as a top challenge, with 16% identifying it as the No. 1 hurdle and 15% ranking it No. 2.

Checking in on borrowers to inquire about forbearance exit-readiness also was among the top challenges for 27% of respondents, with 19% ranking it No. 1 and 8% ranking it No. 2.

“Technology and the process for homeowners to request assistance were much less of a concern,” noted Caroline Patane, a vice president at Fannie and author of the blog.

Servicers can thank post-Great Recession software developers for that.

A number of software tools were created to address the need to provide scalable mortgage relief during that period, after paper-intensive processes led to huge backlogs. In one case, for example, piles of unopened modification applications reportedly

In contrast, servicers contending with the current crisis reported that they were able to better manage their workloads thanks to technology and the fact that CARES Act forbearance was offered upon request for pandemic hardships.

“Nearly 60% reported that their website helped reduce call center volume from homeowners inquiring about forbearance plans,” Patane noted in the blog.

However, even with automation’s help, companies reported having enough people to manage capacity among their top challenges.

More than one-third called “customer-facing staffing capacity” a major hurdle, with 21% identifying it as their No.1 challenge and 13% identifying it as No. 2. “Training customer-facing staff” was pegged as a key concern by 29%, with 12% ranking it No. 1 and 17% ranking it No. 2.