-

The root of the credit reporting sector’s problems may be its dominance by a handful of big firms, lawmakers from both parties said at a hearing.

February 26 -

Ahead of testimony by the CEOs of the major bureaus, House Financial Services Committee leaders proposed sweeping changes for the credit reporting industry and credit-score protections for furloughed government workers.

February 25 -

Consecutive-month default rates for home loans are increasing, and they could remain higher the next few months, according to a recent report.

January 15 -

The Federal Housing Finance Agency has proposed barring Fannie Mae and Freddie Mac from using credit scores developed by VantageScore over concern about conflicts of interest with the joint venture of Equifax, Experian and TransUnion.

December 13 -

Nov. 07--Alabama just misses out on the top ten among states with the nation's lowest total mortgage debt.

November 9 -

A new credit score that includes consumers' cash flow alongside their credit score is winning praise for its potential to help expand access to credit, but some worry it gives the credit bureaus even more data that could be compromised.

October 23 -

In a move designed to improve access to financial products for consumers with low credit scores and short credit histories, Experian, FICO and Finicity are developing an "UltraFICO" score that lets individuals share checking and savings account data and help lenders better assess risk.

October 22 -

Senators at a hearing Thursday discussed a bill establishing an online portal for consumers to monitor their credit reports free of cost.

July 12 -

As mortgage lenders continue seeking ways get more trustworthy consumers into the housing market, a majority of them are utilizing alternative credit as a means of assessing borrower risk, according to Experian.

May 25 -

Supporters say pending legislation would help consumers with little or no credit history. But the bill would instead roll back key consumer protections.

May 17 Pennsylvania Utility Law Project

Pennsylvania Utility Law Project -

Some speculate that the banks who do business with credit reporting agencies may be looking for alternatives after mounting concerns about their ability to keep information private. But breaking up is hard to do.

April 4 -

Some fear that the removal of such data from individual credit reports could lead lenders to believe a consumer is a better bet than they really are.

April 2 -

Default rates in second mortgages and bank cards rose notably in December, suggesting consumers are having trouble managing increased spending.

January 17 -

The average VantageScore last year was higher than it has been since 2007 due to improved hiring and despite stagnant wages that aren't keeping pace with rising debt levels.

January 11 -

A breach at Alteryx that exposed sensitive information from more than 100 million U.S. households could add to fraud risks in housing finance

December 22 -

Consumer credit bureau and data aggregator Experian will gain a foothold in the U.K. mortgage market by acquiring a minority stake in mortgage brokerage London & Country Mortgages Limited.

December 11 -

Consumer default rates are up month-to-month, which may reflect a gap between spending and income that is stressing second mortgages and bank cards, Standard & Poor's and Experian find.

November 22 -

Calls for less reliance on credit bureaus and Social Security numbers for verification are leading many to envision a future of identity on a distributed ledger.

October 30 -

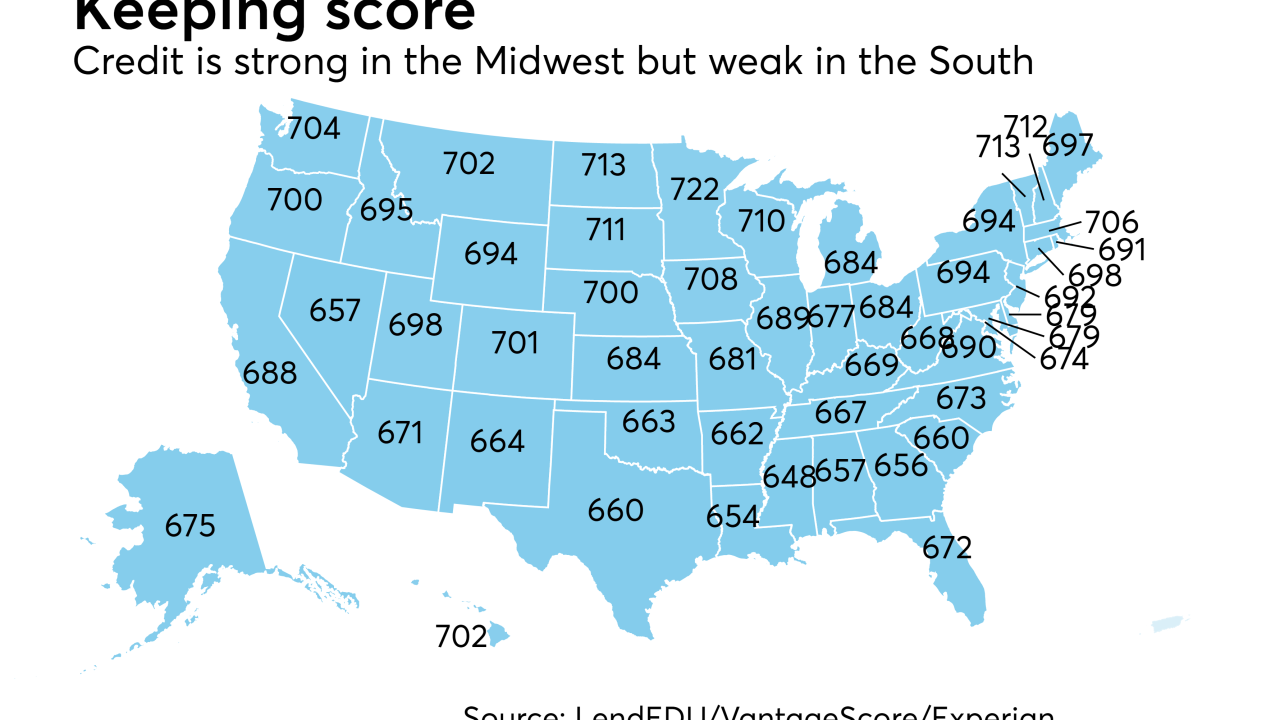

Consumer credit varies nationally due to regional variations in income and the cost of living. To get a sense of where it's strongest and weakest, here's a look at the five best and worst states for consumer credit scores.

October 23 -

Mortgage defaults keep rising and are getting much nearer to where they were in 2016 as damage from natural disasters continues to add to slight upward pressure on credit.

October 17