-

The four prudential agencies, which will enforce the new credit loss methodology developed by the Financial Accounting Standards Board, said they want to promote consistency.

October 17 -

Executives sent a letter to the federal banking regulators last month expressing concern that an alternative to the London interbank offered rate could limit credit availability.

October 16 -

The three federal banking agencies moved to raise the threshold for residential transactions that require an appraisal from $250,000 to $400,000.

September 27 -

Sheila Bair, who holds board seats at several other organizations, will sit on Fannie's compensation, corporate governance and risk policy committees.

August 21 -

The company withdrew an earlier bid to become an ILC after regulators identified problems with its application. It is seeking a Nevada bank charter because it wants to add deposit management services and expand into small-business lending.

August 14 -

Banks need to mitigate potential bias in algorithmic predictive models using artificial intelligence, as regulators are weighing how to oversee the emerging technology.

August 6 Regions Bank

Regions Bank -

The regulators have yet to complete rules on regional bank supervision, community bank capital and other provisions meant to ease institutions' burden.

August 1 -

After years of largely standing on the sidelines, lawmakers are taking a closer look at whether algorithms used by banks and fintechs to make lending decisions could make discrimination worse instead of better.

June 26 -

Sens. Elizabeth Warren, D-Mass., and Doug Jones, D-Ala., cited research that found algorithmic lending can lead to higher interest rates for minority borrowers.

June 12 -

Democrats and Republicans on the House Financial Services Committee called for steps to minimize the harm to community banks and credit unions bracing for the new accounting standard.

May 16 -

Recent remarks from top officials at the FDIC and Fed suggest the agencies' recent impasse over reforming the Community Reinvestment Act may be ending.

March 18 -

While the OCC has led the charge on modernizing the Community Reinvestment Act, Gov. Lael Brainard gave a rundown of new ideas under discussion — from updating assessment boundaries to a comprehensive community development test.

March 12 -

Private flood insurance rules that go into effect this summer have a safe harbor for some policies, but determining whether others are compliant could be a time-consuming, imprecise and costly exercise.

February 27 Buckley Sandler LLP

Buckley Sandler LLP -

The federal banking agencies will not hold a hearing on a proposal to reduce the number of residential real estate transactions that require an appraisal.

February 22 -

Depository mortgage lenders are optimistic the final version of a regulation designed to open up the flood insurance market will make it easier for them to comply with a rule requiring them to accept private carrier policies.

February 11 -

The comptroller of the currency also addressed, in his role as acting FHFA head, whether Congress or the Trump administration will spearhead GSE reform.

February 7 -

Federal Reserve Board Gov. Lael Brainard said public comments demonstrate a desire among stakeholders for reforms to be implemented consistently across the Fed, OCC and FDIC.

February 1 -

As suspense builds over which firm will be the first to seek the special-purpose charter, a side discussion has emerged over which financial services sector has the most to gain — or lose — from the new option.

January 27 -

The agencies are weighing a plan to reduce the scope of residential real estate transactions requiring an appraisal, but appraisers have warned that the proposal could have consequences.

January 3 -

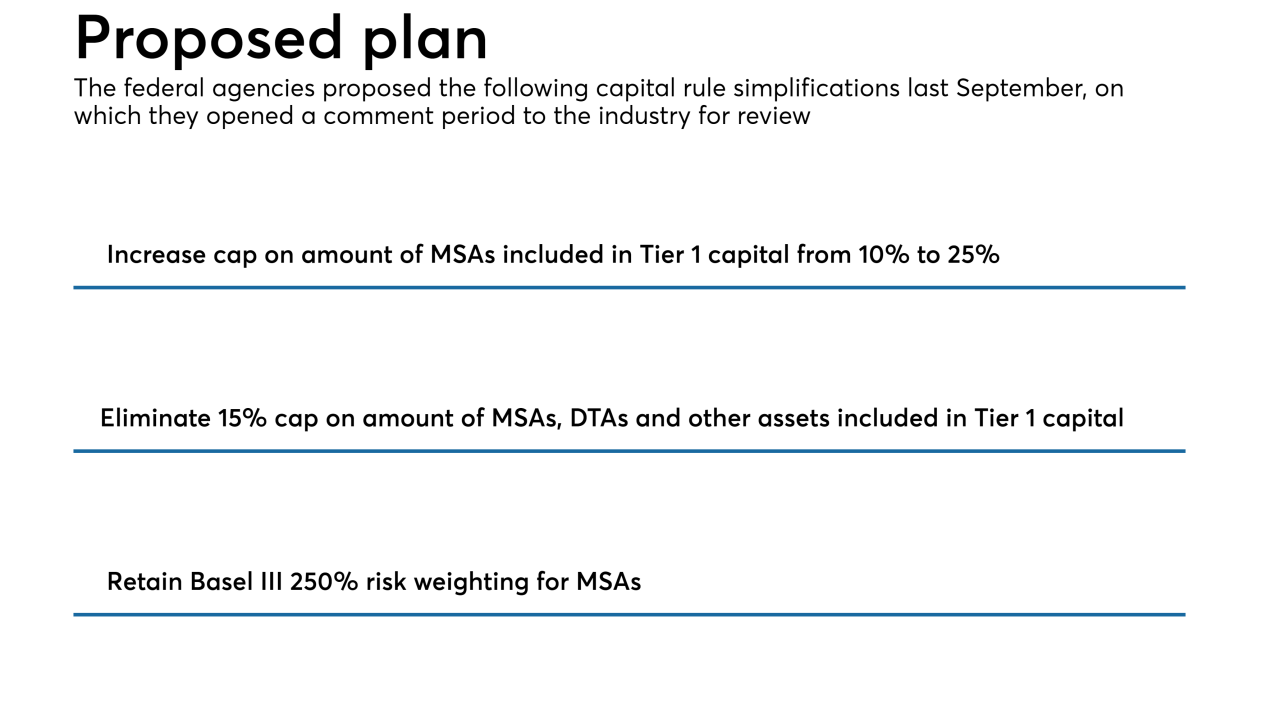

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18