Fair Isaac has announced cross-industry confirmation that its FICO Expansion Score reliably and consistently predicts credit risk levels using nontraditional credit data.Results from a study -- including bankcard and auto lenders as well as mortgage lenders and investors such as Freddie Mac, HSBC, First Franklin, and Option One -- show that U.S. lenders can "confidently assess the credit risk of nearly 50 million Americans who have little or no credit information on file at the major credit reporting agencies," according to a Fair Isaac spokesman. The FICO Expansion score taps nontraditional sources of consumer data in order to assess the credit risk of adults, including recent immigrants and young adults, who have minimal or no credit history on file. Thirty-five percent of credit-underserved consumers in the study had FICO Expansion scores above 640, satisfying typical lenders' approval requirements.

-

While federal examination and investigative activity has all but stopped, the regulator is still providing regulatory guidance to the industry.

1h ago -

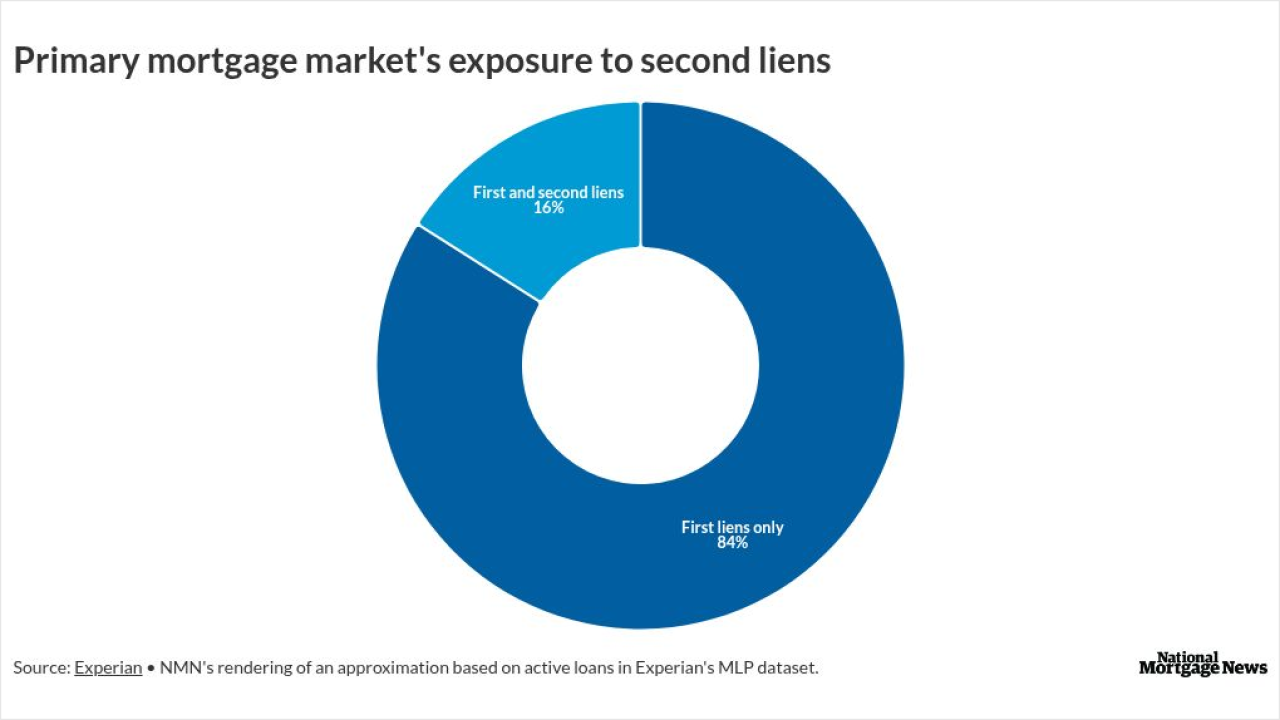

Agency MBS investors have had limited information about primary loans coexisting with home equity products, and may want to get more now, according to Experian.

March 11 -

A near-record share of homeowners unable to sell their properties are renting them out instead, with "accidental landlords" accounting for 2.3% of listed rental stock in October, per Zillow data.

