-

The GSEs are on their way to paying back the money they owed the government under the original bailout deal made at the height of the financial crisis, making 2018 an opportune time for an overhaul of the housing finance market.

December 29

-

From deregulation to digital innovation, here's a look at the top storylines that defined the mortgage industry in 2017.

December 26 -

The announcement Thursday that Treasury Secretary Steven Mnuchin and Federal Housing Finance Agency Director Mel Watt agreed to let Fannie Mae and Freddie Mac each build a $3 billion capital buffer avoided a potential crisis.

December 21 -

Fannie Mae and Freddie Mac will be allowed to build capital buffers to protect against losses under an agreement between the Treasury Department and the Federal Housing Finance Agency announced on Thursday.

December 21 -

The two government-sponsored enterprises have relied on the “classic” FICO credit scoring model for the past 12 years. But the Federal Housing Finance Agency is weighing whether the GSEs should upgrade to more recent scoring alternatives.

December 20 -

Updated dynamic and interactive versions of Fannie Mae and Freddie Mac's redesigned Uniform Residential Loan Application are out.

December 20 -

Fannie Mae and Freddie Mac's final Duty to Serve plans are moving ahead with expanded support for manufactured housing through both single-family and multifamily programs, including controversial personal property loans.

December 18 -

The Home Affordable Refinance Program recorded a 45% drop in volume in October from the previous year as it continunes to wind down, according to the Federal Housing Finance Agency.

December 15 -

The maximum loan amount for Federal Housing Administration mortgages will go up in more than 3,000 counties for 2018.

December 7 -

Testing of the common securitization platform is taking longer than expected, but the Federal Housing Finance Agency said it won't delay the 2019 launch of Fannie Mae and Freddie Mac's new single "uniform mortgage-backed security."

December 4 -

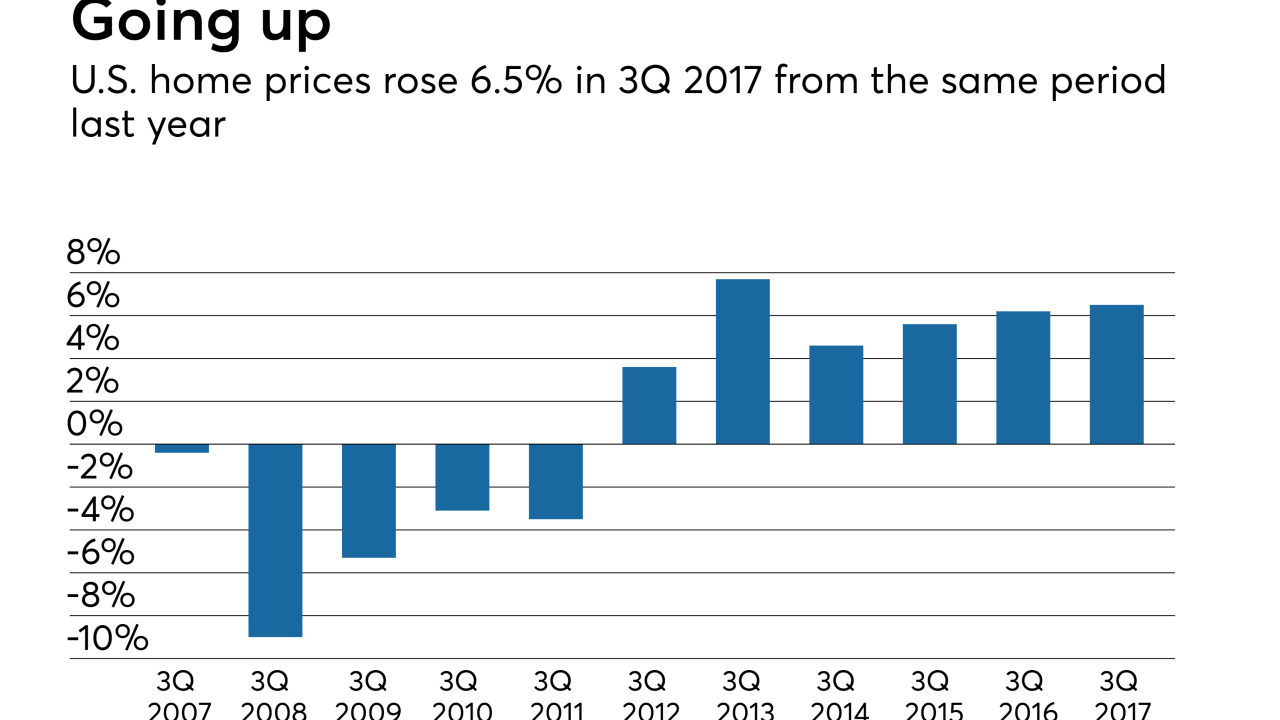

Borrowers will be able to take out a substantially bigger home loan backed by Fannie Mae and Freddie Mac next year, thanks to a 6.8% increase in home prices nationwide.

