After a year rife with natural disasters, housing experts are calling on homebuilders to enforce stricter principles to prevent damages and avoid relying on insurance to clean up the mess, according to Zillow.

But home sales have already stalled on higher prices and previous growth in mortgage rates, and additional construction measures could drive up property values further — affecting potential borrowers already struggling with affordability.

Real estate experts and economists already expect home prices to grow another 4.3% by the end of the year, and some even predict cumulative growth of 28.3% through 2023. But at the same time, natural disasters are growing both in frequency and intensity, with residential development getting closer to vulnerable areas, Aaron Terrazas, Zillow's senior economist, said in a press release.

"Policymakers are struggling to find solutions to protect their communities and often face a difficult tradeoff between new building regulations and infrastructure investments that can drive up housing costs and taxes, or requiring insurance that also raises costs to homeowners and, in some cases, makes taxpayers liable for the bill," Terrazas said.

"There are no easy solutions, but the one outcome that is clear is that residents of the most at-risk communities will ultimately pay the cost in one way or another," he said.

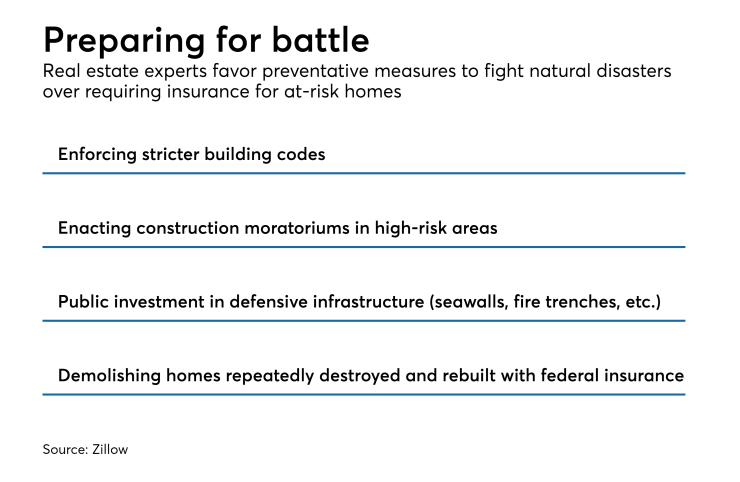

Only 19% of real estate experts think the government should underwrite or subsidize property-loss insurance, and less than half support government requirements for homeowners in high-risk areas to carry insurance against natural disaster losses, according to Zillow's Home Price Expectations Survey.

Instead, housing economists stand in support of building codes to meet certain resilience standards, declaring construction moratoriums in the most at-risk regions and public investment in things like seawalls or deforested zones, according to the survey.