-

Tax reform caused Fannie Mae to burn through retained earnings that had been approved just two months ago and to post a fourth-quarter loss. CEO Timothy Mayopoulos argued it was a one-time event that overshadowed strong fundamentals.

February 14 -

Fannie Mae will request an infusion of taxpayer money for the first time since 2012 because of an unintended but anticipated side effect of the corporate tax cut signed into law in December.

February 14 -

Fannie Mae is doing more to expand its list of Day 1 Certainty report suppliers, naming Blend as the first online point of sale system to directly offer asset validations.

February 13 -

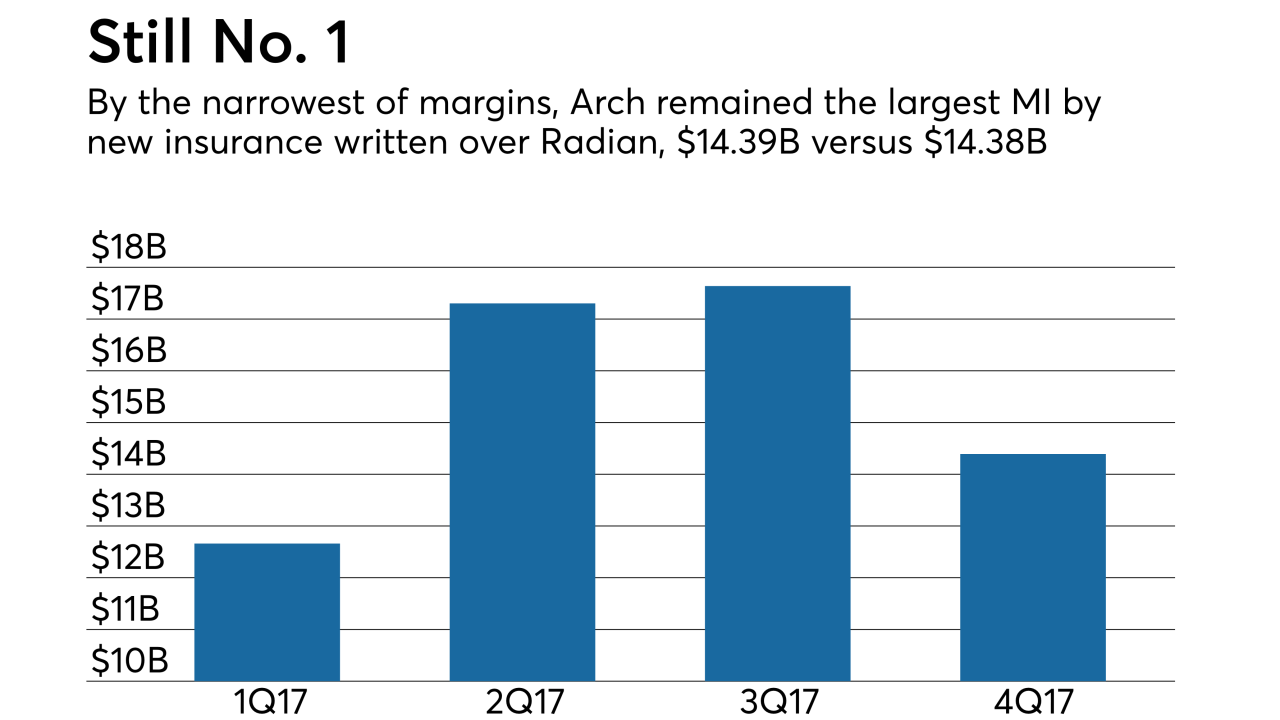

Arch Capital Group's mortgage insurance subsidiary increased its cushion under the secondary market capital standards in the fourth quarter even as its delinquent inventory grew.

February 13 -

The Trump administration’s 2019 budget highlights the administration’s goal of reining in the post-crisis regulatory apparatus, with proposed cuts for several agencies including the Consumer Financial Protection Bureau.

February 12 -

Quicken Loans, Citizens Bank and Better Mortgage are refinancing loans using Airbnb income as part of a pilot project with Fannie Mae.

February 9 -

As conservator, FHFA Director Mel Watt has substantial leeway to remake the government-sponsored enterprises without congressional input. Here's one way he might do so.

February 7 -

From insights about borrower payment preferences to new automation assisting with natural disaster recovery efforts, here's a roundup of news coming out of the Mortgage Bankers Association Servicing Conference.

February 7 -

Recent stock market volatility may further constrain jumbo lending, while inflation concerns have lenders paying close attention to rising mortgage rates.

