-

Mortgage rates edged higher after the Fed held rates steady, with markets weighing political shifts, Treasury moves and mixed signals on where borrowing costs head next.

February 5 -

Looking to build on last year's live sing-along, Lady Gaga will be performing the theme to Mister Rogers Neighborhood in a campaign from Rocket and Redfin.

February 5 -

Fourth quarter pretax income of $900,000 and net income of $656,000 for the segment compared with year ago losses of $625,000 and $197,000 respectively.

January 30 -

Stop chasing digital leads and invest in face-to-face partnerships that build trust and referrals sustainable growth, writes a leader of Choice Mortgage Group.

January 29 Choice Mortgage Group

Choice Mortgage Group -

Even with the 4 basis point rise in the 30-year fixed over the past two weeks, mortgage rates are still hovering near three-year lows, Freddie Mac said.

January 29 -

United Wholesale Mortgage, which was sued twice in December for alleged violations, put the blame for some text messages on an independent mortgage broker.

January 26 -

After the announcement last fall, Embrace added local staff and increased marketing nad outreach in New Jersey to assist potential Oceanfirst borrowers.

January 23 -

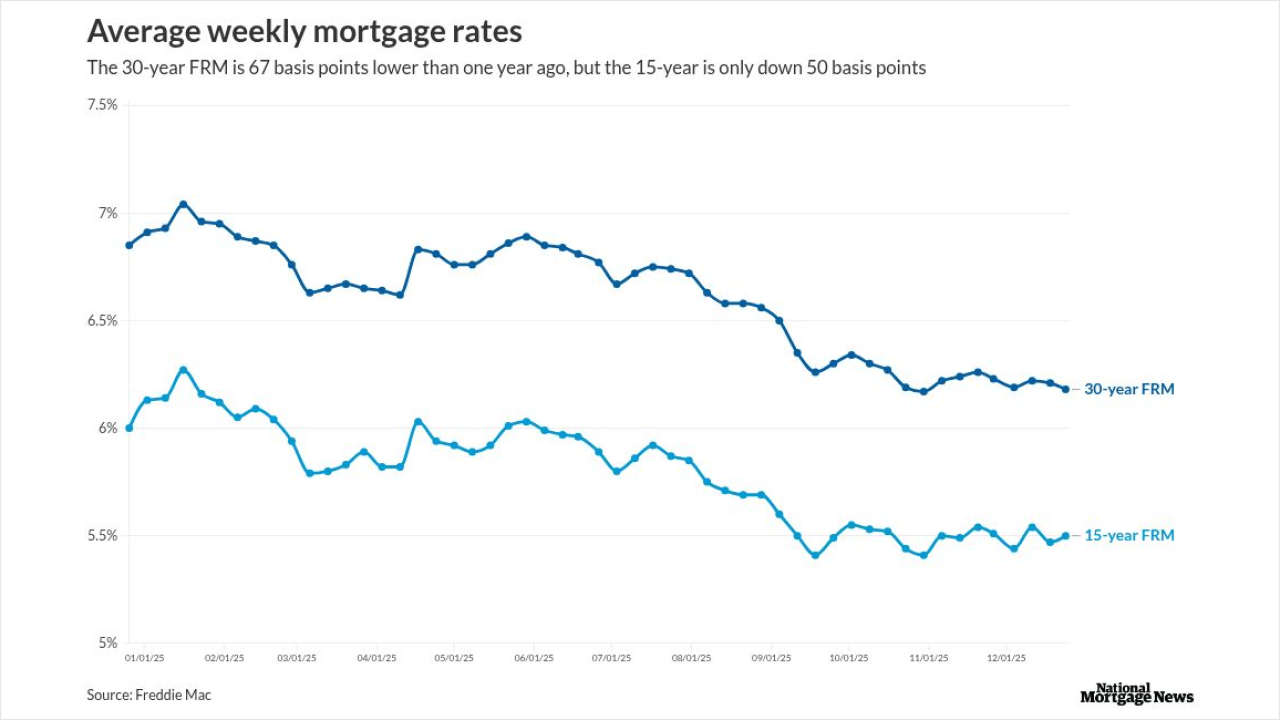

The 30-year fixed rate mortgage increased 3 basis points this past week, off of a three-year low point, but are nearly a percentage point lower than a year ago.

January 22 -

The company reported net income of $5.6 million in 2025, up 61.9% from the year prior, while mortgage banking revenue decreased by $120,000, or 39.5%.

January 21 -

This week the conforming 30-year fixed rate mortgage fell 10 basis points, with Optimal Blue data showing it broke through, at least briefly, the 6% level.

