The meteoric rise and collapse of specialty servicer Wingspan Portfolio Advisors is a stark reminder of what can happen when companies don't adequately respond to shifting business cycles.

It's been almost two years since

At its zenith, Dallas-based

"We, along with many other companies in the mortgage business, were caught a little bit by surprise by how quickly the volume of nonperforming loans fell, and so that definitely produced some financial stress," said former CEO Steve Horne. "That was not ultimately what caused Wingspan's demise though, that was something that could have been fixed."

In an exclusive interview with National Mortgage News, Horne reflects on the lessons learned from Wingspan and why they still matter for lenders and servicers today.

Don’t Diversify without Sufficient Liquidity

When distressed debt servicing dwindled, Wingspan did diversify. It added component servicing and

"Steve deserves a lot of credit for building that business," said E.J. Kite, a former chief information officer at Wingspan. Kite currently works for Ten-X, a company headquartered in Irvine, Calif., that facilitates online real estate sales.

So why didn't diversification work?

An inability on the part of investors to find a viable way to raise enough funds to sustain the company while it repositioned was really what did Wingspan in, Horne said.

"Wingspan started with just a very small, initial investment and grew to the point where we only competing with publicly traded, multibillion-dollar companies. We should all pat ourselves on the back for having accomplished that, but there was a reality moment where we needed to acknowledge that to continue moving forward, we needed to be aligned just to have the resources to pivot as the industry cycles inevitably changed," he said.

It took a while for investors to agree on what was the best way to chart a course forward, according to Horne, who is currently owner of Dallas-area industry consultancy Altavista LLC.

"The legitimate difference of opinion was: Do we sell, or do we try to ride this out, thus avoiding any dilution of individual investors' ownership interests?" Horne said. "I'm a big believer in making the pie bigger, so I was advocating for a relationship with an appropriate larger party that would massively expand the pie, so even if the ownership percentage fell somewhat, you would end up with a much more valuable piece of pie. Other people felt that Wingspan could reposition as the industry changed without that partnership."

Make Sure Funding Resources Are Competitive

Competitors that survived, and chose to stay in the business, had stronger capital resources that Wingspan couldn't match without more backing, said Horne.

"You talk about any number of other companies that have lost over the last few years fantastic sums of money. They've been able to ride through that because they've got a [financial] fortress behind them," he said. "They've got giant funds behind them. They've got a huge parent company behind them. Wingspan had none of that."

Develop Demonstrably Marketable Operations and Skill Sets

While that was a mistake, there were things the company did right, Horne said. Wingspan did help develop some strategies for resolving loans in bulk and some of the people responsible for those strategies are still active in the industry.

"Even after I left, it continued to deliver top of scorecard performance," he said. "We kept literally hundreds of thousands of borrowers in their homes, we were able to process and resolve countless difficult situations involving borrowers, and we did so positively, quickly, accurately, and in bulk."

Be Open to Bringing in a Stronger Financial Partner

In hindsight, what Horne wishes the company had done was found a new long-term outside investor or acquirer with enough resources to make the business competitive from a funding standpoint before while the value of its operation and employee skill set was at its height.

"Essentially we needed [at least] a similarly sized partner," he said. "But the investor group we had did not agree. They did not want to dilute their ownership interests."

Remember Cyclical Trends Return

Horne said he would be willing to get back in the special servicing business, and he thinks there will be more opportunity in the space because distressed loan servicing demand does tend to cyclically recur.

There are signs the cycle could be starting to slowly turn.

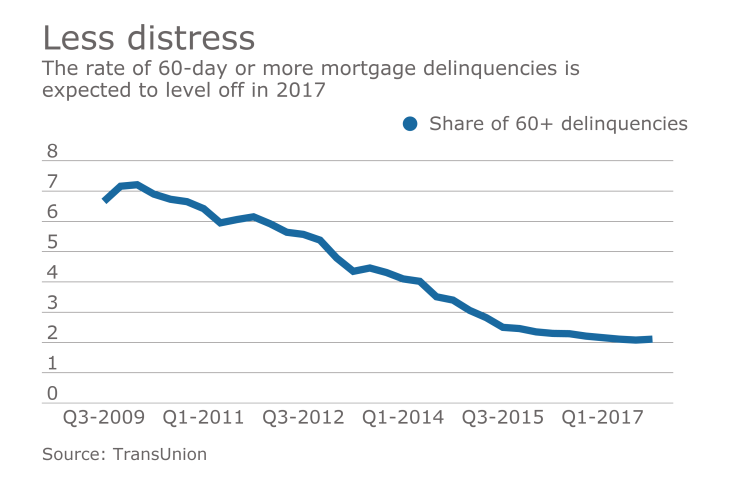

While the percentage of 60-day-plus delinquencies in the market hasn't stopped falling since 2010, it is stabilizing.

"We might be approaching a leveling off," said Joe Melman, vice president and mortgage business leader for TransUnion.