Taylor Morrison Home Corp. mortgage volume inched down during the fourth quarter of 2018, but is hoping a recently added

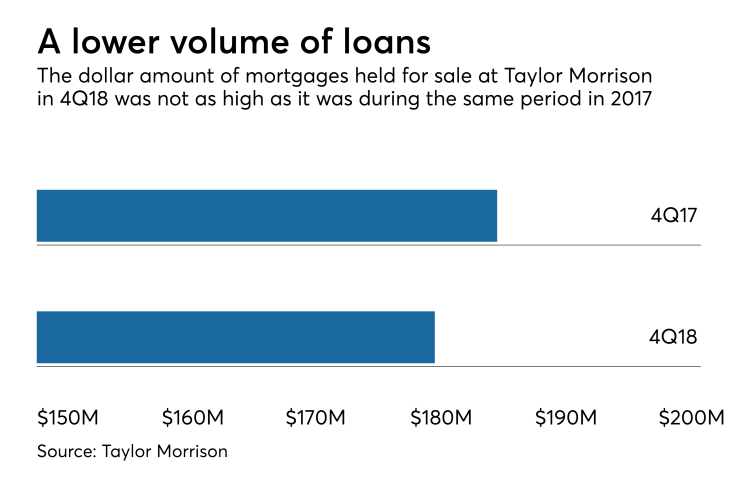

The builder's mortgage volume dropped by less than 3% in the fourth quarter, with loans in the held-for-sale category falling to $182 million from $187 million in 4Q17.

The builder's total revenue for the quarter fell 63% to $1.46 billion from $3.9 billion the same period in the previous year, narrowly missing Seeking Alpha's consensus estimate of $1.47 billion and contributing to an almost 4% drop in the stock's price during premarket trading.

Earnings per share fell almost 70% to just 8 cents from 26 cents a year ago under generally accepted accounting principles, but after adjustments for unusual items its EPS of 86 cents was up almost 12% from 77 cents a year ago.

The company's prospects are favorable, according to Chairman and CEO Sheryl Palmer.

"We continue to believe that the current new-home sales environment has best been described as a break in momentum as the industry finds its new normal. The conditions the industry experienced during the back half of 2018 in regard to interest rates, affordability and the resulting press coverage, led many potential buyers that had been in the market to take a wait and see approach," Palmer said in the company's earnings release.

"There continues to be plenty of macro data points that give us confidence in the near-term outlook," she added. "Unemployment and job creation are still at historically very healthy levels, incomes continue to grow, many of the major markets in the U.S. continue to have limited housing supply and the industry continues to be underbuilt based on historical averages."