January 15 -

United Wholesale Mortgage sees this branding partnership as an opportunity to recruit workers in its home market in the Detroit area, CMO Sarah DeCiantis said.

January 15 -

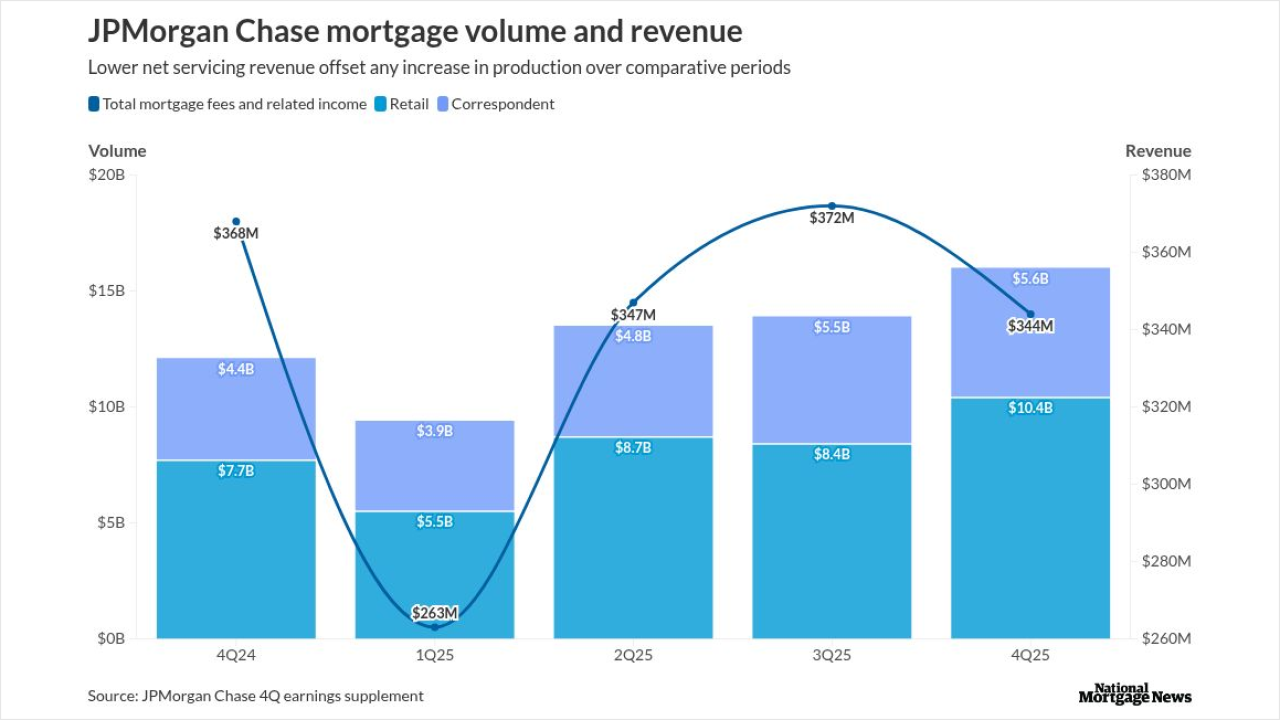

The bank did $16 billion of originations during the final three months of 2025, with the quarter-to-quarter increase beating industry-wide growth forecasts.

