Western Alliance Bancorp., which endured major deposit outflows during last month's banking crisis, will reassess its capital and liquidity strategy, executives said Wednesday.

The Phoenix-based company's management outlined a plan to increase its common equity Tier 1 capital ratio to 11% in an effort to insulate against future liquidity issues. Western Alliance said it plans to sell certain loans and focus on deposit growth in an effort to boost its liquidity and loan-to-deposit ratio.

"We continue to aim to be more aligned with the country's largest banks by rebuilding our capital level, enhancing insured deposits and liquidity, lowering our loan-to-deposit ratio and deepening our client relationships," Western Alliance Chief Executive Officer Ken Vecchione said on a call with analysts Wednesday. "We want to be seen as equal to these banks."

Western Alliance suffered one of the banking industry's largest share-price declines last month, after the failures of Silicon Valley Bank and Signature Bank

Shares of the $71 billion-asset parent company of Western Alliance Bank closed up 24% on Wednesday at $40.35. But Western Alliance's stock has yet to recoup all of its crisis-induced losses.

The stock-price declines prompted some depositors to withdraw their money from the bank, Western Alliance executives said. On a single day during

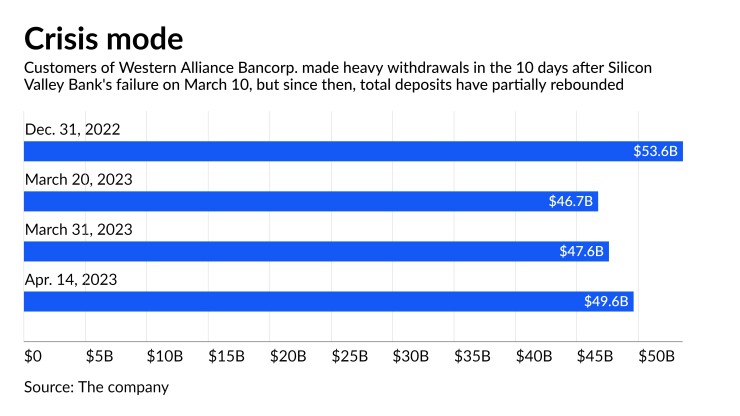

Deposit outflows have stabilized across the industry in recent weeks. At Western Alliance, they settled at $49.6 billion on April 14. That represents a $2.9 billion increase from March 20, when deposits reached their lowest level of $46.7 billion. They haven't yet returned to their Dec. 31 level of $53.6 billion.

Western Alliance executives said that 68% of the deposits that left during the crisis went to the country's four largest banks: JPMorgan Chase, Bank of America, Citigroup and Wells Fargo. Customers who took their money elsewhere didn't close their accounts at Western Alliance, executives said.

Vecchione said that nine times out of 10, bank employees managed to reassure customers that their deposits were safe and to discourage them from moving funds elsewhere. That didn't work in all cases, though, including with some large corporate customers, he said.

"It is hard to rationalize a person out of a situation they didn't rationalize themselves into," Vecchione said.

Western Alliance's capital ratio in the first quarter stood at 9.38%, higher than the 9% it recorded a year ago and up slightly from 9.32% at the end of 2022. Its target for the second quarter is at least 10%. The bank said it plans to shrink its balance sheet by selling certain loans from its portfolio, which should help boost capital.

"They don't want to find themselves in a situation where they're strained for liquidity again," said Brad Milsaps, managing director and senior research analyst at Piper Sandler.

Western Alliance executives said they wouldn't consider repurchasing shares of the bank until they reach the 11% capital ratio. Even then, they said, potential buybacks will depend on the strength of the economy.

"We will pay off short-term borrowings and return to more traditional bank funding," Chief Financial Officer Dale Gibbons said Wednesday afternoon.

Western Alliance anticipates a decline in its net interest margin in 2023, from its current level of 3.75% to about 3.65%, and a slight increase in deposit costs. Loan growth is expected to slow in what management predicts will be a flat interest-rate environment later this year. Net charge-offs could increase to 15 basis points, roughly triple their current level, the bank said.

Overall, Western Alliance reported $142 million in net income, down from $250 million a year ago. Revenue totaled close to $552 million, just below last year's level of $556 million. Loans fell by $5.4 billion in the first quarter, while deposits declined by $6.1 billion.