Federal Reserve

Federal Reserve

-

It's not clear exactly what might pull investor sentiment and 10-year Treasury yields, which rates for the 30-year mortgage are benchmarked to, off the current lows.

December 31 -

An effort to increase awareness of the transition to a new benchmark rate, and nudge banks to start preparing, is expected to intensify in 2019.

December 30 -

When it comes to reversing their crisis-era bond buying, central bankers are focused on the destination. Traders in risk assets care more about what could be a painful journey.

December 26 -

There is no banking crisis, but the president’s actions are threatening to create one.

December 24 -

Mortgage rates continued to drop this week with the positive effects already aiding housing, according to Freddie Mac.

December 20 -

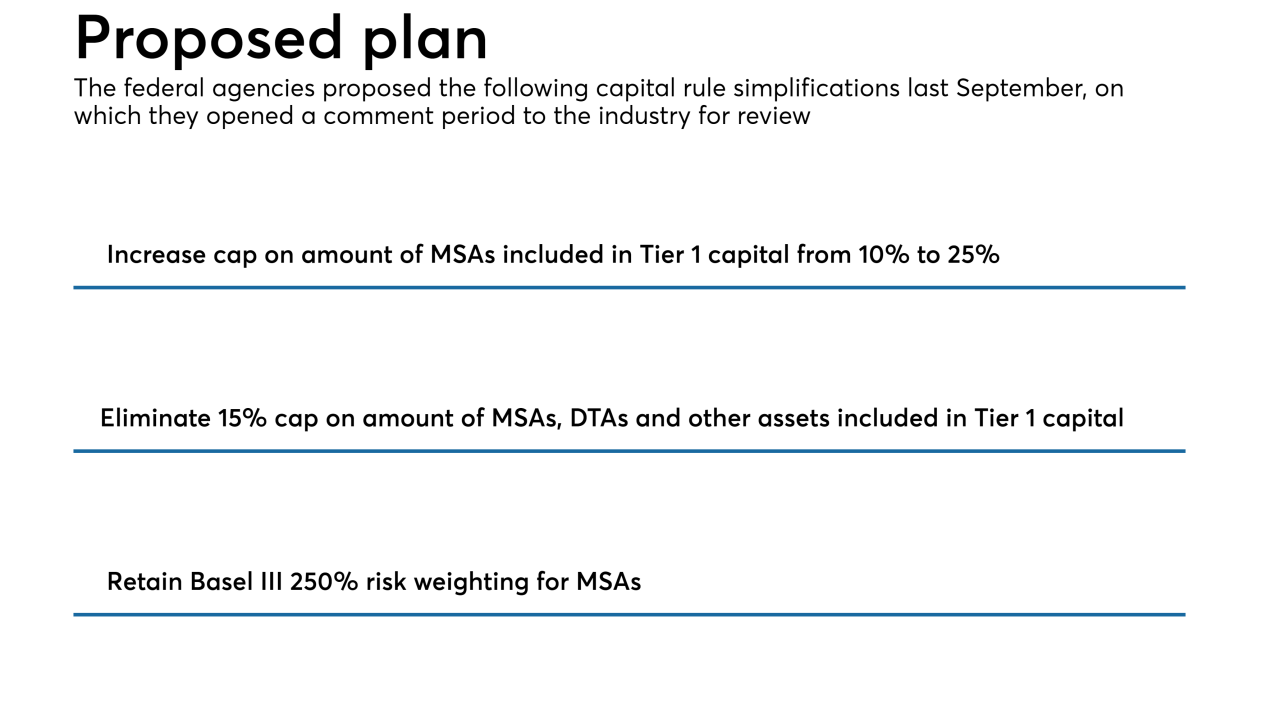

A proposal issued over a year ago by federal banking agencies to simplify risk-based capital rules and ease compliance burdens for community banks has still not been finalized, and mortgage brokers and bankers are calling on them to do just that.

December 18 -

A proposal allowing more lenders to skip outside appraisals could remove a hurdle to quick closings, but appraisers say they could be collateral damage.

December 17 -

Sentiment among homebuilders fell in December to the lowest level since 2015, missing all forecasts and signaling that the industry's struggles are intensifying amid elevated prices and higher borrowing costs.

December 17 -

Investors in agency mortgage-backed securities will find next year to be "anything but smooth sailing" as Federal Reserve rate hikes and balance sheet reduction will lead to an increase in real rates and volatility while pushing spreads wider, Bank of America said.

December 7 -

Mortgage rates held steady this week, remaining near their lowest levels in more than a month, according to Freddie Mac.

November 29 -

Interest rates are nearing the neutral level — the rate that neither stimulates nor restrains economic growth — Federal Reserve Board Chair Jerome Powell said Wednesday.

November 28 -

While a downturn is expected to come for the housing market, it could be more of a side-step than falling off a cliff, according to the latest Barclays Global Economics Weekly report.

November 26 -

While the housing market perennially decelerates in the winter, it can be a wonderland for potential homebuyers, according to Attom Data Solutions.

November 21 -

If the predictions prove correct, the benchmark rate would reach 3.50% by the end of next year.

November 21 -

While it's normally a time the market slows down for mortgage lenders relative to the rest of the year, this winter shouldn't be used to hibernate, according to Attom Data Solutions.

November 20 -

Confidence among homebuilders plummeted by the most since 2014 as the highest borrowing costs in eight years restrain demand, adding to signs of a cooling housing market that will weigh on the Federal Reserve's debate over how far to raise interest rates.

November 19 -

Bank jumbo mortgage underwriting standards weakened in the third quarter by the most in three years and as profitability remains under pressure, loosening should continue at an accelerated pace, a Moody's report said.

November 16 -

After last week's surge of 11 basis points, mortgage rates held steady due to a dip in energy costs, even with continued stock market volatility, according to Freddie Mac.

November 15 -

The move allows the New York multifamily lender to make more loans without having to raise capital.

November 15 -

Mortgage rates rose significantly across the board as the economy continued to show resilience with strong business activity and growth in employment, according to Freddie Mac.

November 8