Wells Fargo is taking bigger precautions on its office building loans, setting aside more funds to cover potential losses as the sector continues to deteriorate.

The office market "continues to be weak" in many cities, Chief Financial Officer Michael Santomassimo said Friday. But he also argued that general trends can be misleading, and said the bank has been doing a property-by-property analysis to see where its specific risks lie.

The warning from one of the country's largest banks hints at signs of trouble that smaller banks may share as they start reporting earnings next week. Office loans make up about 3% of Wells Fargo's total loans, but many smaller lenders have bigger concentrations.

Wells, which has $1.9 trillion of assets, continued to conduct a deep dive into its office loan book in the second quarter, which prompted it to set aside more reserves to absorb potential losses later on.

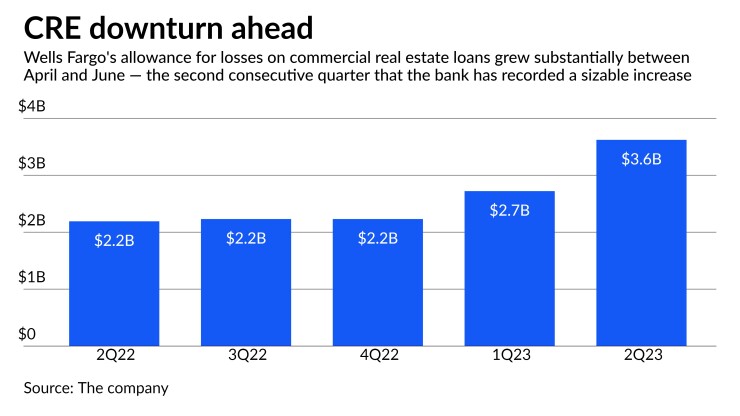

After stress testing its commercial real estate loans, the bank's allowance for credit losses in the CRE sector jumped to $3.6 billion in the quarter — up 64% from a year earlier. Office vacancy rates have climbed as remote work has shown staying power.

Wells Fargo executives, who also

"We've gone through a number of stress scenarios and feel like at this point, we're appropriately reserved," Santomassimo said on the bank's second-quarter earnings call.

JPMorgan Chase also bumped up its reserves during the quarter due to office loans, though its executives cautioned against reading too much into the buildup, given the bank's limited exposure to the office sector. JPMorgan Chief Financial Officer Jeremy Barnum said the company wanted to get "ahead of the cycle," but he noted that most of the bank's CRE portfolio is tied to loans backed by multifamily buildings.

Wells Fargo and other large banks have manageable exposures to office buildings and other commercial real estate, said CFRA research analyst Kenneth Leon, pointing to the

Wells Fargo's CRE team is focused on "surveillance and de-risking," Santomassimo said. The bank highlighted diversification in its portfolio, with an investor presentation showing that office loans make up 22% of its CRE book.

Loans backed by apartments, a sector that Santomassimo said is performing "quite well," account for 26% of Wells Fargo's CRE book. Warehouse, hotel and retail loans make up smaller chunks.

Nearly a third of Wells Fargo's office loans are in California, and the remainder are spread across several other states. San Francisco, where Wells is headquartered, has been a source of worry in the office market, given that tech companies have embraced remote work more than many other firms. One office building there has

Asked about office-related risks in California, Santomassimo said that worries are not "isolated to California" and "you see weakness in a lot of cities these days." He also cautioned against focusing solely on geography.

"Even in California, we've got as many examples where clients are actually reinvesting in buildings, even if lease rates are low or even empty in some cases, as they are going into a workout," Santomassimo said.

Wells CEO Charlie Scharf said it's "a very big mistake" to think that a building's geographic location is the only factor that will determine whether losses occur.

"We have examples in cities that are struggling where the structure of our loan is quite good — the underlying property has very high lease rates for an extended period of time," Scharf said. In markets that are doing well, specific properties may be at more risk due to a large amount of upcoming lease terminations, he added.

"That's the level of detail that we've used to come up with what we think the appropriate level of reserving is," Scharf said. "We've tried to be as diligent as we can."