Expenses related to a number of legal woes limited second quarter earnings for Sterling Bancorp, company representatives said on an earnings call Monday.

After losing $13 million over the course of 2020, Southfield, Mich.-based bank drew profit for the opening two quarters of 2021, reporting a second quarter net income of $2.57 million, or $0.05 per diluted share. This rose

Last year, Sterling faced a

The bank is also currently converting its IT system and that added around $600,000 in costs through the quarter,

“Expenses continue to run high, the second quarter included a lot of moving parts,” O’Brien said. “We’re comfortable they will drift down in the third and fourth quarters, primarily because the anti-money laundering lookback and securities class action are nearing their conclusions and the costs that go with them will start to dissipate.”

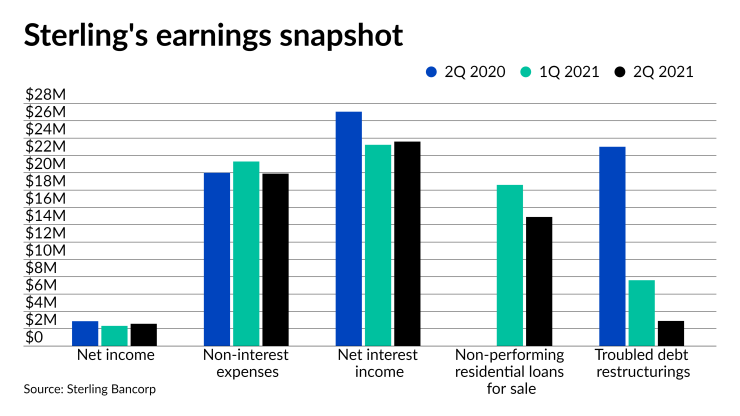

Sterling compiled $19.9 million in non-interest expenses during the second quarter, including $5.7 million in legal and professional fees. These came down from the previous quarter’s $21.3 million and $8.8 million respectively, and a year ago’s $20 million and $8.3 million. Due to amortization of mortgage servicing rights from the repurchased loans, lower valuation allowance recovery and lower servicing fee margins, non-interest income fell to -$269,000 from $453,000 quarter-over-quarter and $1.3 million year-over-year.

The company’s total assets declined to $3.42 billion from $3.69 billion in the first quarter and $3.74 billion the year prior. Non-performing residential mortgage loans held for sale dropped to $14.9 million from $18.6 million and $19.4 million the previous two quarters. Non-performing loans held for investment amounted to $74.8 million in the quarter, down from $83.6 million and up from $54.3 million a quarter and a year ago, respectively. Meanwhile, Sterling’s troubled debt restructurings totaled $2.9 million compared to $7.6 million and $23 million from those same time periods.