March 11 -

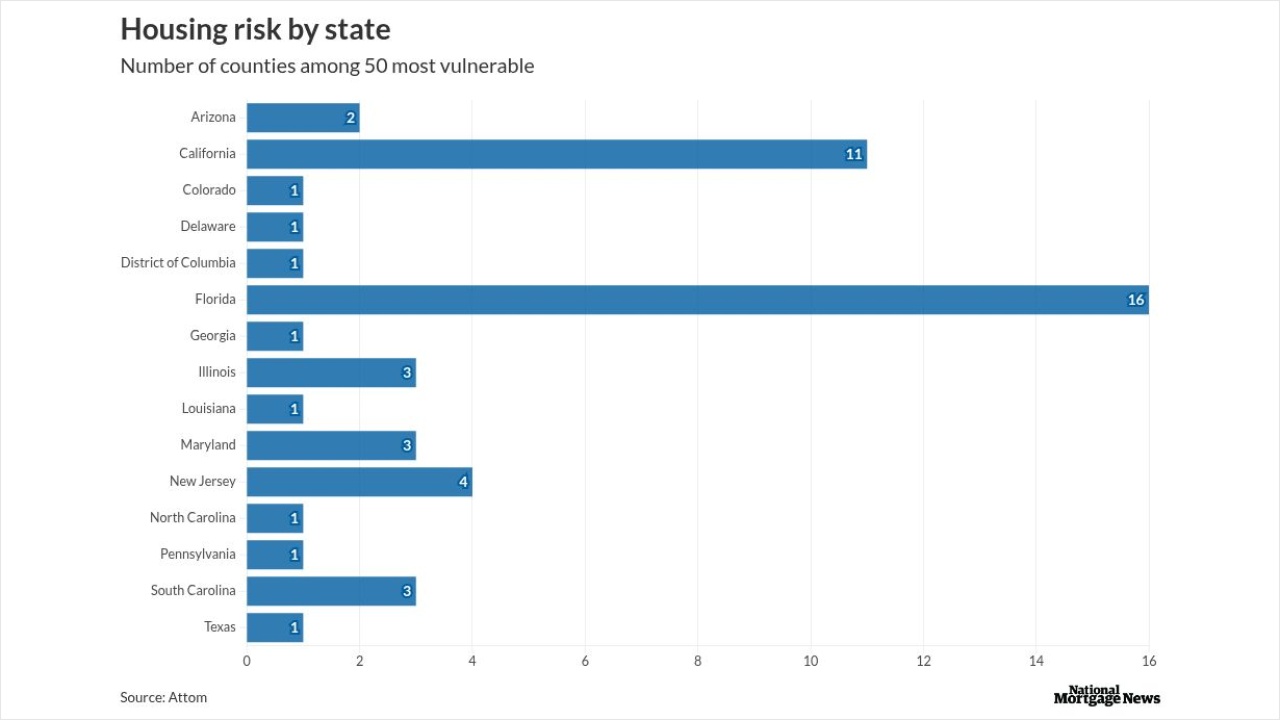

Residents in more than half of U.S. counties need greater than one-third of income to successfully manage major housing costs, according to new Attom research.

March 11 -

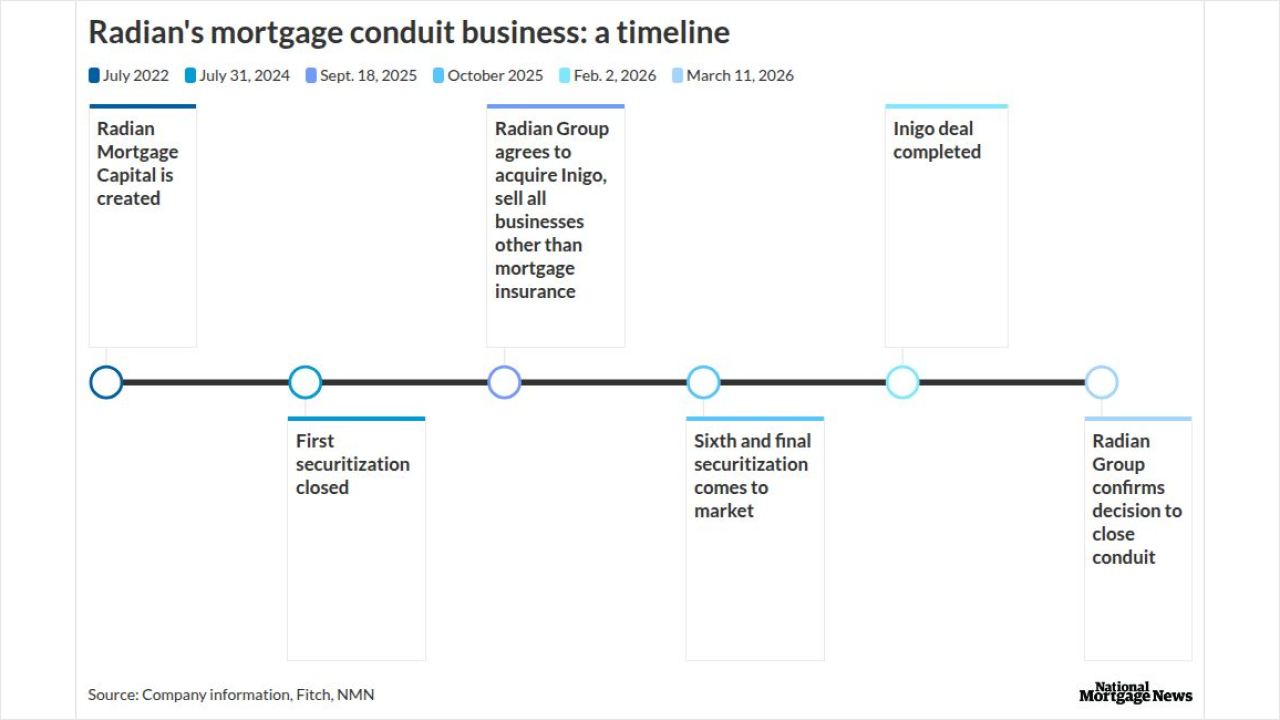

Radian Group was looking to sell the aggregator, along with its title and real estate units, following a business model pivot related to the Inigo buy.

March 11 -

Some of the best mortgage companies to work for discuss how they incorporate community service in their plans and the resulting business and personnel benefits.

March 11