-

Lenders shouldn't expect the latest jobs numbers to yield major monetary policy moves after the unemployment rate came in mostly flat last month, experts say.

January 9 -

Economists cautioned that October's employment report may not provide a fully accurate representation of the economy due to recent hurricanes.

November 1 -

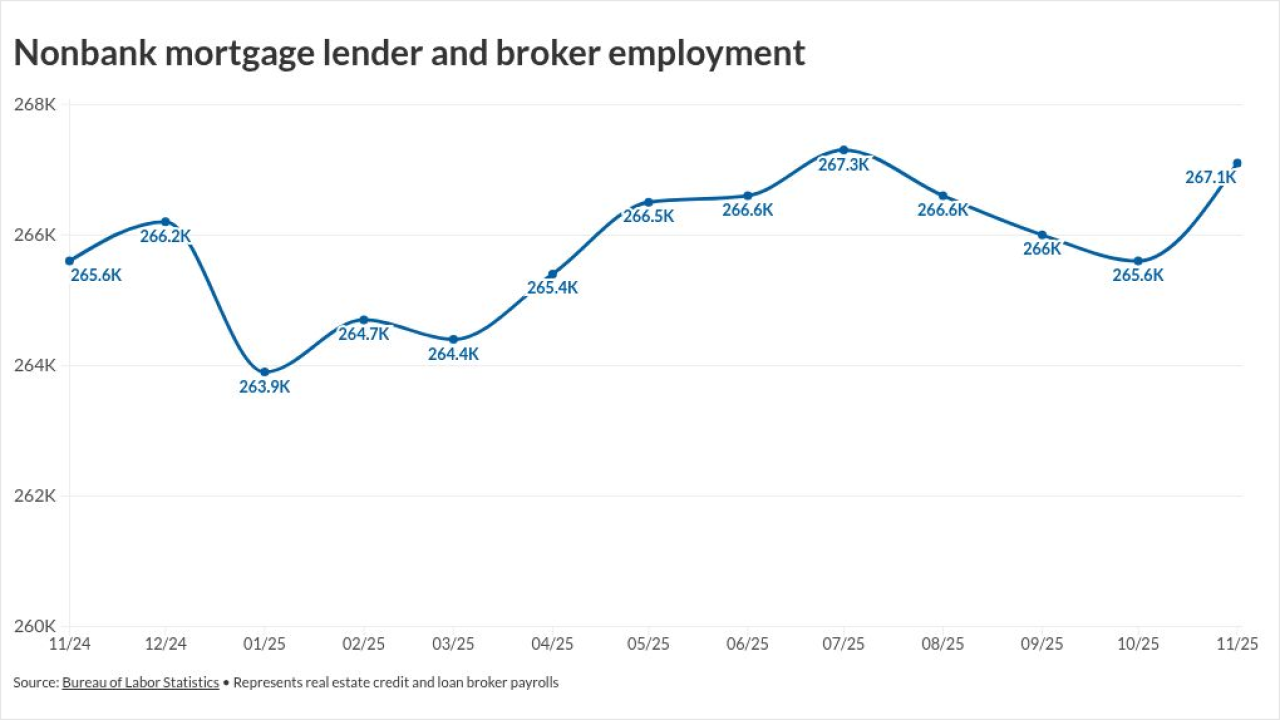

The annual reconciliation shows nonbank cuts were deeper than the initial read suggested, and comes as the latest numbers for broader employment show a surge.

