-

Risk management and technology systems at the Federal Housing Administration lag decades behind Fannie Mae and Freddie Mac and desperately need to be revamped, according to a top official at HUD.

June 18 -

The bill aimed at helping struggling homeowners also requires documentation of servicer behavior and FHFA evaluation of the services provided to borrowers.

June 18 -

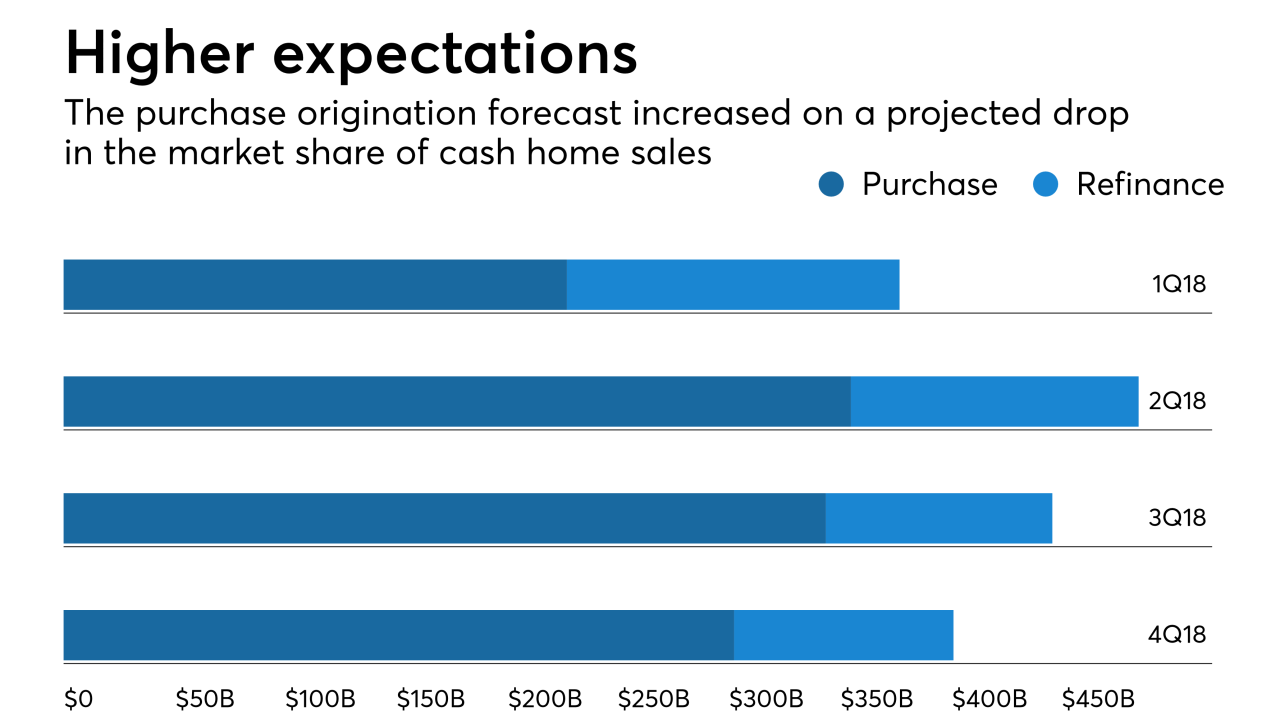

A declining share of cash home sales will drive purchase home originations higher than previously expected through 2019, according to Fannie Mae.

June 18 -

No plan will be implemented as long as Fannie Mae and Freddie Mac remain in conservatorship, but a capital framework for the companies could still have a substantive impact.

June 15 -

Sales of nonperforming loans by Fannie Mae and Freddie Mac slowed during the past year as the number of delinquent loans on their books continued to drop.

June 14 -

Freddie Mac hit the $1 trillion mark on credit risk sharing for single-family mortgage loans with its second lower LTV deal of the year.

June 13 -

Goldman Sachs affiliate MTGLQ Investors won another bid for Fannie Mae's nonperforming loans, persisting as a buyer for the product even as Fannie keeps working to diversify the investor base.

