-

Equifax, the credit-reporting firm that suffered a massive data breach last year, said it will notify an additional 2.4 million U.S. consumers that they were affected by the hack.

March 1 -

Sen. Elizabeth Warren released a scathing report Wednesday on Equifax's handling of the data breach last year, part of an effort to gain backing for legislation to rein in the credit bureaus.

February 7 -

It is unclear whether the Consumer Financial Protection Bureau is abandoning its supervisory oversight of Equifax or just taking a back seat to the Federal Trade Commission as the latter investigates the credit bureau.

February 5 -

The two senators are set to introduce a bill that would force such firms to pay $100 per customer whose personal information was compromised.

January 10 -

The credit bureau enraged many with its response to a massive data breach this fall, but closing the company down would ultimately harm consumers.

December 29 Consumers' Research

Consumers' Research -

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

Equifax reported earnings that were 27% lower and mortgage services revenue was 2% lower on a year-to-year basis after revealing a major breach and taking steps to improve security.

November 10 -

Calls for less reliance on credit bureaus and Social Security numbers for verification are leading many to envision a future of identity on a distributed ledger.

October 30 -

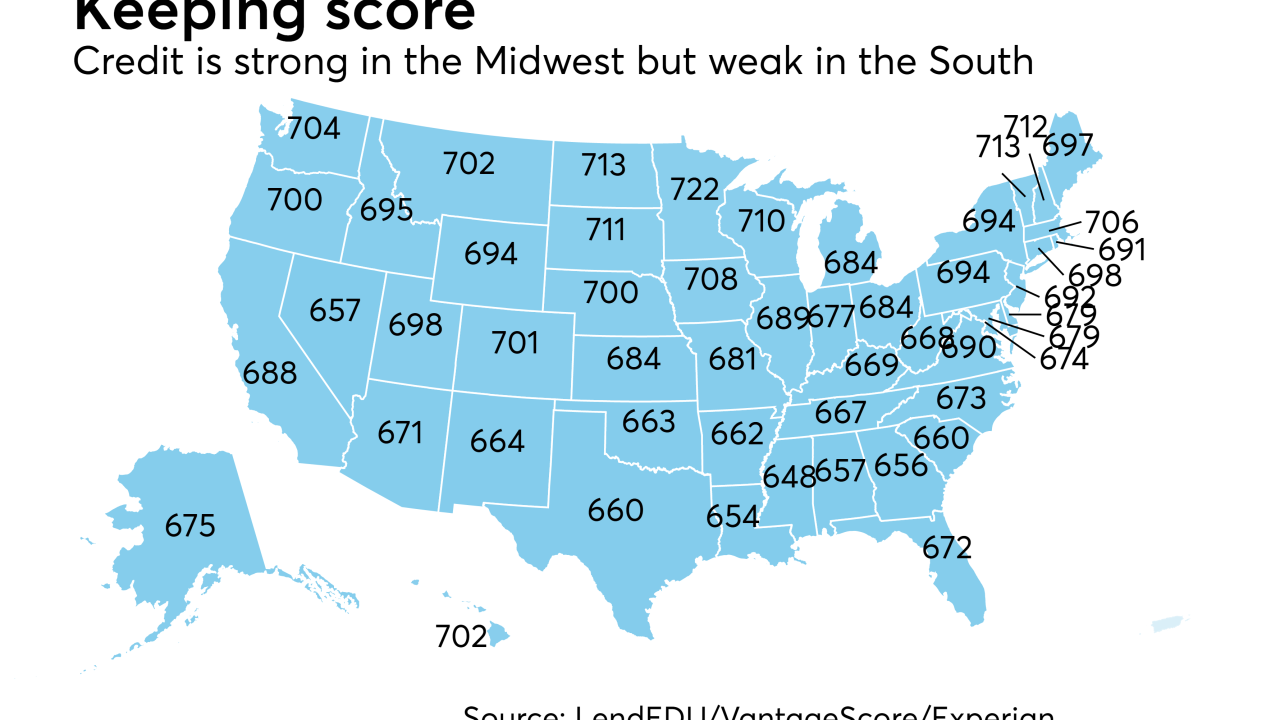

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

Fannie Mae is authorizing additional suppliers of reports that can give lenders immediate representation and warranty relief on certain data, diversifying beyond an exclusive partnership with Equifax in one category.

October 23 -

The CFPB's practice of "regulation by enforcement" forces mortgage companies to develop compliance standards based on the mistakes of their peers, rather than clear guidance from the enforcement agency, said David Motley, the new chairman of the Mortgage Bankers Association.

October 23 -

Equifax continues work to add new security features and restore full access to The Work Number following a report highlighting potential security vulnerabilities in a browser-based portal of its employment verification service.

October 20 -

Cybersecurity and breach notification procedures have caught the most public attention following the massive hack at Equifax, but lawmakers are also interested in the accuracy of credit reports.

October 17 -

Recently exposed security vulnerabilities in an Equifax tool used extensively in the mortgage industry are raising new questions about the reliability and veracity of the beleaguered credit bureau's employment verification service.

October 13 -

The legislative response to the Equifax breach is increasingly bipartisan, but will congressional proposals actually reduce the threat to consumers?

October 12 -

Congress may soon try to limit the personal identifiable information that companies and the government can collect on consumers based on their reaction to the massive data breach at Equifax.

October 4 -

Richard Smith came to Capitol Hill this week to speak about the massive breach at Equifax, but it was clear Tuesday that he will be defending the entire credit reporting industry.

October 3 -

Tim Welsh has spent his first two months on the job thinking about how to make U.S. Bank as central to consumers’ lives as Amazon, develop new personal financial management services, and expand into new cities.

September 29 -

Equifax observed an increasingly well-worn ritual of scandal-ridden firms by jettisoning CEO Richard Smith: apologize, promise to do better in the future, and sacrifice your top executive in the hopes it will ward off action by Congress and regulators.

September 26 -

Inevitably, Equifax’s CEO Richard Smith has left his post. For the credit bureau's sake, let's hope it has a long-term plan that's better than promoting from within.

September 26