-

The overall number of applications decreased for the fourth straight week, but average loan sizes headed back up, according to the Mortgage Bankers Association.

March 2 -

The Federal Reserve Chair Jerome Powell said the central bank expects to raise interest rates later this month to tackle hot inflation amid a tight labor market while Russia’s invasion of Ukraine has added uncertainty.

March 2 -

CoreLogic reported a 19.1% rise in annual appreciation but also noted that several of today’s hot markets are overvalued or at risk of declines.

March 1 -

Affordable housing and legal expert Sharifa Anderson returns to the government-sponsored enterprise after prior roles at the Federal Home Loan Bank of Pittsburgh and HUD.

March 1 -

Optimal Blue researchers found correlations of 75% or more when looking at numbers of different loan-size cohorts, but the percentages came in lower when state data was analyzed.

February 28 -

Although forbearance exits are not yet complete, two arms of the Department of Housing and Urban Development have decided to make some temporary pandemic relief programs permanent.

February 28 -

Panorama Mortgage Group and Hunt Mortgage also appoint COOs, SitusAMC adds to its title sales team and non-QM lender Sprout finds head of TPO business with internal promotion.

February 25 -

Its modifications aim to help two government-sponsored mortgage investors manage risk and rebuild capital while retaining enough flexibility to fulfill their affordable housing missions, said the Federal Housing Finance Agency’s acting director, Sandra Thompson.

February 25 -

But the company turned its first full-year profit since 2013.

February 25 -

Fannie Mae delayed a scheduled residential mortgage bond on Thursday due to market volatility spurred by Russia’s invasion of Ukraine, according to people with knowledge of the matter.

February 25 -

With an Q4 earnings report that showed declining revenues, Jay Farner called out lenders who reduce pricing and threw shade at certain unnamed lenders who fire employees via video call.

February 24 -

The move confirms speculation that the Federal Housing Finance Agency would return to a pre-pandemic plan to tighten requirements for mortgage lenders and servicers that work with two government-sponsored enterprises.

February 24 -

Strong economic data was countered by international political developments, sending the 30-year rate lower for the first time in a month.

February 24 -

The Federal Reserve's capital guidance for S corporations is hindering some community development banks' access to the Treasury's $9 billion Emergency Capital Investment Program. The Fed has offered exemptions in the past, so why isn't it doing so now?

February 23 -

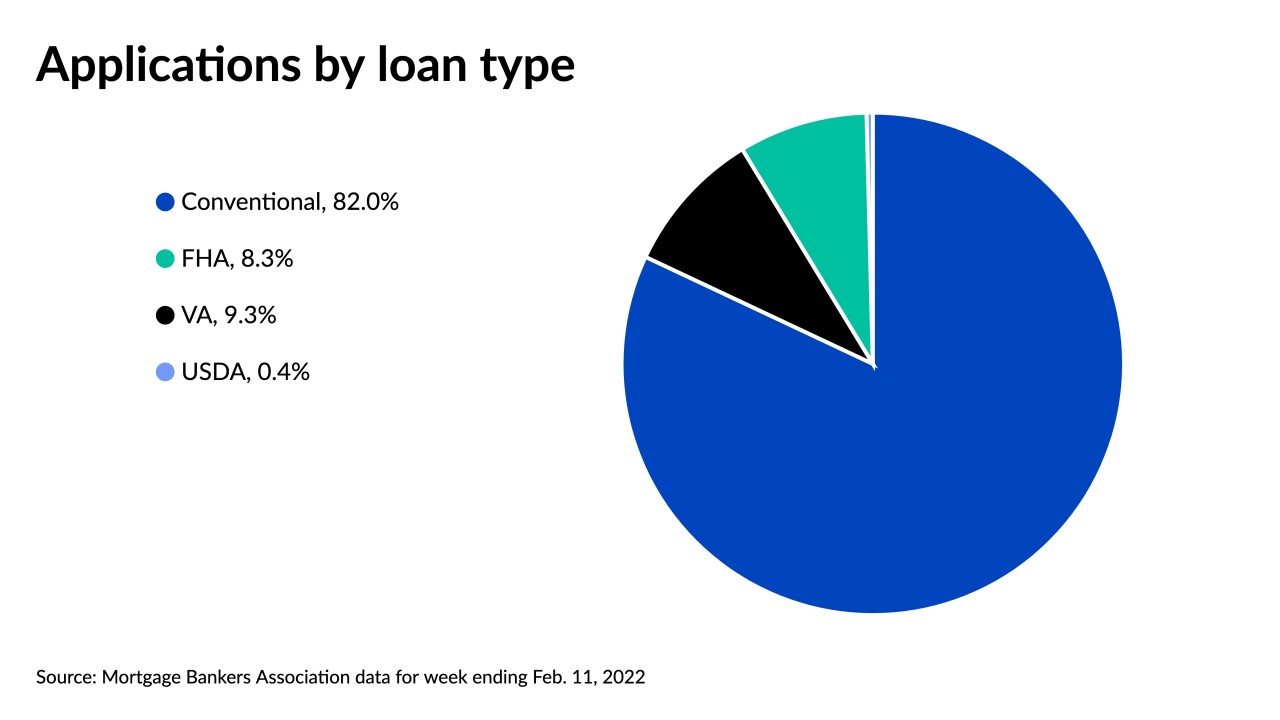

Overall application activity was down by more than 40% compared with one year ago, the Mortgage Bankers Association found.

February 23 -

Federal Reserve Governor Michelle Bowman suggested that a half percentage-point increase in interest rates could be on the table next month if incoming readings on inflation come in too high.

February 21 -

In a Senate Banking Committee hearing on the economy, Republicans reiterated their demand for more transparency from Sarah Bloom Raskin, President Biden's pick to serve as vice chairman for supervision at the Federal Reserve.

February 17 -

The 30-year average increased by 23 basis points on inflation, geopolitical news.

February 17 -

Minutes of the Jan. 25-26 Federal Open Market Committee meeting, released Wednesday, “[tell] us that they will raise the fed funds rate in March, and that a 50 basis point rate hike is in play,” said Gus Faucher, chief economist for PNC Financial Services Group.

February 17 -

Credit availability also tightened in January, contributing to early 2022’s lending slowdown, according to the Mortgage Bankers Association.

February 16