Mortgage lending has a long way to go before most people associate it in any way with virtual reality.

However, that doesn't mean that there are no elements of the business it doesn't have relevance. A case in point: Union Bank is considering applying VR to enable appraisals of high-value homes, potentially saving customers money and shortening the loan-approval process.

"In the future, the appraisal could be done virtually, with the owner or buyer holding up his or her phone when visiting the home to provide all the necessary information," said Paul Appleton, head of resident lending and small business banking at Union Bank, a subsidiary of Japan's MUFG Bank. "Then [it would be] reviewed by a licensed appraiser."

Fannie Mae and Freddie Mac already support automated valuations for mortgages conforming to their lending standards, replacing physical inspections with data that describes the neighborhood and the price range of similar loans. Much of Union Bank's mortgage lending business, however, is in California and up the West Coast, where very high priced homes typically require nonconforming jumbo mortgages.

Using virtual reality would further mortgage lenders' popular goal to make the origination process more efficient for customers. On that front, Union Bank enjoys the benefit of a concentration of financial-technology startups and major technology firms near its headquarters in downtown San Francisco.

"I spend about 10% of my time meeting with different fintechs and established technology companies in San Francisco that can work with Union Bank to build a more digitized mortgage platform," Appleton said.

He added that surveys by Union Bank and others reveal only 40% of borrowers are satisfied with their mortgage experience, and it still takes 35 days on average to complete the process. With millennials, reared on highly automated and fast internet-based services making up an ever-larger portion of homebuyers, Union Bank views technology as offering a competitive edge.

Union Bank has concluded, as have other mortgage lenders, that customers prioritize speed, minimal effort to provide information to the bank and understanding their loans' status. To that end, it perpetually searches for new electronic services it can attach to its loan origination system via application programming interfaces.

With customer consent, for example, it can electronically collect documents such as pay stubs and tax forms that previously had to be mailed or emailed, now only for employees of large companies but coverage is expanding.

"Loan officers tell us it has taken a few days out of the work they’ve typically done upfront," Appleton said. "We see this technology playing out as not replacing loan officers but augmenting them with tools so they can be more efficient and productive, developing their business instead of processing loans."

The bank is working to digitize the credit decision, providing customers with immediate understanding of whether they'll qualify for the loan they're seeking. Building such an ecosystem of fintech-generated services requires significant due diligence, ensuring compliance with information security protocols and an array of regulatory requirements. Appleton said the bank is steadily improving that process and onboarding technology partners more quickly.

Loan officers have seen significant benefits. Sending borrowers a link enables them to go through the application process on their own time, with loan officers only stepping in when needed. And physical marketing is being augmented with digital platforms such as LinkedIn, Redfin and Zillow to generate and maintain realtor relationships.

"We have a team checking those [communications] before they go out. In time we plan to switch over to a text-analytics capability, to do this automatically," Appleton said.

Training to adapt to this new mortgage-loan environment is largely conducted online via multiple technology-driven methods, where loan officers' progress can be monitored.

For example, "we're rolling out a virtual reality training mechanism across the organization whereby you can literally put the phone up to your eye and it delivers virtual training," Appleton said.

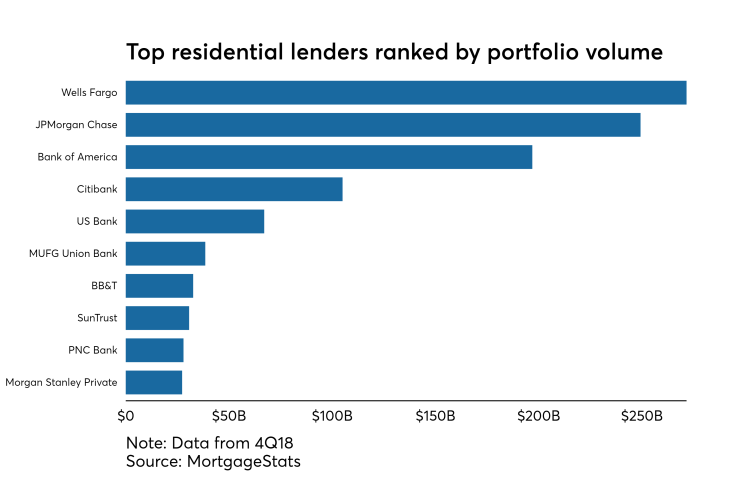

The bank's mortgage lending business also operates in Arizona and Nevada and expanded into Illinois a few years ago, but most of its business and 350 branches are in California. Among U.S. banks, Union Bank's mortgage portfolio is sixth largest.

A team analyzes factors such as inventories of homes for sale, prices and sales, to alert front-line staff to the current dynamics of its different markets. "In many markets inventories are still low by historical standards and lower interest rates will help maintain property valuations and sales activity," he said.