As if

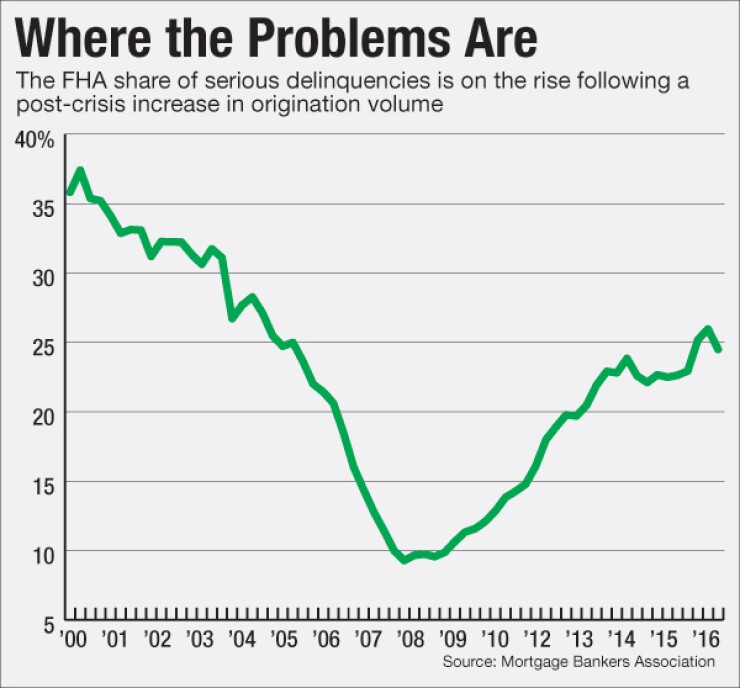

An estimated 25% of all outstanding mortgages that were seriously delinquent at the end of the first quarter of this year were insured by the FHA, up from less than 20% in the first quarter of 2012, according to the Mortgage Bankers Association.

FHA loans typically tend to default more than government-sponsored enterprise loans because they are designed to be more affordable to borrowers by offering lower down payment and credit score requirements. But market conditions that changed during the most recent housing boom-and-bust cycle have made the trend more pronounced.

At one point during this cycle, FHA's share of defaults dropped below an estimated 10%. So the increase in FHA default share to nearly a quarter of the market has been a shock to the servicing industry, particularly those servicers that entered the market when FHA defaults were low.

"They don't know how to service FHA loans, and it's hitting them in masses," said Matt Martin, CEO of Chronos Solutions, a mortgage industry vendor that offers FHA foreclosure property services.

The root of the problem is twofold. FHA's share of origination soared as subprime and other mortgage products that competed with FHA disappeared after the housing crisis; the rise in default share is a natural reaction to that. Second, the combination of longer foreclosure timelines and loss mitigation options that didn't exist before the crisis have extended historical timelines for defaults to peak in a given vintage of loans.

Distressed servicing in general has become so much of a challenge that even experienced banking giant JPMorgan Chase & Co. is feeling the pain. "If we had our druthers, we would never service a defaulted mortgage again," CEO Jamie Dimon said in an

"We do not want to be in the business of foreclosure because it is exceedingly painful for our customers, and it is difficult, costly and painful to us," he added.

FHA servicing is particularly challenging, Dimon said. JPMorgan Chase has been dealing with the concern by

"By making fewer FHA loans, we have helped reduce our foreclosure inventory by more than 80%, and we are negotiating arrangements with Fannie Mae and Freddie Mac to have any delinquent mortgages insured by them be serviced by them," Dimon said.

While Fannie and Freddie don't require servicers to advance funds during default, FHA loans require more of an upfront outlay of cash that is later reimbursed.

"The FHA servicers have to front all the money and then, after the asset is sold, they get their payment from FHA," said Amy Crews Cutts, chief economist at credit reporting company Equifax.

The higher share of FHA loans in seriously delinquent product is not all bad news, or completely unprecedented.

The compensation for FHA servicing is relatively higher than the fee for servicing GSE loans, and FHA loans can help servicers who also lend reach more borrowers, Crews Cutts added.

Also worth noting that while the share of FHA defaults is high compared to recent history, it's still below what it was before the anomalous housing boom in 2005. In the second quarter of 2002, for example, the FHA share of seriously delinquent loans was more than 37%.

And while FHA's share of defaulted loans may be increasing, the overall performance of its loans is improving.

The FHA's 90-day delinquency rate for April was 2.6%, down from 3.17% in April 2015 and 2.76% in March of this year, according to FHA data. Its serious delinquency rate, which includes loans in foreclosure and bankruptcy, was 5.16% in April, down from 6.28% a year ago and 5.31% the previous month.

The number of seriously delinquent FHA loans in the first quarter of this year, at 313,759, is about half of what it was when foreclosures were booming in the second quarter of 2012, and the number was 614,495, according to the MBA.

"No one's pointing to a '07, '08, '09 crisis," said Collin Harbor, vice president at Dimont, a company that provides insurance claims-related services for servicers handling FHA foreclosure properties.

So if FHA loan performance is improving and the number of FHA defaults is shrinking, why is the FHA share of defaults growing and putting more of a strain on servicers now?

Part of it is that assumptions about when defaults occur have changed in some cases.

All single-family mortgages are expected to experience a smattering of early payment defaults in the first year, and then go through a second wave of defaults in the next three to five years.

But during the Great Recession and its aftermath, many loss mitigation options and regulations that didn't previously exist came into being and have challenged the market's historical assumptions.

"In the past, you didn't have as many types of programs and products for the defaulted mortgagor, and that is one of the things that causes uncertainty now," said Patrick Nackley, a senior vice president at Superior Home Services, a company which specializes in helping to remediate FHA properties in default.

Post-crisis changes not only have raised servicing costs but have lengthened some foreclosure timelines.

"With the rapid increase in FHA lending that began in '08, really ramped up in 2009 and then remained elevated in 2010, 2011; many of those loans are five-, six-years-old and, if they're still outstanding, they are hitting usually their peak levels of risk for foreclosure," said Frank Nothaft chief economist at CoreLogic.

Also, given the low rates seen in recent years, loans that are left outstanding typically are ones that have some kind of credit problem that prevents them from refinancing into a lower-rate product.

The FHA share of defaults is 30% or more for all vintages originated since 2008, up from 10.2% in 2007, 5.6% in 2006 and 5.5% in 2005, according to RealtyTrac statistics. The FHA share is highest for the 2009 vintage at 64%.

Even recent vintages have had relatively high FHA default shares, or at least FHA default shares that remain higher than they were between 2005 and 2007. The FHA default share for 2015, for example, is 30.8%.

"Since the housing crisis, FHA loans have grown dramatically. So, with even a nominal default rate, there will be a pretty significant volume of FHA loans that that will be still working their way out in the market for some time," said Harbor.