-

Picking a new benchmark for adjustable-rate mortgages is the easy part. Industrywide implementation is where things get tricky.

August 10 -

Dividend payments by Fannie Mae and Freddie Mac are due to come one day after the U.S. is estimated to hit the debt ceiling, raising the stakes in the debate over whether those payments should continue.

August 9 -

The Federal Housing Finance Agency promoted Andre Galeano to oversee its regulation and supervision of the 11 Federal Home Loan banks.

August 9 -

Low-down-payment purchases are on the rise, but not necessarily with the same pre-crisis practices and risk factors.

August 8 -

PHH Corp. will pay the Justice Department $75 million to settle a False Claims Act investigation of its underwriting practices on government-insured mortgages and loans sold to Fannie Mae and Freddie Mac.

August 8 -

The mortgage finance giants Fannie Mae and Freddie Mac could need nearly $100 billion in bailout money in the event of a new economic crisis, according to stress test results released Monday by their regulator.

August 7 -

Credit risk transfers have emerged as more than just a method for mitigating taxpayer exposure. They could be a key component of comprehensive housing finance reform.

August 7 Moody's Analytics

Moody's Analytics -

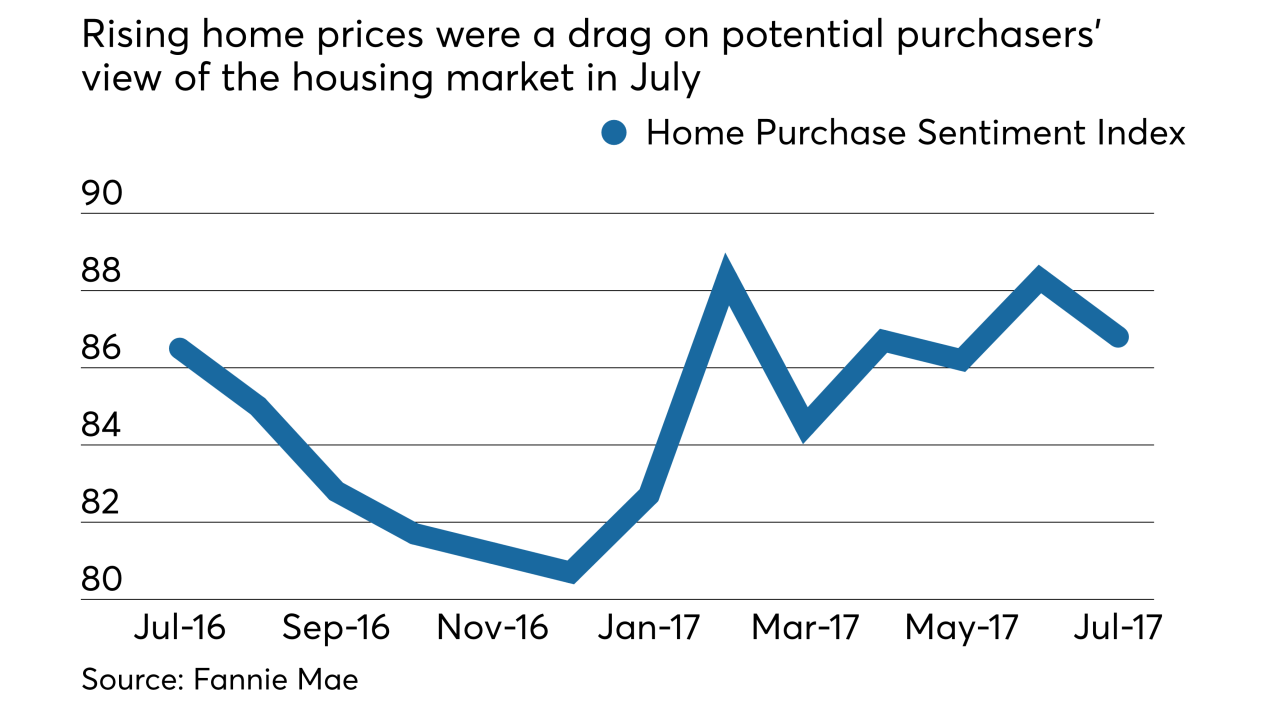

The percentage of people who said July was a bad time to buy a home increased to a survey high because of rising prices, according to Fannie Mae.

August 7 -

The nonbank mortgage sector had its largest one-month employment gain in a year, as independent mortgage bankers and brokers enjoyed stronger-than-expected originations during the second quarter.

August 4 -

The government-sponsored enterprise is still looking for the right balance between offering a product that's attractive to investors and a cost-effective way to reduce risk.

August 3 -

Flagstar Bank has hired Kristy Fercho, former senior vice president and customer delivery executive for Fannie Mae, to lead its mortgage division.

August 2 -

A bipartisan duo of lawmakers is set Tuesday to introduce a bill designed to increase homeownership opportunities for “credit invisible” consumers.

August 1 -

Freddie Mac is on track to double the number of low down payment mortgages it will buy in 2017, while continuing to see its serious delinquency rate fall to record lows.

August 1 -

Freddie Mac said it earned enough in the second quarter to send a $2 billion dividend to the U.S. Treasury, but the press release announcing the company’s financial results includes new language suggesting uncertainty as to whether the payment will be made as scheduled.

August 1 -

Garden State Home Loans has launched a 1% down payment program for first-time buyers, opening the door for millennial purchasers.

August 1 -

CoreLogic will fully integrate its 4506-T income verification product in August with Fannie Mae's Desktop Underwriter platform to provide Day 1 Certainty service.

July 31 -

Regardless of whether Congress could act, proponents don’t seem to fully appreciate the potential unintended consequences of a future without Fannie Mae and Freddie Mac.

July 31

-

The run-up in expenses involved in making a home loan is one of the trends limiting new construction, says Fannie Mae Chief Economist Doug Duncan.

July 28 -

Three California men who previously operated Star Reliable Mortgage were ordered to pay $1.1 million in restitution and are facing multiyear prison terms related to a foreclosure rescue scheme.

July 28 -

Shareholders of Fannie Mae and Freddie Mac say a trove of documents they have obtained bolsters their case that the government lied when it decided to take all of the mortgage companies’ profits.

July 28