-

The deal significantly grows United Wholesale Mortgage's servicing portfolio, and it will increase the float on its common stock, making it more investable.

December 17 -

The lawsuit is the latest scrutiny over personnel moves this year at the companies under the purview of U.S. Federal Housing Finance Agency Director Bill Pulte.

December 17 -

The trade group's letter to FHFA Director Bill Pulte pointed out that lenders were facing credit report price hikes for four straight years.

December 16 -

Michael Hutchins, the two-time interim chief executive at the government-sponsored enterprise, will remain with the company in his role as president.

December 16 -

Federal Reserve Gov. Stephen Miran said higher goods prices could be the trade-off for bolstering national security and addressing geo-economic risks.

December 15 -

Fannie Mae and Freddie Mac have added billions of dollars of mortgage-backed securities and home loans to their balance sheets in recent months, fueling speculation that they're trying to push down lending rates and boost their profitability ahead of a potential public offering.

December 15 -

Rohit Chopra is named senior advisor to the Democratic Attorneys General Association's working group on consumer protection and affordability; Flagstar Bank adds additional wealth-planning capabilities to its private banking division; Chime promotes three members of its executive leadership team; and more in this week's banking news roundup.

December 12 -

The Department of Housing and Urban Development announced the FHA-insured loan caps for low- and high-cost areas, which are set based on conforming loan limits.

December 12 -

Kansas City Federal Reserve President Jeffrey Schmid and Chicago Fed President Austan Goolsbee said in statements Friday that their dissents from this week's interest rate decision were spurred by inflation concerns and a lack of sufficient economic data.

December 12 -

The new monthly reporting rule lists improved accuracy and timeliness of MBS payments among its goals, with implementation planned for February 2026.

December 12 -

Leading Democrats on the Senate Banking Committee sent a letter to Chair Tim Scott, R-S.C., pointing out the as-yet unsatisfied legal requirement for prudential regulators to appear in Congress semiannually.

December 12 -

The Federal Reserve Board of Governors voted Wednesday to reappoint 11 sitting regional Fed presidents, without any dissents. The move precludes any effort the White House might have made to pressure the board to deny reappointments.

December 11 -

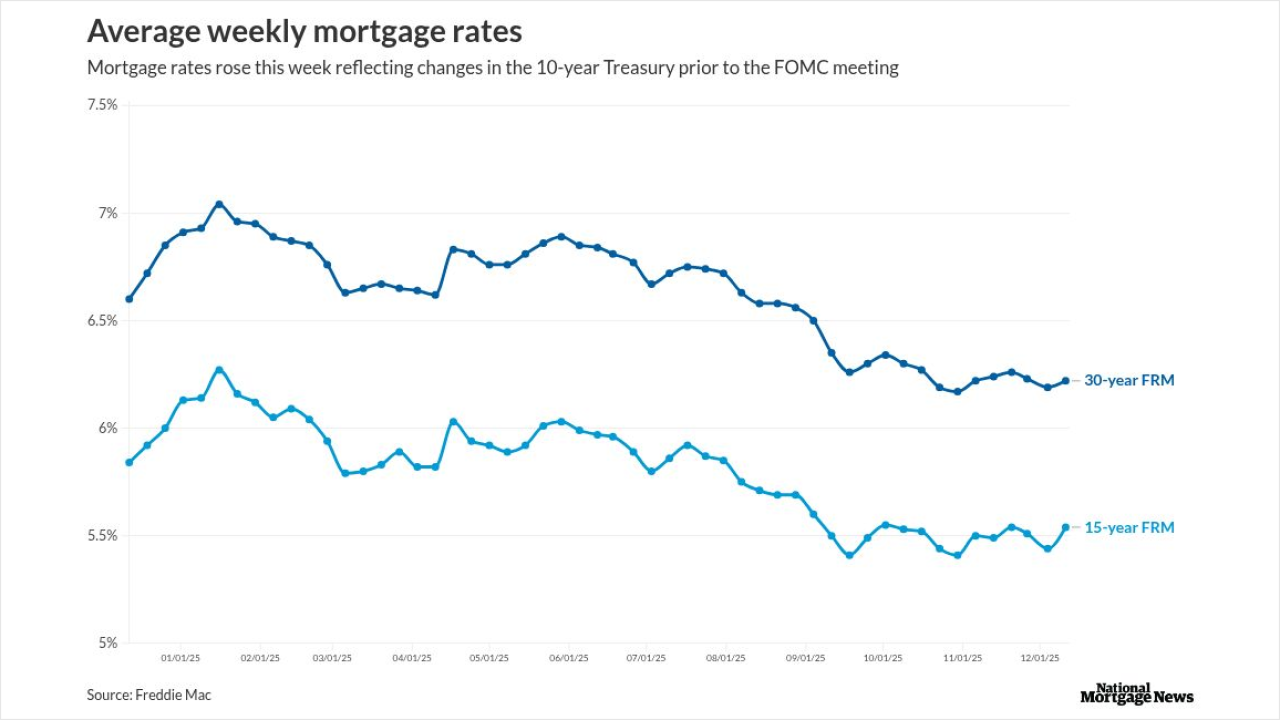

The investor markets already set mortgage rates to include the 25 basis point reduction the FOMC announced, and it is too early to see the longer-term effect.

December 11 -

With the Federal Reserve decision largely factored in, Jerome Powell's comments on future outlook is more likely to influence the housing market.

December 10 -

Charlie Scharf has a mostly optimistic take on Wells' consumer banking prospects entering 2026. But he's more downbeat about the company's once-dominant residential mortgage business.

December 10 -

In a new interpretive letter, the Office of the Comptroller of the Currency will allow banks to serve as middlemen for "riskless" crypto trades, extending existing brokerage authority for securities to digital assets.

December 9 -

New rules means sellers and servicers will need to have plans demonstrating proper oversight of their artificial intelligence and machine learning practices.

December 9 -

Michael Burry, the money manager made famous in The Big Short, believes a re-listing of the US housing-finance giants is "nearly upon us."

December 9 -

In oral arguments held Monday morning, a majority of Supreme Court justices seemed poised to overrule a 90-year-old precedent validating multimember independent commissions, but it remains uncertain what limits — if any — the court may impose on the president's removal powers.

December 8 -

Federal Reserve watchers expect a board of governors vote in February to reappoint the 12 regional Fed bank presidents — which is typically treated as a formality — to be the next flashpoint in the White House's effort to bring the central bank to heel.

December 8