Mortgage services provider SitusAMC announced that it has added 1,500 people to help process originations and clear a due-diligence logjam in the non-agency securities market.

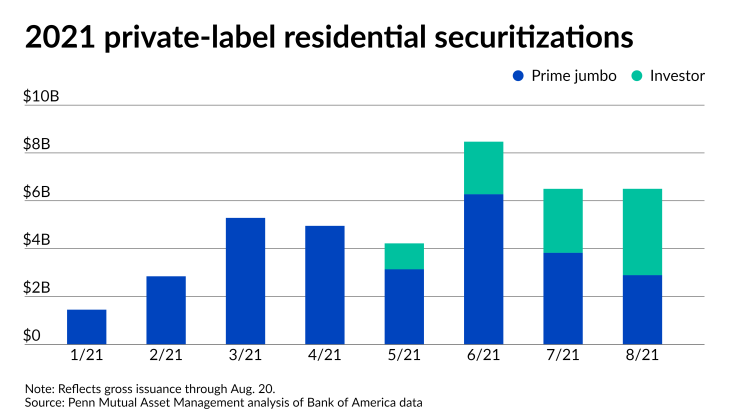

“With private-label securitization coming back strongly in 2021, we’ve seen some parties run into bottlenecks getting their diligence done on time,” CEO Michael Franco said in an interview, In response, the company has invested heavily in recruiting to add additional capacity in

The reduction in

While the non-agency market still constitutes a small share of the mortgage-backed securities issued in the United States, volume is on track to be

SitusAMC’s recent hiring, when added to other staffing increases and acquisitions completed since the end of 2019, has more than tripled its headcount, Franco said, noting that it now tops 7,300. While that gain does include some merger activity, the bulk of it has been organic, he added.

The company’s doors remain open to potential new hires and its recruiting staff will keep an eye on demand levels in the market, but it may not be as quick to keep adding to headcount going forward, according to Franco.

“Are we looking to hire at the same pace that we have been throughout the course of the year? Probably not,” he said, but added that the company is “always interested in adding healthy people to the organization.”