November 30 -

The Federal Housing Finance Agency's final guidelines for evaluating "duty to serve" activities create new ways for Fannie Mae and Freddie Mac to get extra credit for going above mandatory levels of lending to underserved markets.

November 30 -

Home prices rose again in the third quarter, where they showed little evidence of slowing down, according to the Federal Housing Finance Agency.

November 29 -

Conforming loan limits for mortgages bought by Fannie Mae and Freddie Mac will increase for the second consecutive year in response to the rapid rise in home prices, the Federal Housing Finance Agency said.

November 28 -

Home prices in 20 U.S. cities rose in September by the most in more than three years, indicating resilient demand at a time of persistently scarce inventory, according to S&P CoreLogic Case-Shiller data.

November 28 -

The Federal Housing Finance Agency must set fees equal to the cost of capital that private banks hold against similar risk, not just the amount of capital that Fannie and Freddie think are right for themselves.

November 3

-

Federal Housing Finance Agency Director Mel Watt said the agency is poised to examine alternatives to how a Fannie Mae and Freddie Mac assess creditworthiness of home buyers, including seeking public comment on the issue later this fall.

October 23 -

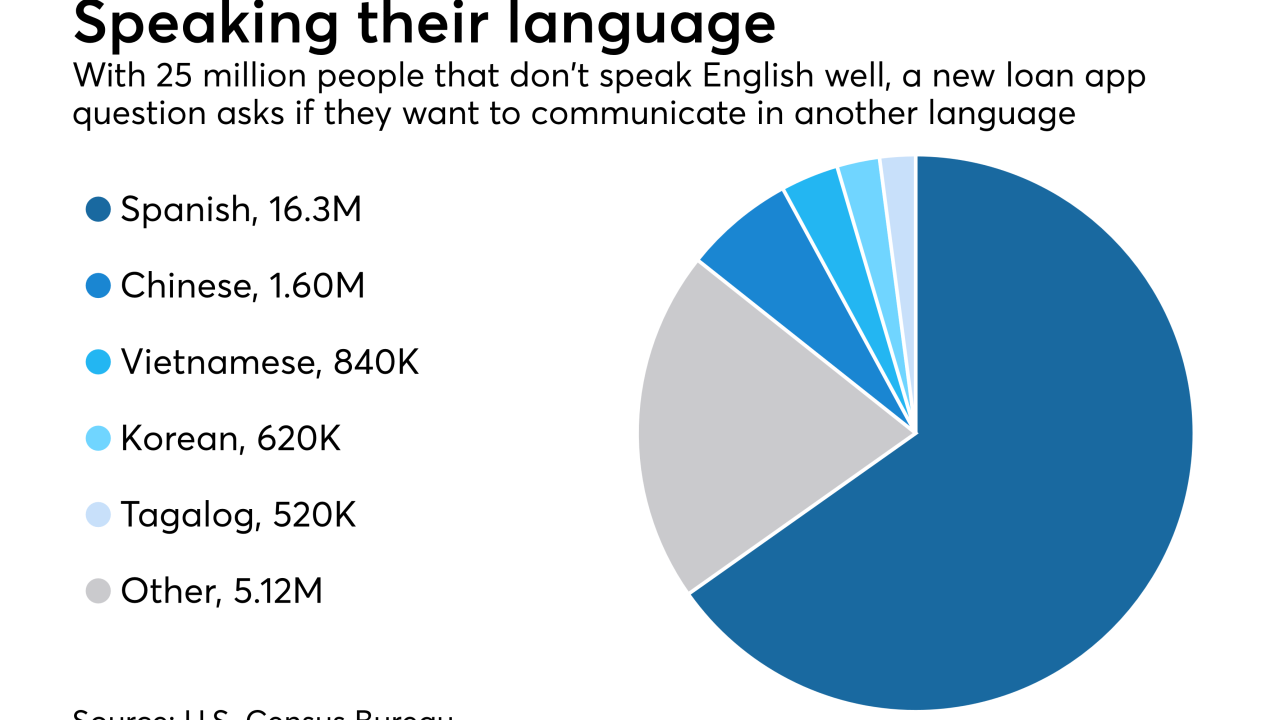

The Federal Housing Finance Agency added a language preference question to the loan application, rejecting the mortgage industry's wishes.

October 20 -

In a moment of rare unity, the Independent Community Bankers of America and National Association of Federally-Insured Credit Unions sent a joint letter to FHFA arguing to stop the GSEs' profit sweep.

October 19 -

From debating the future compliance landscape to developing a digital mortgage strategy, here's a preview of the top issues, ideas and themes on tap when the industry convenes in Denver for the Mortgage Bankers Association's Annual Convention & Expo.

October 17