WASHINGTON — Recent market share gains by nonbank mortgage lenders have come primarily from refinance originations. But as refis decline and purchase mortgages remain muted by limited available housing inventory, depository mortgage lenders may be in a position to recapture market share.

"Large nonbank lenders are overly reliant on refinance and over staffed," while banks are better positioned to take advantage of the increase in purchase mortgage originations going forward, Chris Gamaitoni, assistant director of research at Compass Point Research & Trading, said in a Dec. 27 research note.

"The shift in originations from refinancing to purchase mortgages is going to give banks a boost going forward," Gamaitoni wrote, citing lower profitability outlooks in the latest

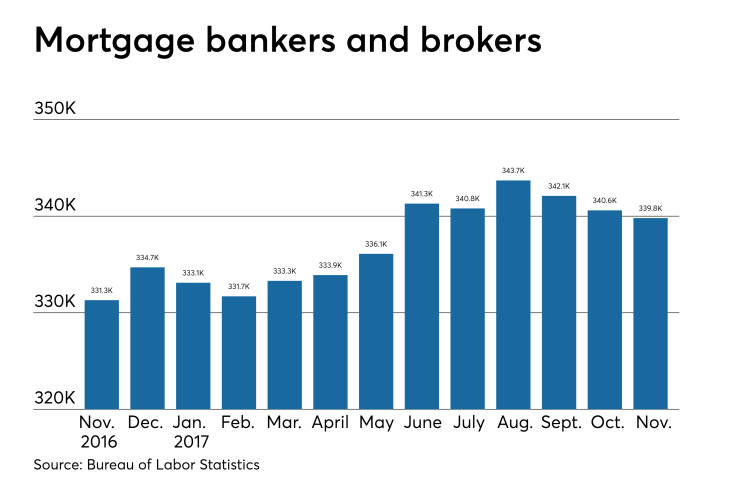

Nonbank mortgage lenders and brokers employed 339,800 full-time employees in November, down from

It's the third straight month of job declines, as nonbank mortgage companies have trimmed their payrolls by 3,900 employees

Nonbanks "seem to be competing aggressively against each other and leading to the declining profit outlook," Gamaitoni wrote. "We believe this is likely the start of a shift of market share back to the banks that are better positioned from a cost of capital standpoint, product mix standpoint, and have not expanded staffing to levels unsupported by the future market."

Purchase mortgage originations will increase to $1.2 trillion in 2018, from $1.14 trillion in 2017, while refinance loans will drop to $536 million in 2018, from $672 million in 2017, according to

But the real headwind may be rising interest rates due to the faster economic growth.

"We expect the Federal Reserve will raise rates four times in 2018," according to Mortgage Bankers Association Chief Economist Mike Fratantoni.

Meanwhile, sales of newly built single-family homes rose in November to a seasonally adjusted annual rate of 733,000 units. This is the highest sales pace since July 2007, according to the National Association of Home Builders.

Industry-specific data lags overall employment estimates by one month. Total nonfarm employment increased by 148,000 jobs in December and the unemployment rate remained unchanged at 4.1% for the third straight month, the BLS also reported.