January 13 -

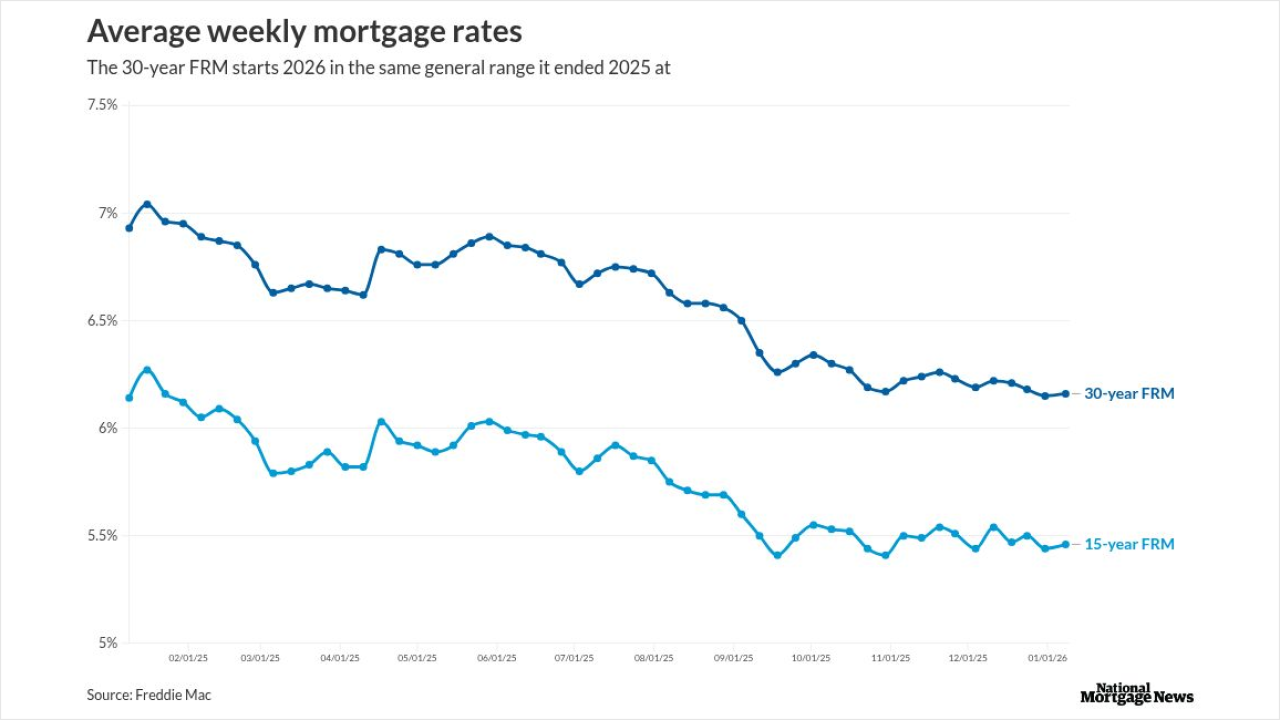

The 30-year fixed remains in its current range, but most expect the rate to reach 6% for 2026, and one observer feels it could actually break under this point.

January 8 -

The company was founded in 1986 by current CEO Mat Ishbia's father Jeff and became the No. 1 originator by dollar volume in the third quarter of 2022.

January 7 -

Although some of the cohort surveyed were flush with savings, others admitted having precarious debt situations and steadfast attitudes toward luxury purchases.

