The average number of attempts to defraud mortgage companies each month increased by almost 42% this year and hit the smallest businesses hardest, according to LexisNexis Risk Solutions' latest survey.

"Smaller mortgage firms indicate a significantly higher distribution of fraud losses due to identity fraud than any other financial services or lending firm segment, with the majority of this related to account takeover," the company said in its annual True Cost of Fraud report.

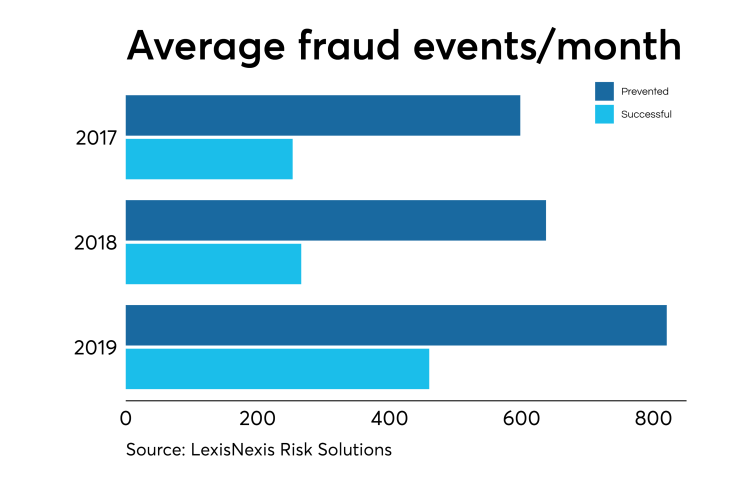

This latest increase in mortgage fraud to 1,280 incidents per month on average suggests activity is rising at a faster rate. Last year, average monthly incidents rose by just 6%.

The percentage of mortgage fraud attempts that are successful is increasing as well. For the previous two years, 29%-30% of fraud incidents were successful. This year, 36% were.

LexisNexis Risk Solutions attributed the uptick in fraud activity to risks linked to the increased use of mobile technology, and botnet activity in which networks are compromised by hackers in order to do things like steal data, send spam or stage distributed denial of service attacks.

"Identity verification has particularly increased as a mobile channel challenge for mortgage lenders," the company said in the report. "The rise of synthetic identities and need for more real-time third-party data contribute to this, as well as (directionally) the inability to determine location origination and distinguish between malicious bots and legitimate human transactions."

LexisNexis Risk Solutions surveyed 205 risk and fraud prevention executives at financial services and lending companies in the United States for its study.