June 13 -

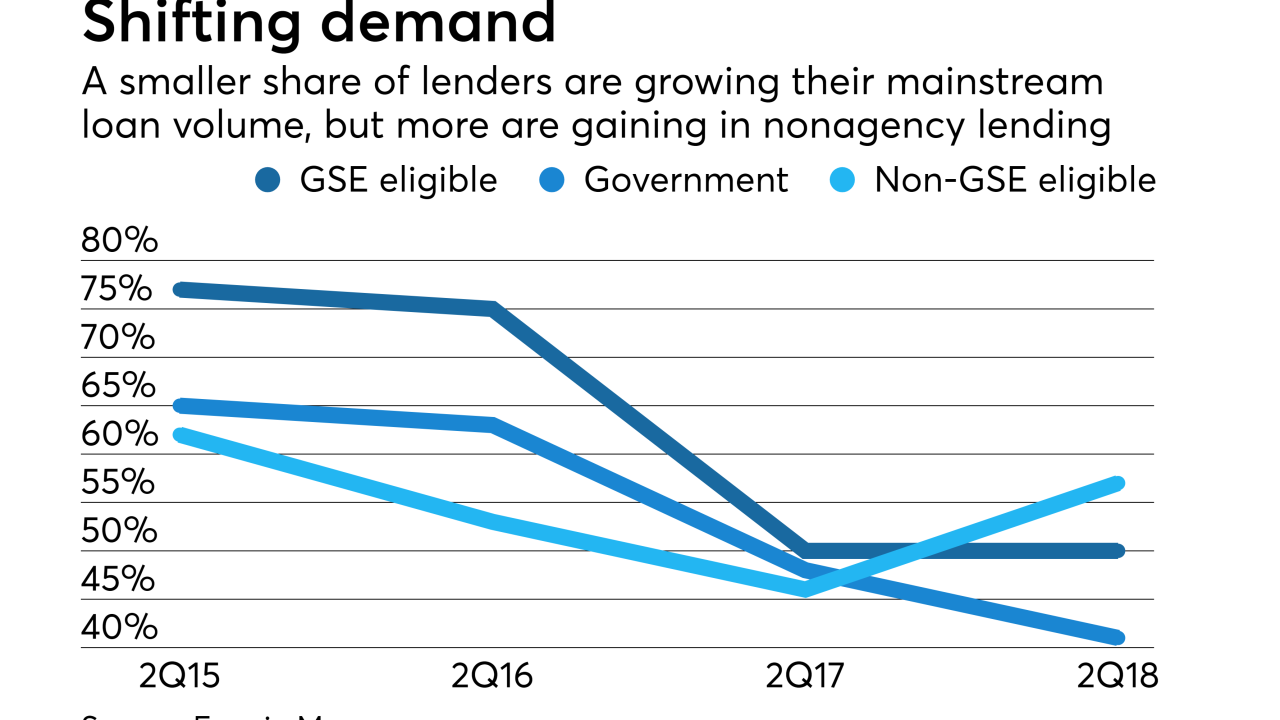

The net share of government and agency mortgage lenders who found spring homebuyer demand to be strong enough to drive purchase loan growth is considerably lower than three years ago.

June 12 -

The agency proposed new minimum capital requirements for Fannie Mae and Freddie Mac that would only go into effect if the government ends its conservatorships.

June 12 -

Continued optimism in the sell side of the real estate market outweighed the growing negative perception on the buy side, as consumer sentiment about purchasing a home reached a new high, according to Fannie Mae.

June 7 -

Fannie Mae is lowering down payment requirements and lender fees on manufactured housing loans to improve affordable housing access.

June 6 -

MountainView is brokering a $3.6 billion nonrecourse package of Fannie Mae mortgage servicing rights with a high refinance loan concentration.

June 4 -

Seasonal hiring gave employment among nonbank mortgage lenders and brokers a boost in April and partially reversed an earlier decline despite growing signs of consolidation in the industry.

June 1 -

The federal government has opened a criminal investigation into whether traders manipulated prices in the $550 billion market for corporate bonds issued by Fannie Mae and Freddie Mac, according to people familiar with the matter.

June 1 -

Fannie Mae is warning mortgage lenders and servicers about possible fraud schemes in Los Angeles County involving "34 apparently fictitious employers being used on loan applications."

May 30 -

To make its technology more relevant to the mortgage industry, Fannie Mae is taking a new approach to developing tools that engages lenders earlier in the process and makes lending more efficient.

May 29 Fannie Mae

Fannie Mae -

Freddie Mac's economists took a more bullish outlook than others on the 2018 mortgage market, raising its forecast by $30 billion citing higher-than-projected refinance activity.

May 25 -

A group of low- and moderate-income first-time homebuyers tracked in a Fannie Mae study did not properly prepare to get a mortgage, which created a prolonged and complicated purchase process.

May 24 -

In the continued absence of legislation, Fannie Mae and Freddie Mac’s regulator announced work on a new capital framework.

May 23 -

Republican Bob Corker of Tennessee and Democrat Mark Warner of Virginia are acknowledging the legislative efforts to end government control of Fannie Mae and Freddie Mac are dead, at least for now.

May 23