-

The administration’s choice to regulate the government-sponsored enterprises appeared to distance himself from speculation that the White House may try to overhaul housing finance without legislation.

February 14 -

Rep. Blaine Luetkemeyer, R-Mo., told the mortgage giants' chief federal regulator that the Financial Accounting Standards Board’s new model for estimating loan losses could pose risk across the mortgage market.

February 14 -

Industry observers will be closely monitoring Mark Calabria's testimony before the Senate Banking Committee on Thursday for hints about how the Trump administration plans to proceed on mortgage finance reform.

February 13 -

The Senate Banking Committee will examine the nomination of Mark Calabria to oversee the regulator of Fannie Mae and Freddie Mac, as well as nominees for the NCUA board and Treasury.

February 7 -

Recent developments give the impression that the administration and lawmakers are in direct competition, but the ultimate framework may rely on coordination from both branches of government.

February 5 -

Absent some policy change, nearly a third of the loans backed by Fannie Mae and Freddie Mac could be in violation of the Consumer Financial Protection Bureau's Qualified Mortgage rule in two years.

February 4 -

Despite the release of Senate Banking Committee Chairman Mike Crapo's outline of a government-sponsored enterprise reform plan, most policy changes will likely come from the White House, and may even materialize this year, said Keefe, Bruyette & Woods.

February 4 -

As policymakers consider administrative reforms to Fannie and Freddie, they must address the problem of capital arbitrage to avoid overleveraging the mortgage system.

February 4

-

Just as the Trump administration appears focused on releasing a framework without Congress, the Senate Banking Committee has re-entered the policy fray with a new proposal.

February 1 -

The Senate Banking Committee chairman released an outline for overhauling the U.S. housing finance system more than 10 years after the government put Fannie Mae and Freddie Mac into conservatorship.

February 1 -

The Federal Housing Finance Agency has appointed a special assistant to President Trump and former Trump campaign official as chief of staff of the agency.

January 31 -

The agency's acting director said he welcomes lawmakers' “insight and perspective” on how to end the conservatorships of Fannie Mae and Freddie Mac.

January 30 -

A White House spokeswoman said the administration wants to work with Congress on a housing finance reform plan, providing evidence that changes might not be imminent.

January 29 -

The acting head of the Federal Housing Finance Agency has promised substantial changes for Fannie Mae and Freddie Mac, but the exact mechanics and timeline of an administration plan are still a mystery.

January 28 -

Recent comments attributed to the acting head of the Federal Housing Finance Agency (who is also comptroller of the currency) have stoked speculation about the Trump administration’s housing finance policy.

January 25 -

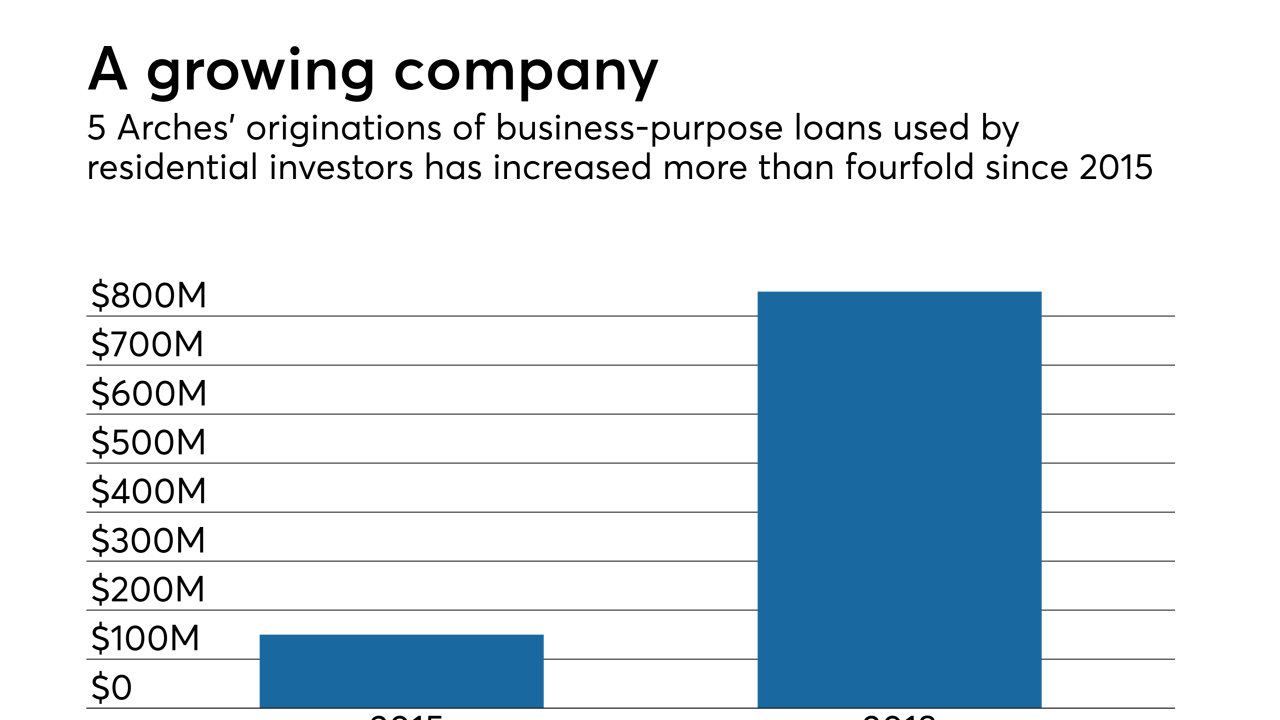

Redwood Trust has exercised its option to expand its minority stake in 5 Arches to 100%, increasing Redwood's exposure to loans used for house flipping and other types of residential investment.

January 23 -

Fannie Mae and Freddie Mac shares soared Friday amid fresh reports that the Trump administration is working on proposal that would recommend freeing the mortgage-finance giants from government control.

January 18 -

The Milken Institute's plan to address the housing finance system proposes a number of measures that could be carried out by regulators, after years of stalled legislative attempts.

January 17 -

Fannie Mae and Freddie Mac are adding another round of new underwriting requirements and a workaround for employment verification in response to the prolonged government shutdown.

January 17 -

A federal appeals court ruling that found the leadership structure of the FHFA unconstitutional will face an "en banc" review later this month.

January 16