More veterans are turning to Department of Veterans Affairs loans to buy a house as the number of purchase mortgages shot up 59% compared to five years ago, according to an analysis of VA data by Columbia, Mo.-based VA lender

While VA purchase loans are more in demand than in 2013, the VA refinance loan count tanked 41% as refi candidates fell off on rising mortgage rates. Still, the VA loan has had the lowest average interest rate on the market for 53 consecutive months, according to

VA loans overall now represent 10% of the mortgage market as a new generation of veterans utilize the department's mortgage program, Veterans United said. In fiscal year 2017, veterans between the ages of 26 and 35 obtained 162,979 VA loans — the most of any age bracket, according to VA data. By comparison, 105,900 veterans aged 56 to 65 secured VA loans over that same period.

"This historical benefit program has experienced a resurgence since the housing crisis," Chris Birk, director of education at Veterans United, said in a press release. "More Veterans have used this $0 down loan in the last five years than in the prior dozen years combined."

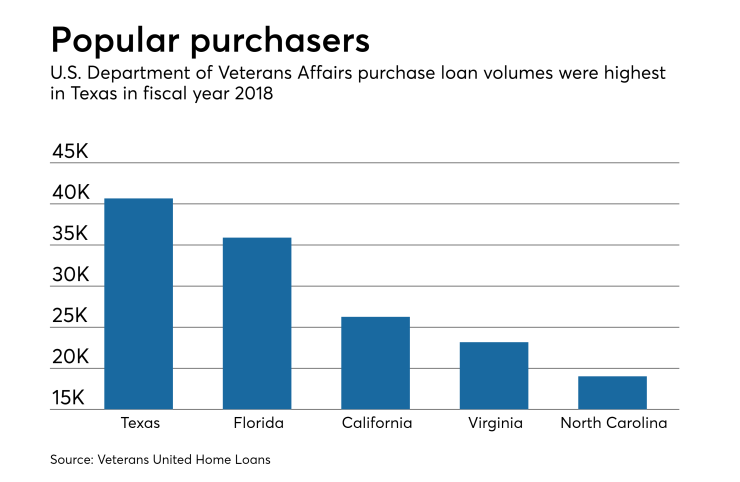

The VA backed 610,513 loans in fiscal year 2018, with an average loan amount of $264,197 and a total dollar volume of $161.3 billion.

VA loans are appealing to veterans, especially as

Veterans United financed more than $10.2 billion last year.