-

Leading Democrats on the Senate Banking Committee sent a letter to Chair Tim Scott, R-S.C., pointing out the as-yet unsatisfied legal requirement for prudential regulators to appear in Congress semiannually.

December 12 -

The Federal Reserve Board of Governors voted Wednesday to reappoint 11 sitting regional Fed presidents, without any dissents. The move precludes any effort the White House might have made to pressure the board to deny reappointments.

December 11 -

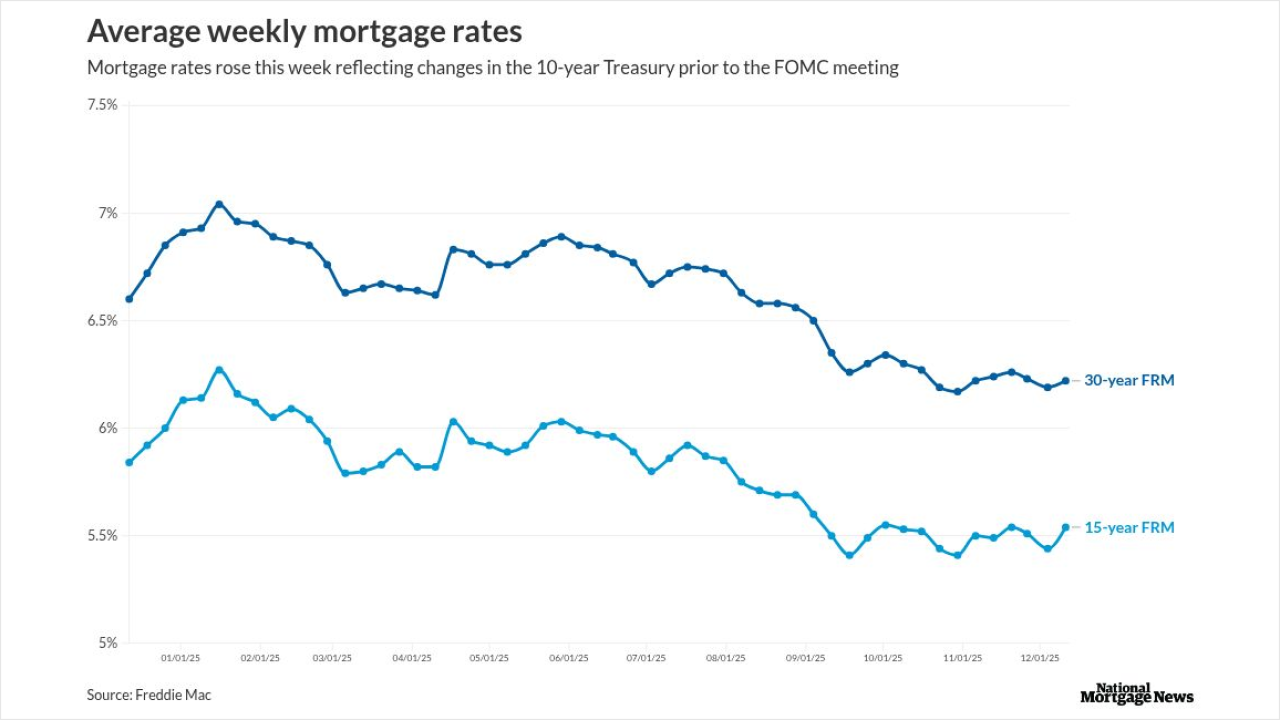

The investor markets already set mortgage rates to include the 25 basis point reduction the FOMC announced, and it is too early to see the longer-term effect.

December 11 -

With the Federal Reserve decision largely factored in, Jerome Powell's comments on future outlook is more likely to influence the housing market.

December 10 -

Charlie Scharf has a mostly optimistic take on Wells' consumer banking prospects entering 2026. But he's more downbeat about the company's once-dominant residential mortgage business.

December 10 -

In a new interpretive letter, the Office of the Comptroller of the Currency will allow banks to serve as middlemen for "riskless" crypto trades, extending existing brokerage authority for securities to digital assets.

December 9 -

New rules means sellers and servicers will need to have plans demonstrating proper oversight of their artificial intelligence and machine learning practices.

December 9 -

Michael Burry, the money manager made famous in The Big Short, believes a re-listing of the US housing-finance giants is "nearly upon us."

December 9 -

In oral arguments held Monday morning, a majority of Supreme Court justices seemed poised to overrule a 90-year-old precedent validating multimember independent commissions, but it remains uncertain what limits — if any — the court may impose on the president's removal powers.

December 8 -

Federal Reserve watchers expect a board of governors vote in February to reappoint the 12 regional Fed bank presidents — which is typically treated as a formality — to be the next flashpoint in the White House's effort to bring the central bank to heel.

December 8 -

Federal Housing Finance Agency Director Bill Pulte should be called to testify before lawmakers no later than the end of January, the Democratic members of the Senate Banking Committee wrote in a letter Friday to Republican Chairman Tim Scott.

December 5 -

Big players, Wall Street and tech firms stand to gain. Community lenders call for policymakers to protect g-fee parity and the cash window. Part 5 in a series.

December 5 -

Treasury Secretary Scott Bessent said the Federal Reserve Board should reject the renomination of any regional Federal Reserve Bank presidents who have not lived in their districts for three years, signaling a potential confrontation when reappointments come before the board in February.

December 3 -

At issue is the CFPB's weekly publication of Average Prime Offer Rate tables, a key benchmark enabling the smooth operation of the $13 trillion residential mortgage market.

December 3 -

What developments around rent reporting and new credit standards portend for mortgage companies. Part 2 of a series on government-sponsored enterprise changes.

December 2 -

Big-picture plans for the government-sponsored enterprises get the spotlight, but other issues may affect the industry more directly. Part 1 of a series.

December 1 -

If cumulative loss or a delinquency trigger event is in effect, then the deal will distribute principal among the class A notes before any principal allocation the class M1 or class B certificates.

November 26 -

Recent high-profile ethics violations by senior Federal Reserve officials, including new revelations concerning stock trades by former Fed Gov. Adriana Kugler, have sparked debate over the effectiveness of the central bank's oversight, even as some observers stress such cases remain rare.

November 26 -

Years ago, the Federal Housing Administration helped finance thousands of loans for manufactured housing. An effort to restart that program would help millions of Americans afford their own homes.

November 26

-

House Democrats argue that HUD's cut to the Continuum of Care Program could push 170,000 people to homelessness.

November 26