A big year for

Stratmor Group Senior Partner Garth Graham said the strategic advisory firm is in the process of transactions with profitable companies who in past cycles would've stood pat, but are now mulling whether the ground is shifting under their feet. Prospective sellers are either bullish on the leverage they have with their technology, or they want to

"The buyers are paying enough to make sellers, even though they're profitable, take notice," he told National Mortgage News.

The industry will see close to 40 transactions this year, and Graham expects a similar amount in 2026. The pace far exceeds the 25 transactions in 2024, despite lenders today only making

The industry veteran spoke with NMN about the factors around today's dealmaking environment, and whether there will be another major deal following 2025's headline moves. Graham also discussed how

This interview has been edited for length and clarity.

Last year you described how unprofitable lenders could face pressure from warehouse lenders funding origination pipelines. Are they still facing those pressures?

Graham: That pressure has not been as great [as last year], because that was when we were literally coming off eight quarters where the majority of companies lost money, which means they're eating into the retained earnings from the big years or they're having to put capital in.

At some point, the warehouse lenders will not continue to support it. There's less companies that fit that bucket. So I think the pressure is less, except if you're in that bottom 20%. Eighty percent of the mortgage companies are making money. Twenty percent aren't. At some point there's not going to be as much tolerance for that.

When 80% aren't making money, are you going to get rid of 80% of your customers? No, but you'll get rid of 10 to 20% of your customers, especially because the ones that aren't making money are also the small ones. Part of the reason they're not making money is they're too small. You could take a whack at that bottom 20% and it would not cost you 20% of your volume as a warehouse lender.

It's not as much of a threat that you must sell. The threat is more from the individual business owner's perspective of, can I compete? Even if the market is getting better, there's kind of a level set: Can I compete with these large plays by some of these large players? There's a lot of lenders, good ones, who are saying, yikes, the landscape is kind of shifting under my feet.

Do you think there will be more major transactions?

Graham: I do not believe we've seen the last deal of deals that I would call big. There's certainly people who are able to write checks for some of these big companies that remain. I don't believe people, one year ago, thought that that Guild was a seller. In fact, they weren't a seller. If Guild, who was profitable, balanced, well-run, strong management, been around forever, heck if they can sell, it's hard to imagine that not everybody, even if it's a public company, might at some point be a potential acquisition target.

How is evolving technology influencing M&A activity?

Graham: It really is difficult to know exactly how this will shake out. There's two ways to look at it. AI is easy enough to experiment with. Maybe it is an opportunity for the democratization of tech. You don't have to be big to make huge bets.

Right now we're in that weird period, sort of like we were at that beginning period of Uber, where every Uber was cheaper than a cab. Uber gobbled up market share, and once they fundamentally changed the behavior of people, it was a better experience than the typical cab, suddenly prices went up. AI is kind of like that.

We are getting asked constantly by lenders, what should I think about AI? We've been involved in some AI implementations, with differing measures of success. But what struck us is the cost of the solutions for what they are fundamentally doing is pretty low, and the contracts are pretty short. And the reason the contracts are short, the vendors aren't sure what to charge either, because they're concerned that the underlying cost of leveraging large language models and hosting and everything else, it's almost like the investment cost is being borne somewhere else.

It's so inexpensive, but it can't stay that way forever. Right now it's an arms race. There's a lot of things coming out, a lot of smaller vendors, and it's super interesting now.

The other way to look at it is, if lenders, especially large ones, who are making big bets in consolidation, aggregate a ton of data and are building out AI — and by the way, the biggest lenders in our space are building AI like crazy — they may get to the point where they are fundamentally driving down the cost. And if you can't compete at the cost level, you could be in trouble.

Now there's many, many, many mortgage bankers who do a very good job justifying the value of the service they provide, that justify premium price, or not a super low price. And there's pretty low-cost lenders who try to race to the bottom on price and don't do very well on purchase. So there's still a space for the person for the premium price to provide a premium service. But is AI or tech investment going to change that? Can you get the low price and have a really, really, really good service?

What do you think about talk of an AI bubble?

Graham: I'm getting PTSD because I rode a bubble as the founder of mortgage.com, so this is hitting me where I live. The fundamental piece in the dotcom bubble, is that our belief was customers would dramatically change the way in which they access the product itself. They would do it online. But in that dotcom bubble, we never changed the economics because the acquisition costs were so high. You still had to spend a lot of money to get people to the website.

The thing that maybe is different is that everything is pivoting towards an AI experience. You start to get used to these quick answers, the synthesis of information in a format, and suddenly that's applied to, "the best mortgage for you is this," and you could certainly see that a consumer would adopt it, or the loan officers and others in our industry would adopt it, because it's pretty darn effective.