January 6 -

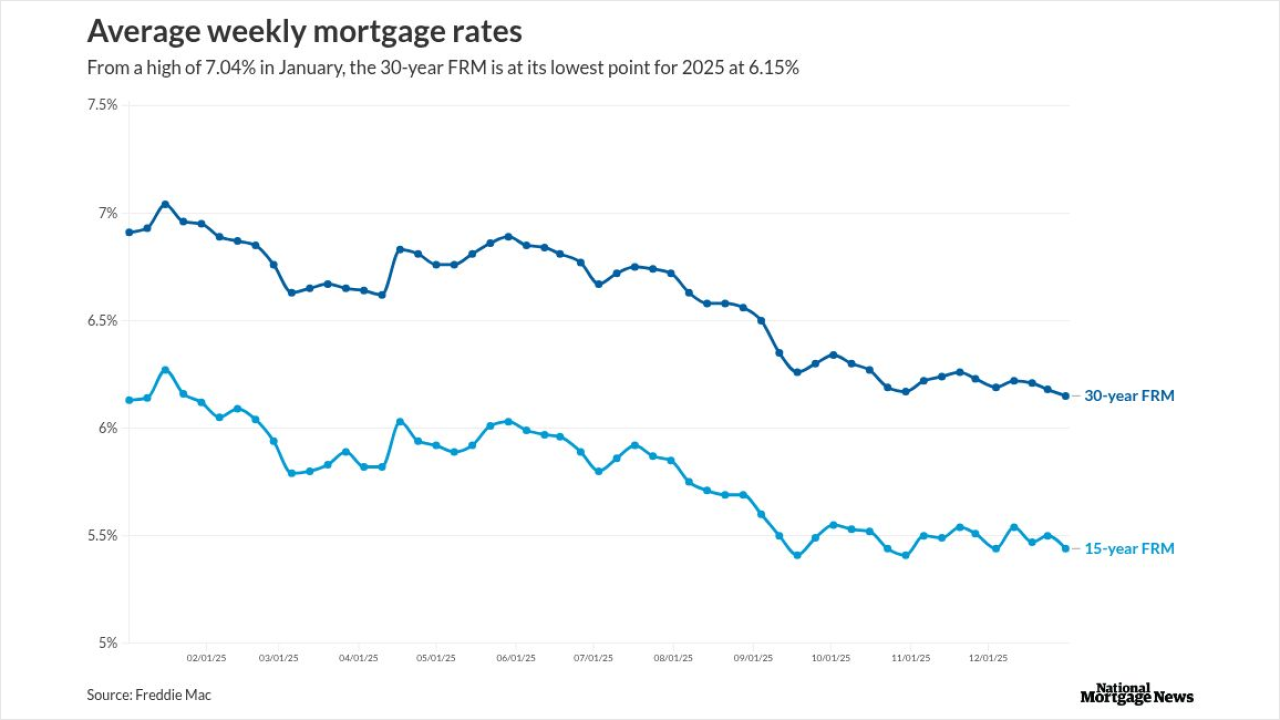

After piercing the 7% ceiling in January, the 30-year fixed trended lower the rest of the year, dropping 89 basis points from peak to trough, Freddie Mac found.

December 31 -

This year it took a homebuyer seven years to save for a typical down payment on a house, compared with 12, according to Realtor.com.

December 29 -

The 30-year fixed rate mortgage dropped 3 basis points this week, its lowest level since October and just over its 52-week bottom, Freddie Mac reported.

December 24 -

The announcement follows Realpha's two previous mergers with mortgage brokerages, as well as its purchases of AI firms and title businesses.

December 23 -

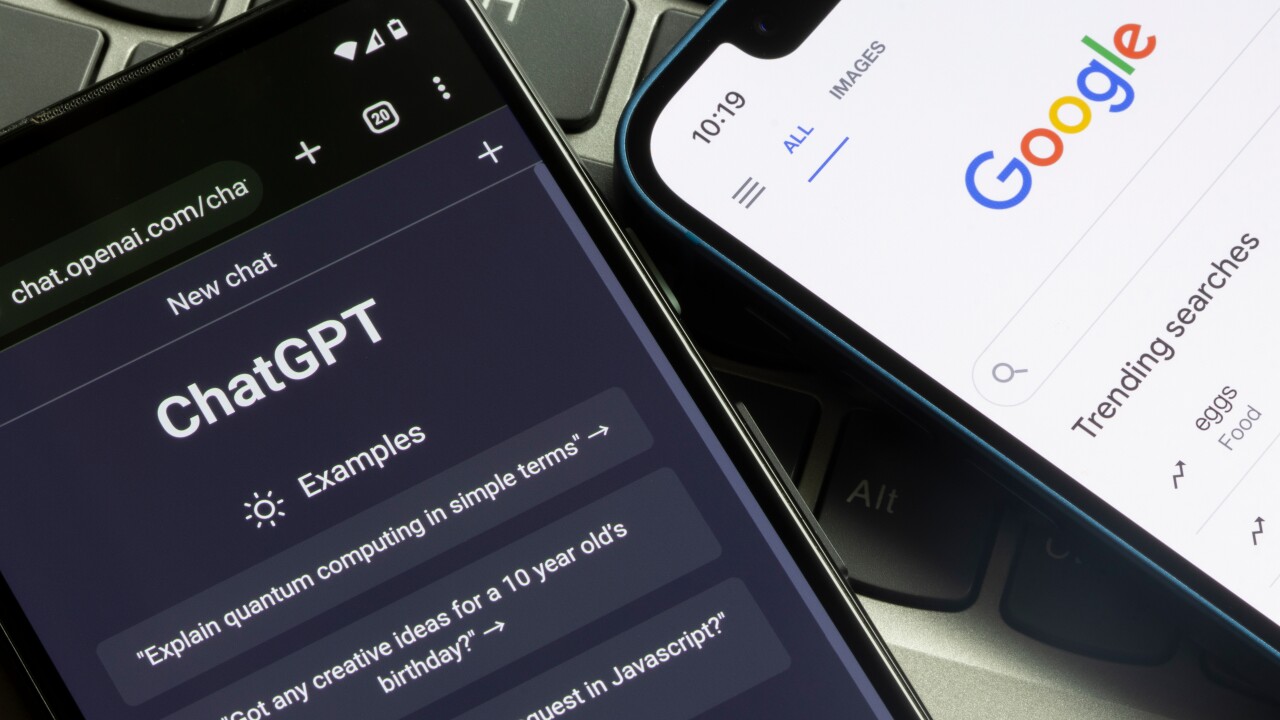

AI tools like ChatGPT are reshaping mortgage marketing, forcing lenders to rethink SEO, brand authority and how they show up as consumers turn to generative search for answers.

December 23