-

Employment by nondepository mortgage companies in June increased for the third consecutive month as seasonal hiring continued even though home resales inched down another notch.

August 3 -

Despite recent industry consolidation, demand from seasonal homebuyers spurred hiring among nonbank mortgage companies for the second consecutive month in May.

July 6 -

Seasonal hiring gave employment among nonbank mortgage lenders and brokers a boost in April and partially reversed an earlier decline despite growing signs of consolidation in the industry.

June 1 -

Employment among nonbank mortgage lenders and brokers fell in March, erasing the unexpected gains in the previous month.

May 4 -

Employment in the nonbank mortgage lender and brokerage sector unexpectedly rose in February after several months of layoffs.

April 6 -

Employment in the nonbank mortgage lender and brokerage sector is falling in the face of rising interest rates and the limited supply of homes for sale.

March 9 -

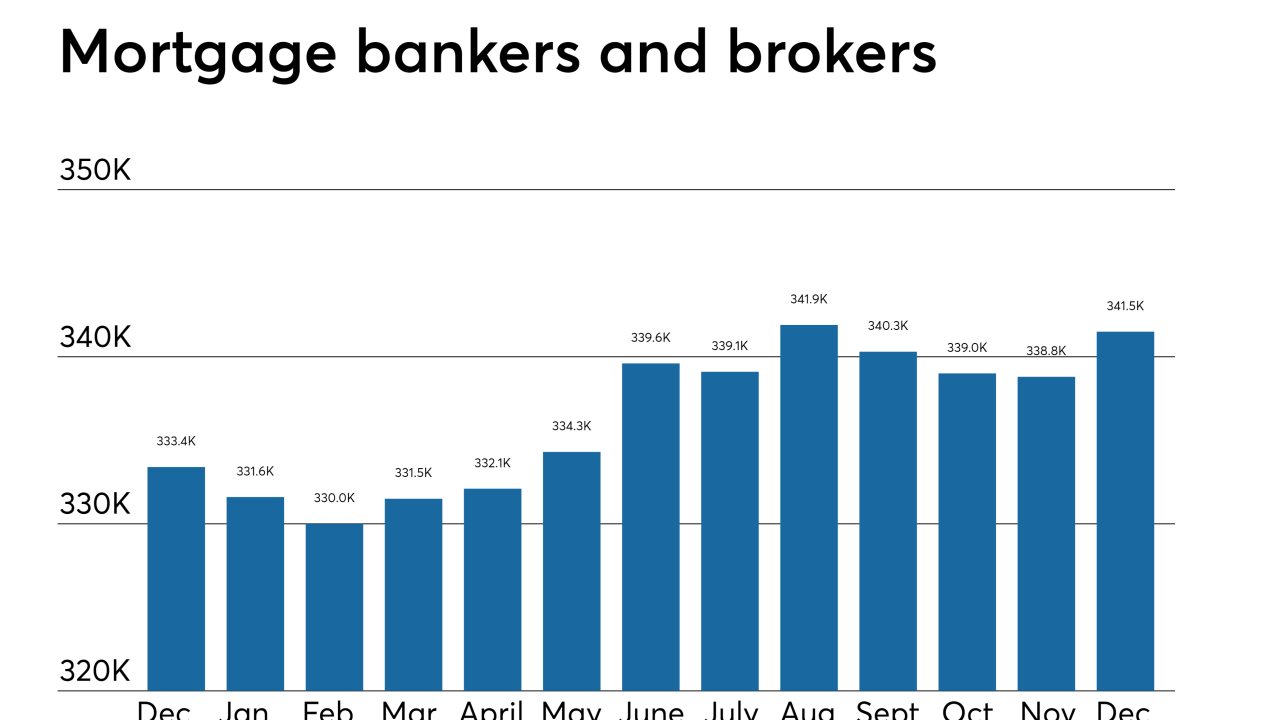

A December hiring spike at nondepository mortgage originators ended a three-month skid and solidified the fourth straight year of job gains in the sector. But with loan volume projected to decline again in 2018, it remains to be seen whether nonbanks will add more workers or start making cuts.

February 2 -

Refinance volume fueled recent market gains by nonbank mortgage originators. But lower volume amid the shift to purchase lending has nonbanks trimming headcounts and may position banks to recapture market share.

January 5 -

Nonbank mortgage employment fell for the second consecutive month, according to the Bureau of Labor Statistics.

December 8 -

Nonbank mortgage employment took its biggest drop since January following the recent hurricanes, according to the Bureau of Labor Statistics.

November 3 -

Nondepository mortgage bankers and brokers increased their headcounts in August, but hurricane recovery efforts and other macro factors may stymie additional growth.

October 6 -

Hurricane Irma hit Central Florida’s home construction industry in more ways than one.

September 15 -

Nondepository mortgage bankers and brokers employment dipped slightly in July, ending a four-month run of hiring pickups.

September 1 -

The nonbank mortgage sector had its largest one-month employment gain in a year, as independent mortgage bankers and brokers enjoyed stronger-than-expected originations during the second quarter.

August 4 -

Employment among nonbank lenders and mortgage brokers grew in May, marking the third straight month of employment gains at a time when housing inventory is tight, refinancing has slowed and home prices are rising.

July 7 -

Employment in the mortgage sector increased for the second consecutive month in April as the spring home purchase season began.

June 2 -

Employment in the mortgage sector rose for the first time in three months in March, driven by an increase in loan broker hires.

May 5 -

Employment in the nondepository mortgage banker and broker sector fell for the second consecutive month in February, a possible sign of growing concern about shrinking demand for mortgages.

April 7