I think the bubble potential is when suddenly the cost of the underlying service gets passed through to the user in the form, and like in the internet, in the form of advertising at some point. Right now we're probably in this rising period because we're kind of not paying for what the real cost of this is. So it's a tricky one.

What else are you hearing from, or telling lenders?

Graham: The concept of the Rocket-Redfin-Mr. Cooper deals are really the concept of merging real estate mortgage ecosystems, for the most part a fairly low margin business for the last few years. If you flip to the real estate side and ask them the same, you'd probably get the same answers. Too many players, pretty small margins, we need to expand where we make money.

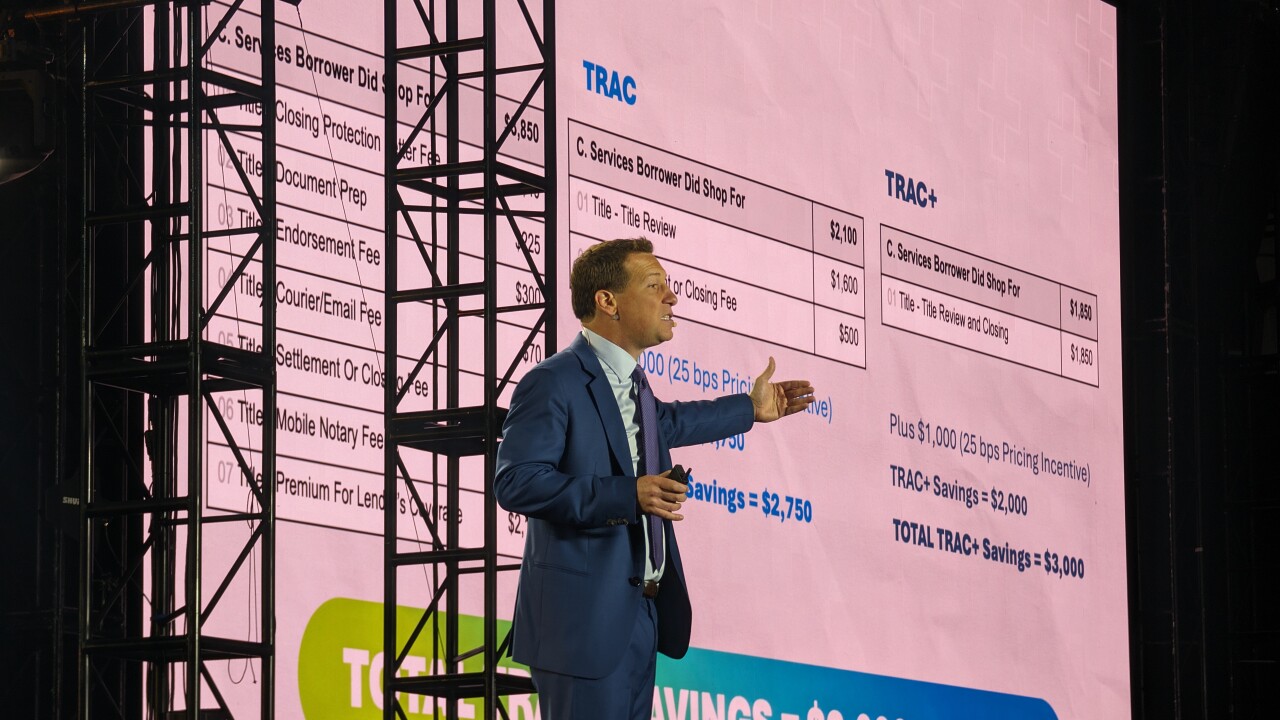

The merging is really two sides of the same equation in how to completely vertically integrate. So title companies, the service providers, the ancillary service providers.

The other thing that's a hot topic, I don't know what it will mean from an acquisition standpoint, property insurance is a mess. It is potentially going to impact default rates. It's impacting pull-through, it's impacting consumer sentiment. Everyone's like, well, at some point these millennials will enter the market to the extent they are ready. Well that insurance thing isn't helping.

You can provide services, the traditional ancillary services, title, etc, but insurance is just a big fat need. I don't know if anyone's going to figure out how to tackle it, especially when you live in Florida or California, or some of these high-risk states.

But to get the ability to help people in that entire journey, which includes the insurance and the mortgage, the real estate side has an opportunity to really move the needle and maybe help them enter the market if they're first-time home buyers, or stay in their home. I think that adds value. I think there'll be consolidation in that area as well.