Within the span of a year, institutional investors with large portfolios of single-family properties have tapped the securitization market with nine deals, creating an alternative form of exposure to the housing market.

But the players sponsoring these transactions hold roughly a quarter of a million properties, in aggregate. That's a cozy village against the massive sprawl of fourteen million or so rental homes held by smaller operators. And as housing prices rise, institutional investors have been slowing their own purchases. Rather than compete with these smaller operators, they are actually financing them.

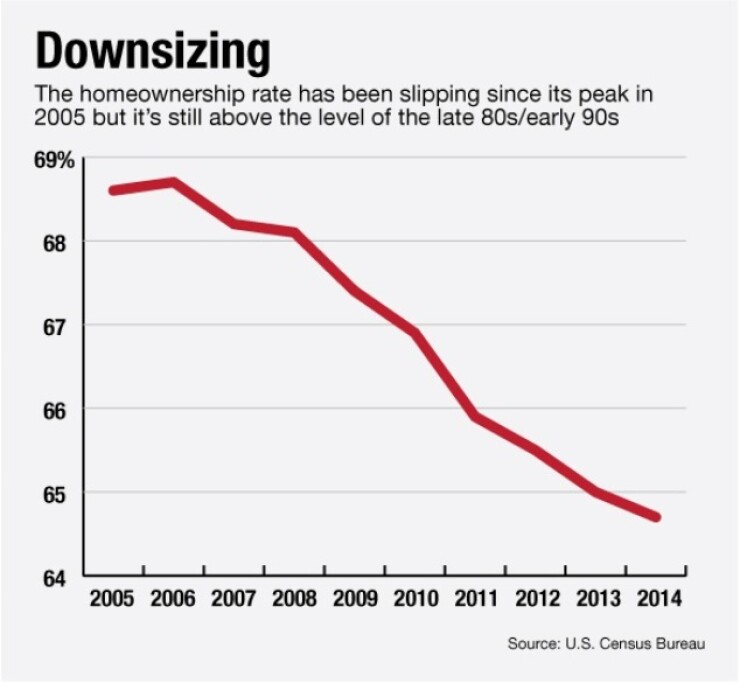

And the little guys — from the mom and pops to the medium-sized investors — are in a market that is still growing, as the share of Americans preferring to own instead of rent keeps slipping.

Structured finance players believe this category of real estate investors will be tapped for the first conduit single-family rental securitization in early 2015.

The collateral in question consists of loans to small-to-medium operators of single-family homes and potentially other kinds of rental properties as well. The three most recognizable lenders in the field — Colony American Finance, B2R Finance and FirstKey Lending — are all under two years old and offer similar but not identical products.

CAF, a unit of Colony American Homes, funds purchases and refinancings of portfolios of five to 500 homes. The loans range from $500,000 to $100 million and can last up to five years.

"The range is extensive because the investor base in this product spans quite a large range," said Beth O'Brien, president of CAF, who pointed out that within a week in August the company was closing both a loan of about $60 million and one for closer to $600,000. But the bulk of demand, she added, is likely to remain closer to the lower end. "There aren't a ton of people who need the larger loans so I wouldn't expect that to be the bread-and-butter of the market," O'Brien said.

B2R, for its part, lends to landlords and rental-home owners who are looking to purchase between five and 1,000 properties, which includes single-family homes as well as two-to-four family homes, townhouses, condominiums and multifamily apartment buildings. The loans run from $5 million to $50 million and are five-year floating- or fixed-rate or 10-year fixed. On its website the lender says it can provide a "blanket mortgage against assets in different states."

Officials at B2R did not respond to requests for interviews.

FirstKey Lending provides loans of $75,000 to $500 million for one-to-four family rental homes, townhouses, and condos. For smaller loans of $75,000 to $1 million, terms are for 30 years and the rate is fixed. The next tier — fixed-rate loans from $500,000 to $3.99 million — have terms of five and 10 years. The largest clients — those seeking between $4 million and $500 million — can take out fixed-rate loans of five, seven and 10 years.

Officials at FirstKey Lending did not return requests for comment on this article as of press time. All the lenders have a potentially wide geographic scope and are open to operating in most, if not all, the states, though demand is widely expected to be concentrated in a dozen or so.

CAF and B2R both have related companies that have already completed single-borrower single family securitizations. CAF's is its parent, Colony American Homes, which has priced two securitizations to date. In the case of B2R, parent company Blackstone also owns Invitation Homes, which issued the first single family rental securitization in November and has followed up with two more.

A key difference with the single-borrower and multiborrower is one of scale: while the former accounts for properties hundreds of thousands the latter is in the millions, perhaps up to fourteen. The sheer size of the potential market, and the fact that single-borrower deals have become a viable asset class only this year, have many in the structured finance market looking forward to the debut multiborrower transaction.

Sources consulted for this article agreed that the first quarter OF 2015 is the likely time for a debut.

"It's going to happen," said Stephen Blevit, a partner at Sidley Austin. "I know the volume that the lenders who are making these loans have made and I think I have a good idea of where they'll be at that time."

Nitin Bhasin, an analyst with Kroll Bond Rating Agency, said that there already does seem to be enough collateral from the three new lenders to justify a maiden SFR multiborrower deal of at least a quarter of a billion, which may be large enough to make the transaction economical.

O'Brien said that securitization was CAF's goal. "All the three main players are building books looking towards securitization," she said, adding that in the case of CAF financing has so far been with the kinds of warehouse facilities that are typically the precursor to securitization. She predicted that the volume of a first deal would likely be between $300 million and $350 million, the amount needed to ensure enough secondary market liquidity.

