Applications for

“While home buyer demand remains strong, purchase activity is being constrained by higher prices and building delays due to supply-chain pressures and building materials shortages,” Kan said in a press release.

In a recent economic summary, Mark Vitner, senior economist at Wells Fargo Securities, also noted that builders were reporting shortages of many products, “with cabinets, countertops and certain electrical products in short supply.”

Unusually cold and snowy weather across the country had an impact, slowing construction activity in January, according to Fannie Mae chief economist Doug Duncan, in a recent statement regarding housing starts. Rising COVID cases early in the month affected the labor force and materials production as well.

The combined effect of

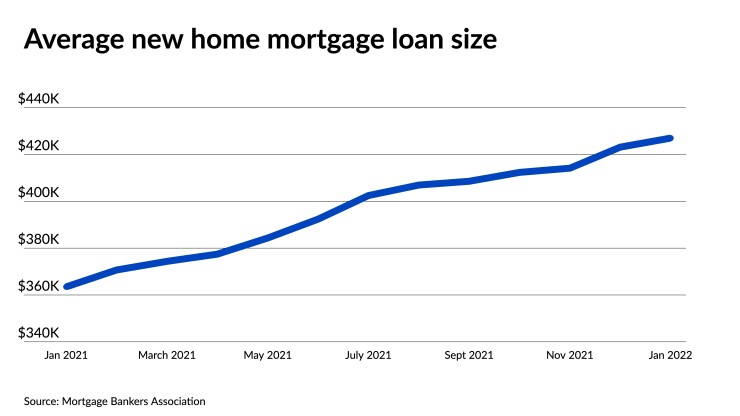

“Purchase activity for new homes continues to be concentrated in the higher end of the market, and overall sales prices continue to increase, as evidenced by another record-setting month,” Kan noted.

Conventional loans, which includes higher-balance jumbo products, accounted for 77% of applications last month, while Federal Housing Administration-backed mortgages equaled 13%. Applications coming through the Department of Veterans Affairs took a 9.5% share, while Rural Housing Service/U.S. Department of Agriculture-backed loans represented 0.5% of total new-home application volume.

The estimated seasonally adjusted annual rate of new-home sales dropped to 821,000 units in January, the slowest pace since July, the MBA said. The number represented a 7.4% decrease from the previous month, when sales ran at an estimated annual pace of 887,000 units. Unadjusted numbers showed 66,000 new homes were sold in January, up 10% from 60,000 in December.

The MBA’s new report comes just a day after the U.S. Census Bureau found that

“Permits are generally more reliable than starts and are currently 8% above starts. This suggests housing starts will strengthen a bit in coming months,” he said.