February 2 -

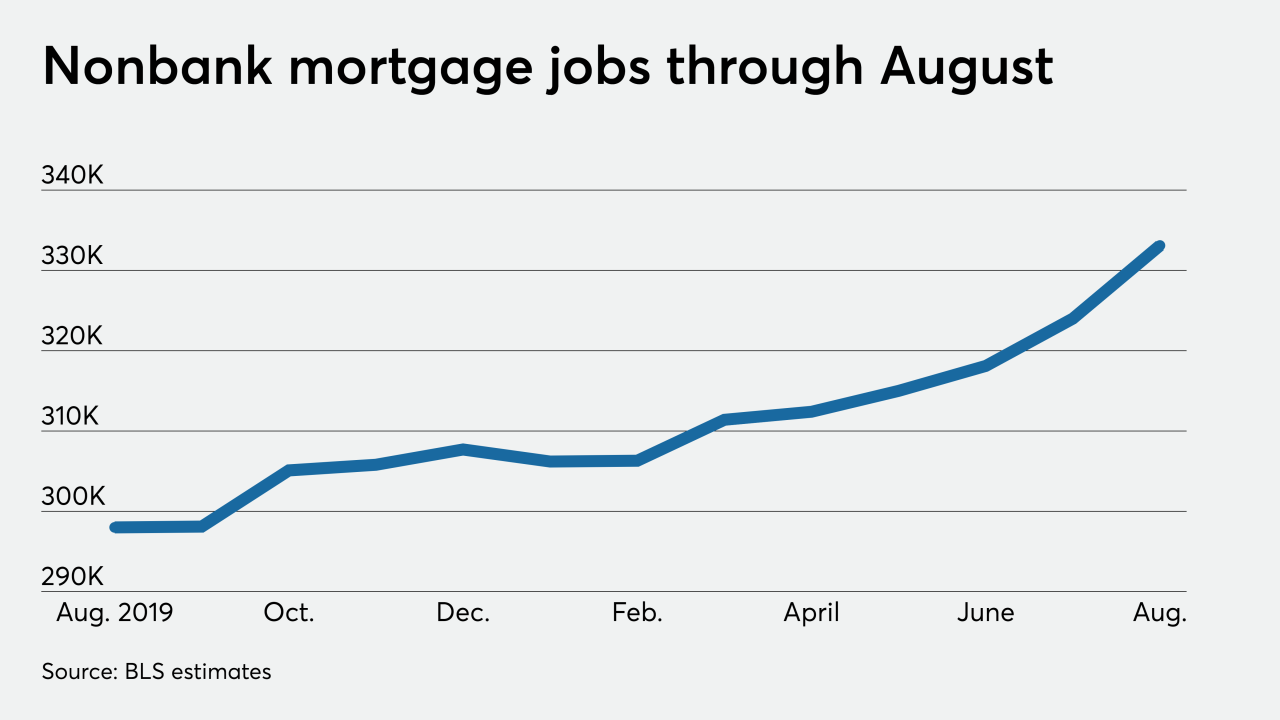

The new record in third-party originator hiring numbers adds to indications that some lenders have been leaning harder on the wholesale channel to address capacity issues amid the origination boom.

November 6 -

There was an estimated total of 333,100 people on nonbank mortgage banker and broker payrolls in August, and that's the highest recorded since at least 2010.

October 2 -

While employment typically ebbs as home buying slows in the fall, several nonbanks have ambitious hiring plans in the works, which call for them to add thousands of workers by year-end.

September 4 -

The rising number of positions appears to reflect an ongoing need to adjust capacity to address rate-driven demand.

August 7 -

While the new employment numbers bode well for housing and loan performance in the short term, concerns abound regarding how the unemployment rate and furloughs could affect prospects for the business later.

July 2 -

Nonbank mortgage hiring inched down when overall employment plunged in April. The subsequent recovery in overall jobs suggests the housing-finance industry is still bearing up well despite coronavirus-related strain.

June 5 -

Hiring by nonbank mortgage and brokers held up unusually well through the early days of the coronavirus outbreak in March, but April's all-time high in unemployment suggests that's unlikely to last.

May 8 -

Nonbank mortgage employment estimates show payrolls in February leveled off after an unusually strong winter, but anecdotal reports of selective hiring persisted through March amid a broader coronavirus-related drop in U.S. jobs.