No one in the market is disputing that this sector will generate securitizations but there is skepticism about whether it can grow into a hefty asset class, in the neighborhood of, say, the residential or commercial mortgage-backed markets.

Laurie Goodman, director of the Urban Institute's Housing Finance Policy Center, is one of the skeptics. "I think the potential is much smaller than what most people think," she said, adding that smaller real estate investors who own a few properties are covered by the GSEs and that many that are too large to meet the GSE limits may find that financing is more economical from banks than from the new crop of lenders.

"I have some real doubts as to whether a hedge fund, or a private equity firm, is going to be the most efficient provider of funding to these entities," she said.

A Freddie Mac spokesperson did not return a request about which products might compete with CAF, FirstKey and B2R.

Bhasin said that as the residential rental market is currently configured, the new lenders may be competing with Freddie Mac and Fannie Mae in the smaller investor market — those operating up to ten one-to-four unit homes — which are targeted by the agencies' investment property mortgage programs. The agencies' programs have limits of up to four to ten units, among other differences.

Fannie Mae did not answer requests for comment.

O'Brien suggested that, as Fannie's investor program has numerical limits and is one asset at a time, the portfolio loans do not compete with the GSE product. "You can't compare apples to apples," she said.

O'Brien declined to discuss the size of CAF's book, but said that growth has been "very fast" with a particularly strong pickup over the last three months. She said there was plenty of pent-up demand for the product. "It's interesting that if you're looking for under $100 million, it's still hard to get financing," she said.

Fitch Ratings Managing Director Dan Chambers said the single family rentals have been underserved by the lending community, adding there was plenty of room for growth for lenders focusing on this segment.

Bhasin said the SFR multiborrower market, with its vast number of operators scattered over a large geographic area, is "fragmented" and "local" in ways that are similar to small balance commercial assets.

"In the past, small balance commercial deals have been sponsored by originators such as Bayview Financial, CBA Commercial, LaSalle Bank, and Washington Mutual, which securitized loans secured by multifamily, motels, retail, and office properties. The loans typically have loan balances of less than $2 million," added KBRA analyst Eric Thompson.

The question, Thompson said, is how much "the B2Rs and First Key's of the world can transform the financing landscape for the roughly 35% of the nation's rental housing stock that's comprised of single family rentals." It will be challenging, he added. What is more, there are currently less than a handful of players with the potential economies of scale that are required to become viable securitizers.

"Deals of $200 million to $400 million between three players — that doesn't add up to tens of billions [a year]," Bhasin said.

Once they do appear, multiborrower deals will pose challenges that are less of a concern or nearly nonexistent in single-borrower deals.

"It's going to be similar to CMBS or RMBS conduits in that you're going to have multiple loans and probably tens, if not hundreds of loans in a typical transaction," said Fitch's Chambers.

The multiplicity of sponsors will translate into less granular date on the operational level. With, say, 100 borrowers in the pool investors in a given deal "won't have the same level of visibility into the operations of the individual borrowers as in a single borrower deal," said Sidley's Blevit.

"Single-borrower deals have on-site reviews — because of their size and resources for the most part they've been able to build massive and efficient systems to be able to manage the operational element. Smaller, non-institutional borrowers and property managers in multiborrower deals will pose higher operational risk," said KBRA's Bhasin.

But the story with multiborrower deals will be starkly different.

A few sources said a back-up operator or operators would be required but given the number, and potential geographic reach, of the borrowers providing these services efficiently will be a big challenge.

"There have to be all sorts of contractual arrangements in place, which makes it much more complicated because you're dealing with a lot of entities rather than only one," said Goodman. This is further compounded by the need to have an additional participant that could determine when a back-up operator would need to step in. And if the deal sponsor does not have operational capacity in that area, they cannot be the back-up operator, and another must be found.

Goodman added: "How do ensure a smooth transition from one rental operator to another? Multiborrower securitizations are an order of magnitude more complicated than single-borrower securitizations from an established entity."

There are, of course, advantages to the potentially fragmented nature of loan pools in multiborrower deals.

Blevit said the multiborrower deals will benefit from diversification in terms of asset type and geography. And while operators may not have the size or market access of those in single-borrower deals, the fact that there are many of them of varying types can be a strength as well given that they're unlikely to all be facing the same problems, if, for instance there is a market dislocation.

CAF's O'Brien said multiborrower deals would have more geographical diversity than single borrower ones, going beyond the five to six states that the single-borrower ones have been concentrated in. She added that the transactions will resemble multifamily CMBS. "The loans themselves look an awful lot like multifamily loans," she added. "It's just that the tenants are in different assets and you have a bunch of different mortgages."

In multiborrower deals, there is less binary default risk than in single-borrower deals, because of the number and variety of borrowers. This can create certain pooling benefit, said KBRA analyst Bhasin. On the other hand, with so many loans there will bound to be some defaults, which may require additional protection for junior tranches in a securitization structure.

Even though some multiborrower pools may have more geographic diversity, individual loans within those pools will likely have more geographic concentration of properties than single-borrower deals, KBRA analyst Dan Tegan said. He added that so far, most properties that KBRA has seen in SFR securitizations are located in areas that saw steep price drops in housing and so encouraged investors to come in and buy, or areas where laws are more landlord-friendly.

The multiborrower segment of the rental housing market is expected to continue to dwarf the single-borrower one.

The yawning difference in size — 14 million vs. 250,000 — is one reason. But the other is that sources said that with rising home prices, the incentive for large buyers to keep buying rental properties is evaporating.

"It's clear that institutional investors are buying a much smaller share of the market than they once were because prices have gone up," said Goodman. "If the institutional share of the market drops as it has been, who picks up the slack? And the answer is it's the mom and pops and medium-sized investors."