February 6 -

The Federal Housing Finance Agency said Friday it will give commenters more time to weigh in on a potential update to the credit scoring requirements for Fannie Mae and Freddie Mac.

February 2 -

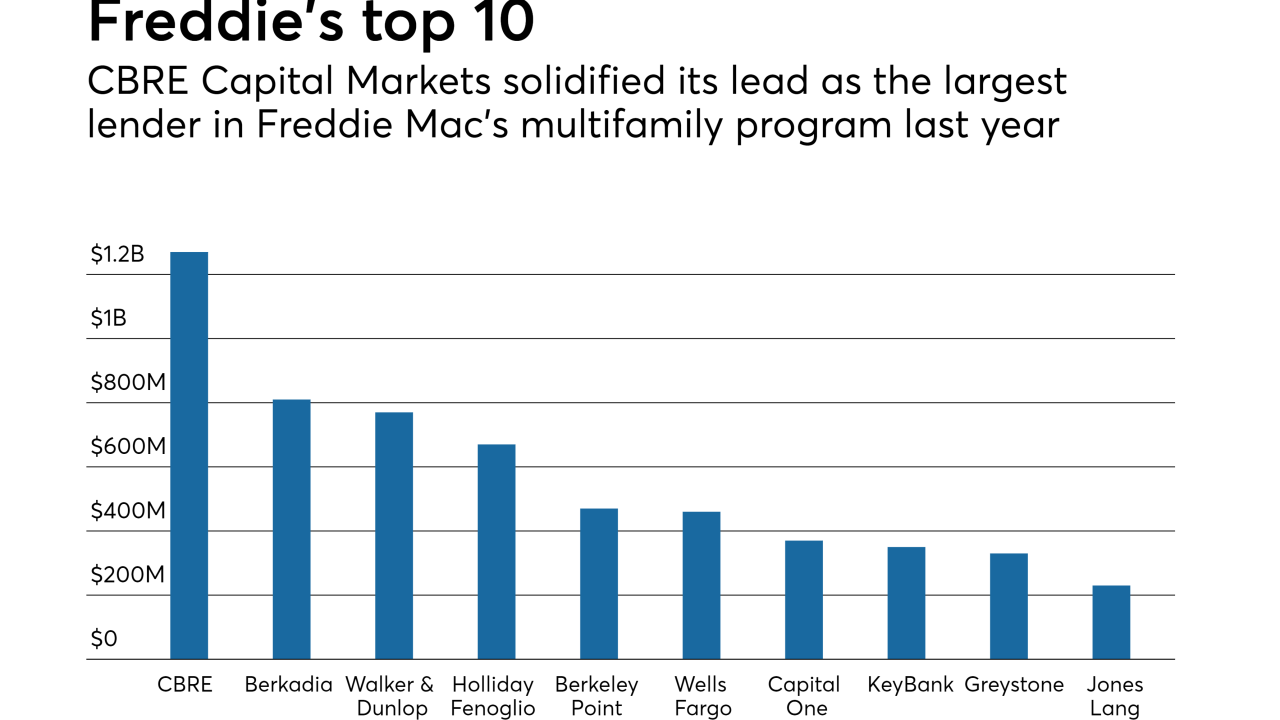

The top five Freddie Mac multifamily lenders remained stable year-to-year, in contrast to the shakeup in competitor Fannie Mae's rankings.

February 2 -

Housing finance reformers are pushing full steam ahead to get a bill introduced before the political calendar makes passage nearly impossible.

February 2 -

The government must continue to provide support for the mortgage market in any new housing finance system, Treasury Secretary Steven Mnuchin said Tuesday.

January 30 -

Fannie Mae's multifamily volume hit another record high of $67 billion in 2017 as former top producer Wells Fargo nearly halved its volume and nonbank competitors increased their market share.

January 26 -

Supporters of an unreleased bill to revamp the housing finance system say the plan strikes a middle ground that can gain support from both sides of the aisle.

January 24 -

While the majority of lenders feel mortgage industry data initiatives have been valuable, their cost is clouding some originators' viewpoint, a Fannie Mae survey found.

January 24 -

The changes created by tax reform will be a mixed influence on housing as consumers will have more to spend to buy a property, but lose other benefits of homeownership.

January 22 -

Here's a look at what happens at five federal agencies that support the mortgage industry during a government shutdown.

January 19 -

Updated Fannie Mae requirements clarify that lenders need to conduct an independent internal audit, something that might require additional investment by nonbanks to set up.

January 19 -

Senate negotiators are working on a bill that would place Fannie Mae and Freddie Mac into receivership and replace them with multiple mortgage guarantors, according to sources.

January 18