April 3 -

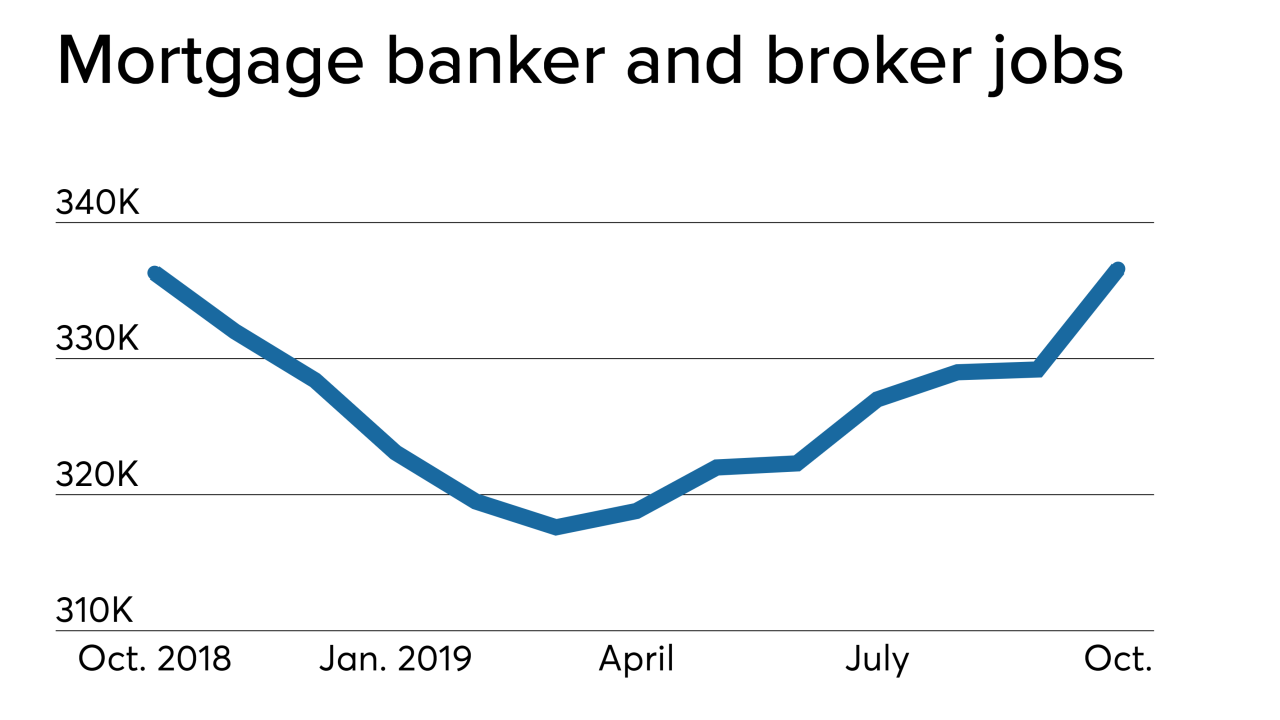

The latest monthly employment estimates for nondepository home lenders and loan brokers rebounded in October and rose year-to-year, reversing a downward trend in 12-month comparisons.

December 6 -

Overall home-loan delinquencies remain near 20-year lows, but in Iowa, Minnesota, Nebraska, Rhode Island and Wisconsin, they are inching up in moves that may be tied to local economic concerns.

November 12 -

Nonbank and bank mortgage employment has leveled off in line with typical seasonal trends, but some lenders remain more interested in hiring than is usually the case late in the year.

November 1 -

As tenant advocates press for even more restrictive rules for rents and capital improvements to support asset values, look for the flow of investment into multifamily real estate to dwindle.

October 29 Whalen Global Advisors LLC

Whalen Global Advisors LLC -

Employment estimates for nonbank mortgage companies rose to a 2019 high as lower rates spurred consumer demand in August, but higher rates in September could mean future numbers will be weaker.

October 4 -

Nonbank mortgage companies added 4,600 employees to their payrolls in July and may add more to address continuing rate-driven increases in loan volume.

September 6 -

June employment by nondepository mortgage bankers and brokers was little changed from the previous month, but later numbers could prove stronger given some influential lenders' interest in staffing up.

August 2 -

From the Carolinas to the Sunshine State, here's a look at the cities offering the biggest job growth over the past five years.

July 19 -

After months of backsliding followed by a modest increase in April, nondepository mortgage companies added 3,200 workers in May, as the overall job market gained steam.

July 5